One of the odder aspects of the so-called housing bubble phenomenon is how so many pundits have been so self-confident in their declarations of bubbleosity.

One of the odder aspects of the so-called housing bubble phenomenon is how so many pundits have been so self-confident in their declarations of bubbleosity.

I find that somewhat ironic — the same people who missed the largest stock bubble in human history have now become expert in spotting bubbles. And they now are spotting bubbles everywhere. The lone exception being Yale’s Robert Shiller, who was timely in spotting the stock bubble, and has also declared housing to be a similar bubble. (I do agree with Shiller that Real Estate may be one of many proximate causes of the next recession).

One of the characteristics of bubbles is that, in its full throat, most of the “fools” involved don’t believe its a bubble. Greed trumps rationality, and nearly everyonme wants a piece of the action, despite the apparent dangers. Hey, this time, its different. Recall the “new paradigm” at the height of the internet bubble: measuring eyeballs, clicks per page, etc.

While there certainly were naysayers, the words “stock bubble” were hardly splashed across the front pages of the WSJ every other day. Over the past 2 weeks, I’ve seen at least 2 front page stories about real estate in the Journal with the word “bubble” in it the title.

There’s something off about that, and its part of the reason for my skepticism.

Which brings us to a Yahoo story about a company called T-shirtHumor.com. It seems their best selling shirt is a parody of the bubble bath soap Mr. Bubble, titled Mr. Hou$ing Bubble.

Here’s the ubiquitous excerpt:

“Striking a chord with uneasy U.S. property investors, T-shirtHumor.com’s latest design — “Mr. Housing Bubble” — has become its best seller in less than a week.

The parody of the decades-old Mr. Bubble bath foam package offers a “Free Balloon Mortgage Inside.” But the smiling pink house-shaped bubble also warns: “If I pop, you’re screwed.”

A disclaimer at the bottom reads, “Not affiliated with Mr. Internet Bubble.”

Anthony Phipps, T-shirtHumor.com communications director, said the Austin, Texas-based t-shirt design and marketing firm has sold hundreds of the $20 cotton shirts since they went on sale last week.”

Think back to 1999 — Can you imagine a t-shirt declaring that tech/telecom/internet stocks were a bubble becoming a best seller back then?

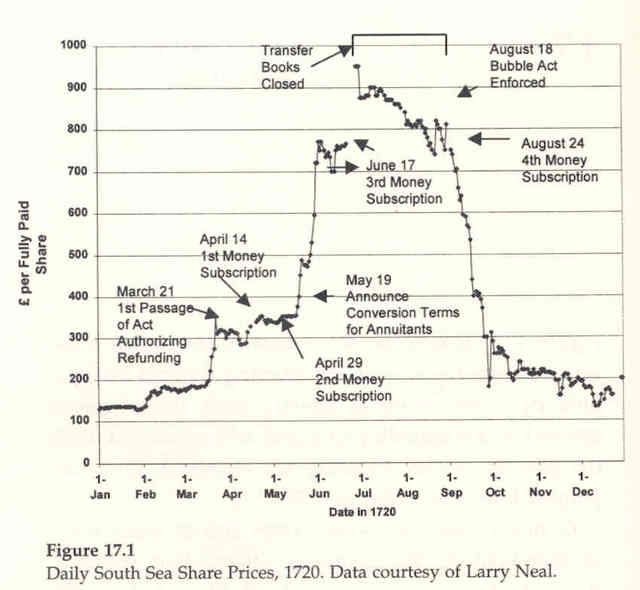

Or even more odd and perplexing, try to wrap your brain around a similar item declaring the “South Sea Bubble” in 1720.

I cannot quite put my finger on precisely why the entire world declaring a housing bubble exists makes it less likely to be so at the moment.

Perhaps all the declarations of the housing bubble are the equivalent of Wall Street’s Wall of Worry. (Note that the cliche is that markets climb a wall of worry).

>>

Sources:

Mr Housing Bubble” shirts strike chord, draw ire

Reuters, Tue Aug 16,11:25 AM ET

http://news.yahoo.com/s/nm/20050816/us_nm/economy_housing_shirts_dc

SOUTH SEA BUBBLE

FAMOUS FIRST BUBBLES

http://www.few.eur.nl/few/people/smant/m-economics/southsea.htm

Two things come to mind. First, as I recall, there was plenty of bubble skepticism and white-knuckle risk taking in 1999. I think we tend to forget it though because the image of over-optimistic investors going over the edge of a cliff is more morally satisfying.

Second, most of the people I know who are buying expensive houses right now are aware that they might be over-paying but they try to rationalize it by asserting that the purchase is a necessity. Most say something like “I know the money is crazy but we really need a bigger place.” This may or may not really be true but the perception that it is keeps people buying houses when they might have stopped buying something percieved as more optional like stocks.

1. Those of us who own property do hope that people take the stupid advice from some to sell their homes, because “it’s cheaper to rent”. That will provide the rest of us with a willing and able stock of tenants.

2. If you do sell, please ask yourself “when do I get back in?” You won’t find that anywhere in print by those advising you to sell your home.

3. My wife and I plan to build a stadium, somewhere in South Phoenix, complete with cots and portable toilets. We plan to charge $10 per night. Capacity will be cut at 40,000. Only criteria: you must have just sold your primary residence.

4. The housing bubble warnings started in March, 2000. Most of these articles are written by people who don’t own real estate. But, ask yourself: If you had taken their advice at any point in the past 5 years, WHERE WOULD YOU BE TODAY? Those who point to Southern California it it fell off the map in 1991-1994 as the last bubble DON’T KNOW WHAT THEY ARE TALKING ABOUT.

5. You will know that there is a bubble when we have a blow-off first. A blow off is when prices explode on the upside before crashing. (recall the nasdaq at the end of 1999?) It can’t be a bubble unless it pops.

6. Next hot trend in RE: OFFICE CONDOS

krimpet: When buying real estate, you always have to buy right.

I’ve been wondering about the same thing. A few possibilities:

– people can relate to home prices a lot more than stock prices, so it’s an easier story for the media to sell

– while there has been a lot of ink spilled about potential housing bubbles, there’s at least as much hype still out there. Full page ads for real estate seminars and the A&E and TLC shows “Flip This House” and “Flip That House” come to mind

I think the media would be doing a bigger service by explaining/warning folks about all the funky mortgages out there.

MRF: The media has talked plenty about interest-only mortgages. However, do you really want journalists providing mortgage advice. Didn’t think so.

The “there is less chance of a bubble because people are talking about it” argument seems specious. Does a shirt prove that there isn’t a bubble? Given that we just had a bubble in the stock market five years ago, the idea of bubble has been impressed on the public awareness. I’d think people would be more aware of the concept, similar to the way most people didn’t have a clue about Osama until the towers fell.

Here’s what I think: with people making comments like those of Mr Nusbaum, I’m betting on a correction.

“I cannot quite put my finger on precisely why the entire world declaring a housing bubble exists makes it less likely to be so at the moment”.

Emotions precedes fundamentals. This is an emotional game. There’s always a “delayed reaction”

As a trader, I learned to ignore fundamentals initially.

The Bubble will burst, the question is: when, and how severe will it be?

“The media has talked plenty about interest-only mortgages. However, do you really want journalists providing mortgage advice. Didn’t think so.”

Why Not!….bankers do it!, they all fall into the same category….sales!

It is definitely tempting to think those calling for a pop must be wrong somehow, because in racetrack terms ‘the form always moves away from the public.’

In my humble opinion, all the potential ‘bubbles’ we are seeing, from condos to gas prices to credit derivatives to emerging markets to Baidu.com, can be traced back to one source, the veritable granddaddy of all bubbles: fed induced liquidity.

The housing boom is a symptom, not a cause—the most visible result of the maestro’s massively unprecedented stimulus extended over a period of years.

Consumers and hedge funds have been leveraging up like crazy because, well, that’s the rational thing to do at a keg party, right?

Personally, I’m not worried by the exaggerated prospect of a complete and total housing collapse. I’m worried that we are so overextended at this point, and so reliant on credit to keep the party going, that even a modest downturn in real estate–a mundane slowdown by historical standards–could trigger disastrous results.

At this point in the game, we don’t need a collapse for all hell to break loose. We are so staggeringly blind drunk that we are forced to keep drinking, in a futile effort to stave off the mother of all hangovers ahead.

Maybe the surprise ending is that real estate tails off without collapsing, as the optimists predict… but an unforeseen credit crunch forces us to reap the whirlwind anyway. RE affordability permanently lowered for most Americans while the ravages of recession take hold.

Now there’s a pretty picture.

Barry, I can’t speak for everyone, but I called the NASDAQ almost perfectly. At that time I was posting on message boards (mostly Silicon Investor), and I was not blogging. My specific advice was given in private although generally it was available to the public (if they read SI). The MSM didn’t notice.

Today the MSM picks up the stories from the blogs. Heck, you’ve written about this phenomenon! That wasn’t happening in late ’99, early ’00.

I started calling housing a bubble early this year. Housing and stock bubbles are very different, but I’m convinced housing is a bubble based on speculation and the evidence that so many marginal buyers have bought recently.

On marginal buyers, I suggest reading the Public Policy Institute of California’s new report:

California’s Newest Homeowners: Affording the Unaffordable

Unlike the NASDAQ where I sold all my tech stocks, I haven’t sold my home. I was still advising people to buy two years ago. Now I suggest renting in many areas.

And finally, if you scan the housing bubble news today, this is what you see:

Duluth housing bubble?

Housing market bubble unlikely: Seattle area looks safe from price corrections, according to new report

Housing bubble not about to burst

Housing Bubble’s Not a Huge Story

Housing Bubble Is A Local Matter

And on and on …

Best Regards!

there are some ideas on a housing bubble at this blog:

http://njk42.blogspot.com/2005/07/housing-bubble-malarky-or-real.html

It is a matter of semantics, what others are calling a bubble you are using less alarmist terms for. But I believe you have stated you think that in some key markets prices are overextended and will flatten or fall.

As Mr. Nusbeam proves there are still idiots out there, that kind of rhetoric is not fed by rational investment approaches, they are clearly the product of a mass psychosis, so I would go with “bubble” though it’s characteristics are a matter of debate. But it is a matter of semantics.

It all comes down to how many people you can find who can afford to pay 500k or more for a house. If you run out of those people, the price will fall. Given the number of interest only loans (made up of borrowers who can’t afford any higher payments), it seems like a pretty solid prediction that if interest rates go up a percentage point, most of those buyers fall out of the market. So how likely is it that interest rates remain where they are?

I agree with the previous poster (CalculatedRick).The way information moved in earlier times was lot slower than what today is. The mere fact that you are able to pick up on an obscure story of Bubble T-Shirt means that information flows faster and hence slows down the reaction time. The new media has also brought down the “Experts” from their Castle closer to the “Commoner” hence dissipating the value of their analysis faster and to wider audience.

It also created pseudo and obscure experts to the forefront which might explain the amount of “Housing Noise”

I think rational thinking proves that there is Housing Bubble only questions are about Why it is going up? How long this can last? I don’t think we will be able to answer that till we are way past the bubble. Then we might gather together and certainly analyze the posts/blogs to see who and how many were right (Another powerful feature of this new media)

Interesting post but I disagree with your assumption that most people involved in a bubble don’t perceive it as such. I can’t speak to the South Sea Bubble but plenty of us had first hand experience with the late great Dot Com Bubble and then (as now) it was certainly the case that many of the fools involved knew full well it was a bubble but were nonetheless caught up in the transport and delight. A bubble is very much a creation of mass psychology, and in that respect the behavior of participants (or celebrants) in the bubble is not necessarily best understood in terms of rational self interest that neo-classically trained economists are most familiar with. instead, to best understand this psychology, you must try to understand the distorted view of the world from inside the bubble looking out, not from the outside looking in.

I’m not aware of too much in the academic literature that explains the nature of this distortion. But if you’d like to get a glimpse of the world from inside the bubble, I can recommend you read my novel Dinkelmann’s Rules, a frothy tale indeed.

More Housing Bubble T-Shirts

Barry at The

Big Picture points out another popular housing bubble t-shirt, a

parody of Mr.

Bubble.

Barry thinks that the fact that because there are declarations of the bubble everywhere, that it is must not be a bubble.

I find that somewhat ir

“The mere fact that you are able to pick up on an obscure story of Bubble T-Shirt means that information flows faster and hence slows down the reaction time.”

housing bubble believers are not obscure. they have not been obscure for a while.

perhaps a bubble t-shirt is obscure.

I really don’t see long term interest rates going anywhere. If anything, they may well edge downward. Speculators may be pinched when the appreciation rate falls below the carrying rate and prices may flatten or decline somewhat when they try to sell but I don’t see that as sufficient to really crash. Long term erosion is more likely.

Misidentification of the bubble might as well be equivalent to not identifying a bubble, in terms of media not calling it right. There is no housing bubble. There is a monetary bubble. What everyone should be worried about is a popping of currency values (i.e. the onset of massive inflation to catch up with the expansion of the monetary base – which, incidentally, would not pop house prices). Think 1970s stock prices – nomininally goes nowhere, but down in real terms, while everything else rises in price rapidly to meet the new level of monetary base.

And that’s if all goes well. If the monetary bubble pops instead of the currency value popping, the credit crunch will make losers of everyone.

The reason that the RE Bubble is more talled of, is because the relationships are easily grasped – wages, mortgages, rents and house prices. There are tangible valuations people can relate to.

In the case of shares, only the market price is tangible – P/E, cash flow, EBIDTA , GAAP earnings – who can figure out all these things and conclude that a stock is worth the price?

How many headlines are you seeing about an REIT bubble?

Break a house into fractional ownership shares and sell it – make every house an REIT – and house prices will go to the moon.

Then no one would be talking about a house price bubble for another 2-3 years.

1. Fact is, everyone is and has been guessing for 5 years. If we are talking about houses in a bubble, does that mean if you buy an $600,000 in Scottsdale and then the bubble bursts it will go down 50%? 75%? 90%?

2. Ask yourself: how many people over the past 20 years made a lot of money investing in real estate. And, how many people do you know that made and kept a lot of money investing in the S&P 500. I am from San Francisco, a place where the average guy had an equal shot a making a lot in real estate and had little chance to make a lot buying and selling stocks.

3. An advantage never discussed about real estate: In a nation of non-savers, real estate is a FORCED SAVINGS PLAN.

4. Good luck trying to time your market!

Another point about the markets that I play in: I no longer can find “value” in residential condos, SFR or foreclosures and I have no interest in trying to test my markets. I have noticed a pull-back as well by so called smart money. So what are they doing? Creating more value in projects than the previous owners. There are no greater examples of that then raw land being subdivided and subdivided being developed. The other example is office condo conversion and office condo new construction.

Remember “irrational exuberance”. Greenspan’s quote about the stock market rise in 1996?

You can have a bubble blown up for quite a while. Should you have been in stocks in 1996 and out in 1999? Sure, if you can time the market.

Real estate doesn’t react as sharply as the stock market – but most people don’t hold real estate as an asset as much as a liability – they own the loan, not the place.

With i-only, neg amort loans – the banking industry has been very successful turning real estate from a forced saving to a forced spending plan.

Posted by: pebird | Aug 19, 2005 6:31:25 PM: When a lender asks a borrower, “How long to you expect to be in your home?”, do you think the borrower really knows on that day? I don’t.

Fact is, in Arizona, the average life of a loan is 2.3 years. People move, sell or refinance. Keep this stat in mind…..

INTEREST ONLY LOANS: If I buy a 30-year fixed rate loan, and the average life of a loan (in AZ) is 2.3 years, isn’t it essentially an “interest only” loan product with a much much hgher monthly payment? Because, you wind up paying virtually no principal at a higher coupon rate. (Because it is a fully amortizing loan) And, you probably paid fees for the privilege of getting that loan.

Solution: Take the interest only loan (fixed for 5 years) and pay the difference between the two in additional principal and have it taken out from your checking account automatically.

I absolutely love all of these delicious comparisons of real estate (never had a down year nationally, year over year, since such figures were kept) to NASDAQ 5000……..

Real estate is not one market anymore than stocks are one market, index, sector, nation, company, size, management team, etc.

Barry said: “I cannot quite put my finger on precisely why the entire world declaring a housing bubble exists makes it less likely to be so at the moment”.

I’ve struggled with that too, but here’s why I’ve finally accepted that that housing can be in a bubble, even if there is general awareness about the possibility.

In the investment world there are almost infinite options for investors in terms of portfolio mix and strategies. But housing is different, everyone needs at least one place to live and you either choose to rent or own. That’s it. There’s no other option short of a cardboard box under an overpass. As such, it’s a market in which everyone is an active participant, either you’re going long by owning or going short by renting.

This differs substantially from the late 90’s stock bubble. Most investors (much less the general population) didn’t even own dotcom stocks. So there was no reason for major concern in the general population and media about the bubble. Of course there would have been had people realized the fallout it would have on their non-tech stocks. But the important point is that it was perceived to be something happening in an isolated sector which most people chose not to particpate in…while still having many other investment options open to them. The same is true of the South Sea Bubble and every other previous bubble I can think of.

Also, you have to look at the context of the housing bubble. Even if a general awareness of the bubble develops, we’re talking about an asset class that is revered only second to “dear old Mom”. We’re talking about hearth and home in a world that many people find much scarier post 9/11. The bulls are right on this one; there’s a huge psychological drive toward home ownership – and then combine this with drive for tangible asset accumulation and massive liquidity in the post-2000 world. All of this of course only helps to inflate bubble that it is, but you can’t coverage mortgage payments with sentiments.

Posted by: PM | Aug 20, 2005 1:35:36 AM: “there’s a huge psychological drive toward home ownership”

It began when G.I.s returned from WW2 and has never stopped.

1. Bubble (tech) stocks can not be cured by time.

2. Real Estate can always be cured by time.

3. It is never better to rent vs. own.

4. If you are worried about a real estate bubble….don’t buy anything right now.

According to research conducted by Russell Investment Group, the “manager of managers”, of the top-performing managers for 1998, not one stayed on top over time. (2000-2003). Over the last 10 years, the S&P 500 has returned over 12% per year. Individuals, handling their own accounts, have returned an average of 2.7% over the same time.

Friday’s NY Times had a front page story on comparing the returns of the S&P 500 vs a SFR since 1980, concluding that the return from stocks is better. BUT, WHO WILL BE MANAGING YOUR STOCK PORTFOLIO?

A good part of the U.S., and the world owe their standard of living, if not their current livelihoods, to the stock markets and general investment in innovation. How is wide-scale investment in housing going to ensure that the U.S. has the innovative products and services to compete in the global economy? My guess is the Chinese are banking on that fact that it won’t. Their purchase of U.S. debt during a housing boom ensures several things:

1) that U.S. consumers keep buying their goods

2) that investment dollars won’t be flowing into helping the U.S. maintain a long-term economic advantage.

3) that U.S. assets will be easy to buy up once consumers hit the debt wall and the Chinese have sufficient domestic consumer demand.

Now how good is that? They’re playing the U.S. like a puppet on the end of a string, and guys like Larry Nusbaum are providing the accompaniment.

No, Jim. Every who shops at Walmart is doing that without any help from me.

Have some cheese with your whine, Jim. Btw, got any solutions? Do you suggest that people sell their real estate or not to buy any at all? If we all sell, maybe the Chinese will own our country a lot faster than you thought.

It’s called the Global Economy and it’s here to stay even if some refuse to accept it. How is the air in your sand hole?

Jim: Do not blame me for the fact that we have a zero net savings rate in this country. People are spending like drunken sailors. They are the ones taking equity from their homes and consuming instead of investing. (I prefer that they do neither with their HELOCs). BTW, they are spending like their role models: The US Congress. And, as president, Mr Bush has yet to veto a single spending bill as president……..

The injection of liquidity has not only come from the generational low in interest rates…the boom in access to mortgage financing is unprescedented. In the past the only folks buying $2M homes were rich. Now I know two people making less than $50k/year with little savings who have each bought one. The plan is to hold for a year and collect the $100k+ guaranteed profit. Now have them take a 120% mortgage and put that down on another property. Or leverage that 5 times for 5 properties. They are price insensitive; prices only go up (“look at the charts”) and they don’t rent them, it’s a buy and flip. So they buy at any price to sell to another flipper who can’t afford a $2M house either. The only problem is that prices must go up about 10% annually to break even. If RE prices flatten for one year, each will be forced to sell their multiple properties at any price.

A core precursor of a bubble is a significant influx of previously unavailable capital. Negative amortization IO & 125% home equity have made this venture (practically) infinitely leveragable. A few years ago you needed 20% down cash. Ha! Now you close and walk away with hundreds of thousands in your pocket.

The problem: when does it pop (regionally I think)? When the infinite leverage is taken away. When will that occur? Likely after I buy a few $2M homes in Vegas. Stay tuned :-(

“Negative amortization IO & 125% home equity have made this venture (practically) infinitely leveragable. A few years ago you needed 20% down cash. Ha! Now you close and walk away with hundreds of thousands in your pocket.”

Shawn: These loan products are as old as the hills. Loose underwriting standards by lenders wanting their share of the fee income in a hot market is as old as the hills. They even had 40 year loans back in the 1980’s to get lower payments when rates were higher. Surprised? Don’t be.

I HAVE NOT SEEN A SINGLE PERSON DEFINE “POP”. Does it mean prices will suddenly decline 40%? 75%?

Everyone seems to be a parrot for the WSJ articles or that really, really, smart, well groomed analyst analyst featured on CNBC. The fact that real estate is not as liquid as stocks prevents the so called real estate “bubble” from popping.

The one little fact that everyone likes to overlook is that of job market growth. Since 2001, nearly 50% of all new jobs have been created in the housing market. Traditionally, housing accounted for no more than 5% of our total market, now it’s the number one growing field for new jobs. Because the housing market is so hot, these new jobs are typically better paying than that of other entry level positions in other industries such as retail or manufacturing. However, these jobs rarely offer any retirement package, paid time off, or medical insurance… all of which are very important to have. Therefore, many of these jobs are dogs regardless of their pay.

The vastly disproportional growth of jobs in the housing sector WILL come to an end as it not sustainable for any period of time. When this time comes, there will be a great number of unemployed tradesmen, not to mention a slowdown in job growth which could spark another recession.