Yesterday’s increase in New Home Sales caught some economists by surprise. I look at those sorts of numbers suspiciously.

Any time I want some insight into any particular datapoint, I find it instructive to go to the actual government source’s website, and simply click around. If you do this with a skeptical eye, you may learn some really interesting facts.

Any time I want some insight into any particular datapoint, I find it instructive to go to the actual government source’s website, and simply click around. If you do this with a skeptical eye, you may learn some really interesting facts.

That’s what I did with the New Home Sales yesterday, simply looking at the release and trying to figure out what they were really saying thru the bureaucratic jargon and legalese. You don’t need to be a forensic accountant (but it couldn’t hurt).

Here’s what I found:

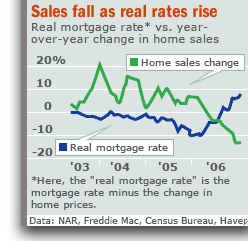

1. The reported increase in sales was 5.3 percent. The margin of error was ±15.6%. Therefore, the likely change in sales ranged from +20.9% to -10.3%. Since this range contains zero, “the change is not statistically significant; that is, it is uncertain

whether there was an increase or decrease.”2. Recently reported increases have been subsequently revised downwards, primarily due to cancellations. Sales in June, July and August were revised down by 67,000.

3. Year-to-date sales are down 16.5%.

4. Commerce department does not do an “Apples-to-Apples” comparison. They report initial New Home Sales (pre-cancellations) versus the prior months adjusted (post-cancellations). This has the effect of lowering the older months data, thereby making the present monthly gain appear larger.

A more consistent methodology might be to compare unrevised data with unrevised data. So for September, we might look at sales of new one-family houses in August 2006 as initially reported — annual rate of 1,050,000 (seasonally adjusted); Then we look at sales of new one-family houses in September 2006 as initially reported: an annual rate of 1,075,000 — just under 2.4%, as opposed to the reported 5.3%. Note this is still statistically insignificant, given the ±15.36% margin of error.

Note that the year over year estimates — down 14.2% percent (±12.2%) below the September 2005 puts zero beyond the margin of error. The range year over year is between down 2% to down 26.4%.

Lastly, watch inventory. Rex Nutting points out that “The supply of inventory peaked at 7.2 months in July. Inventories of unsold homes are up 14.4% in the past year. The number of unsold completed homes rose to a record 157,000 in September, up 47% in the past year.”

~~~

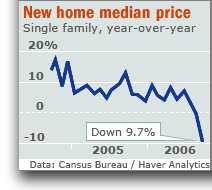

Lastly, a quick word on New Home Prices: The reported sales prices were pretty awful. Again, we go to Rex Nutting: “Median sales prices dropped 9.7% in the past year to $217,100, the lowest price in two years. It’s the largest percentage decline in median prices since December 1970. Median prices for existing single-family homes are down 2.5% in the past year, the largest decline ever recorded.”

Lastly, a quick word on New Home Prices: The reported sales prices were pretty awful. Again, we go to Rex Nutting: “Median sales prices dropped 9.7% in the past year to $217,100, the lowest price in two years. It’s the largest percentage decline in median prices since December 1970. Median prices for existing single-family homes are down 2.5% in the past year, the largest decline ever recorded.”

Here’s the amusing part: Despite the huge price drop, the reported price changes actually understates the actual price changes. This is due to Builder Incentives. Have a look at some of the freebies builders have been using to get sales going: Sub zeros, pools, BMWs, even paying the property taxes for 2 years!

Candy bar companies don’t like to raise prices, so they simply make the candy smaller, selling them for the same price; Curb Your Enthusiasm fans might note how many fewer Cashews go into a can of mixed nuts (“The whole cashew/raisin balance is askew!”).

Builders do the opposite: They add cashews for the same price. Some feel the psychology of lowering prices scares off potential buyers — or at least frightens them into sitting back and waiting. To avoid the appearance of decreasing prices (or to make them appear less severe), they offer more — increasing what they are selling — only without apparently charging for them.

This getting more for the same cost is price deflation — just as paying the same amount for a smaller Almond Joy or less cashews is price inflation.

New Home Pricing today – more cashews – is even more Deflationary than appears

>

Sources:

New Residential Sales

US Census Bureau

http://www.census.gov/const/www/newressalesindex.html

NEW RESIDENTIAL SALES IN SEPTEMBER 2006

OCTOBER 26, 2006 AT 10:00 A.M. EDT

Census Bureau, Manufacturing and Construction Division

http://www.census.gov/const/newressales.pdf

Builders slash prices to sell more homes

Sales up 5.3% in September, but prices plunging at fastest rate in 36 years

Rex Nutting

MarketWatch, 1:10 PM ET Oct 26, 2006

http://tinyurl.com/yytnqg

Existing-Home Sales Declined In September Despite Price Drop

JEFF BATER

WSJ, October 25, 2006 11:38 a.m.

http://online.wsj.com/article/SB116178393213203300.html

I spent the last two weeks looking at houses on the west coast of Florida from Naples to Sarasota.

Some typical anecdotal information: In a subdivision built by Lennar in Sarasota, completed unsold houses were reduced by 20%. When I still appeared reluctant to buy, the salesman threw in landscaping worth a few thousand dollars. Some of these houses sold last year for a million dollars. They are now in the 8 hundred thousand or less range. About one third to half of the houses sold last year are on the market. They were purchased by investors thinking they would flip the property and are now stuck with it.

I was the only potential buyer in sight. I spent time with a broker looking at existing homes. The broker’s cell phone rang every 25 minutes with other brokers that knew my broker had a customer, calling to tell her about price reductions.

The market was much worse than I thought and convinced me not to buy yet.

Barry,

Even if the sales stat is correct…….higher sales with lower prices, shows a much worse picture of the housing mkt than lower sales with steady prices. New house price declines are a leading indicator to existing house price declines.

The big revision hit on July’s numbers. Originally 1,072,000 new sold in July, now revsied down for the second time to only 984,000. What if that number hit the lines in August?

GDP coming….

This guy does a great dive into all of the housing numbers:

http://calculatedrisk.blogspot.com/

Somewhat OT, my apologies, but 3Q GDP deflator comes in at 1.8% vs. 3.3% in 2Q? Gas prices are down 20% (from their max), and housing prices are, too. But 1.8% seems kinda low to me. Re-engineered M3 is trucking along at 8%…

…Housing is a monster of it’s own. Median price of new homes is back to Sep 04 levels. ‘How you doin?’ At what point does the ‘I can always just refi’ crowd start to really white-knuckle it? Collateral values are f-ugly and ARM resets are fixin’ to shoot the pooch.

Finally, how much longer will mortgage originators be able to claim non-cash earnings on option-ARM delinquents?

Vega,

“An inflation gauge tied to the GDP report showed that core prices — excluding food and energy — advanced at a rate of 2.3 percent in the third quarter, which was down from 2.7 percent in the second quarter.

Over the last 12 months, however, this inflation measure rose by 2.4 percent, the largest annual increase since 1995.”

Do the math, if the old deflator was used there would be almost no GDP growth.

I actually believe these price declines are overstated in that they don’t so much reflect 10% price cuts as a decline in sales in higher priced areas which drove the median down. Offhand I’d guess that actual price declines were more in the 4%-5% range.

That said, housing is experiencing a complete rout which will only get worse as we move into the Fall and Winter months.

I am building a house in Westchester NY, that will be ready mid Nov.. All of this talk of a housing bubble really made it easy to buy a house in this area. There are not many buildable lots left in the nice parts of Westchester. And prices have come in atleast 20%. But as for a crash it is a pipe dream in this area. If you want a new house here you have to pay atleast 450K for a crap house and tear it down. The prices of these lots are not going lower as they are owned by people who have been living there for 30 years. They are not panicking out of anything. In fact there is no panic at all here, my builder just started a 3 million dollar project another town north. I would like to hear comments about places like this. I think what happens in Florida doesnt relate to this area. Am I wrong?

Barry, I think you have this wrong: “Commerce department does not do an “Apples-to-Apples” comparison. They report initial New Home Sales (pre-cancellations) versus the prior months adjusted (post-cancellations). ”

My understanding is that the caccellations are never subtracted. The revisions are just revising the number of contracts signed in a given month.

Apparently, the cancellations are in a hidden inventory. Pretty odd. Bll=oomberg’s Caroline Baum did a column on it a while ago.

V L, we must be pulling data from different sources. I’m referencing the GDP deflator. I see in Bloomberg that both the deflator and price index you refer to increased 1.8% for 3Q, down from 3.3% in 2Q. There’s probably another price index you see that I’m not aware of…

“Motor vehicle output contributed 0.72 percentage point to the third-quarter growth in real GDP after subtracting 0.31 percentage point from the second-quarter growth.”

either this number is going to be revised down, or Q4 is absolutely going to plunge. check out the comments from Autozone’s CEO yesterday re: the Big 3’s inventory and production levels

“Durable goods increased 8.4 percent, in contrast to a decrease of 0.1 percent.”

Anyone know where to find durables ex airplane sales? My guess is this number is not nearly as strong as it appears. Plus, look at Caterpillar’s guidance. I think durables are going to fall to.

-17.4 in residential fixed investment. nice.

Goldilocks? methinks not…

I am in the Sarasota-Bradenton area in FL and was also at a Lennar development in Manatee County a couple weeks ago. We were the only people there on a beautiful Saturday afternoon and the agent seemed desperate to unload some houses. The model we looked at was listed 16% below what it sold for last fall and by the time we left the agent had dropped the price another $60k making it about 30% below Fall ’05 prices. I think if we were serious we could have negotiated down much further. Oh yeah, and half of the neighborhood had For Sale/For Rent signs up since it had been bought up by foolish flippers. This area is definitely Ground Zero for this bust IMO. Sarasota reported a nice 16% price decline yoy yesterday…ouch.

From Roubini (who had predicted 1.5%)

The weakness in Q3 growth is widespread: real residential investment fell at an annualized rate of 17.4%, much worse than the 11.1% drop of Q2; the trade balance was a negative drag on growth as the trade deficit widened sharply in Q3 relative to Q2; inventory accumulation was slightly lower in Q3 than in Q2 thus being a small drag on growth as well; non durable consumption grew only at an annualized rate of 1.6%; and while durable consumption grew faster in Q3 than in Q2 you can expect significant slowdown in durable consumption in Q4 as the glut of autos and housing related durables consumption takes a hit on the economy. Even non-residential investment in structures that was growing at an annualized rate of 20.3% in Q2 slowed down its growth to 14% in Q3: you can expect a much sharper slowdown in such non-residential investment in Q4 and 2007 for reasons discussed below. Real investment in software and equipment – that had fallen in Q2 – recovered in Q3 to a 6.4% growth rate; but further weakness in the economy in Q4 and 2007 will lead to a significant slowdown in such investment in the quarters ahead.

Durables Ex-transportation was 0.1% vs. 1.0% expectations

The economy is growing well below the inflation rate. Technically, we are already 3 months in the recession if you adjust for real dollars.

Besides, housing chopped 1.2% GDP growth in Q3, and Q3 was still not so bad for housing as we see now, in October.

And we don’t feel it at all! Because for the stock market, the sky is limit!!!! Hahahahahaha!!!!!

Looking at the primary reason for decline in new house pricing… I come up with one very simple reason: Greed.

My family is in the residental construction business [general contracting, flatwork, painting]. The nice thing about being an insider is that you know precisely what it costs to build some of these houses and what the builders are asking.

My anecdote is simple: The wife and I are building a new house. We’ve taken 98% of our floor plan from an existing house in a very very nice golf-course based neighborhood. We extended 3 of the bedrooms and added a bathroom [all to the top story]. The total cost for me to build this house, including my land is approximately 42% of the asking price of the [almost] identical house in the nice neighborhood.

FWIW, I paid about as much for my 3+ acres as the lot on the green [<0.5 acres] would have gone for.... so apples-to-apples.

Builders of the upper class houses in my city have gone out of control recently. And with all of the people who think it's worth it to pay that much per square foot, they've been making hippoloads of cash. I suppose it's the definition of market driven prices... but now they're coming back down to earth.

How many people, if you told them they could have a $1,000,000 house for $600,000 without much effort, would turn down that huge difference? I think the idiots have already purchased... and now the not-as-idiotics are left, ready to pounce.

red herring. this has been old news for over a year. doesn’t everyone know that prices could not stay up at those levels forever? everyone expects prices to drop 10 to 20 percent from the highs. now that the drop is here, interest is coming back slowly. outside of phila, new construction still humming along even though sales have slowed. pricing for lumber still shows demand albeit off from fall 2005 highs. but so what???

the big news is why this market is on a tear. give me the answer on that one not that ” housing prices are coming down”. thats too easy…

Off-topic but interesting, I was surprised real GDP cracked 1.5% (aside to bob, these numbers are all ‘real’ numbers, after applying the deflator, not before). While energy prices are down plenty, I had not expected a deflator under 2%. Then, I admittedly am no expert. Anyone have some insight?

In re housing, I put up a little chart of the three-month revision cycle for the last dozen census department reports. Long story short: revised down, revised down, revised down some more. I also don’t trust seasonally adjusted numbers in strongly trending markets (up through last summer, down since), so I plotted year-over-year growth vs supply in months of trailing-year sales. Supply is still at levels not seen for a decade, and growth is still negative, negative, negative.

The homebuilders, of course, continued to rally yesterday.

JT: The housing bubble is illusive. The only ones that can see it are the sellers. Ouch….!

How much does it cost a builder to build a home? I would suspect that this cost should be the center of gravity of home prices in a competitive economy. How wrong am I? Would anyone please enlighten me?

I second wcw’s doubt of the chain deflator. The COLA for Social Security this year was 3.4%! Does anyone believe this government has no interest in cooking the books? They lie about so many things, I think the presumption should be that they are lying about these numbers in a systematic way. After all, it is an election year.

U.S. new home sales down almost 10% Y.O.Y.

I wasn’t attune to the housing market slump back in the early 90’s.

Were homebuilders as aggressive as they are now in offering incentives when the market slowed noticeably?

I am amazed that risk appears to be a foreign concept in this market. Dow down 20? C’mon.

Apparently The Great Distribution is not scheduled to begin just yet.

And remember back in June with oil over $70/barrel , when the hedgies that the banks were squeezing couldn’t get $60/sh for their XOM => but now after a revenue light earnings report and oil < $60/barrel those who bought during the fire sale are gettin $72/sh! "we decide the price of a paper clip and everybody shakes their head and asks how'd they do that?"

Here in Silicon Valley, Santa Clara County y-o-y volume is negative for the 22nd straight month (since December, 2004) and 25th out of the last 26. (Putting the volume peak at August, 2004.)

For more stats, check out: http://www.viewfromsiliconvalley.com/id273.html

To keep up with, “What’s Really Happening,” in Silicon Valley, please visit,

http://www.viewfromsiliconvalley.com

Thanks!

Barry, in case you didn’t catch it, you were quoted in today’s Marketbeat (WSJ). Regarding builder incentives buttressing apparent gross sales prices. Way to go, you got ’em early:

http://online.wsj.com/article/SB116194987801405880.html

I’m more curious as to the effect of softening (collapsing) new house valuations upon markets that heretofore have not caught the housing bug. As laggards, do they get pounded similarly or do they just sit tight?

Surely the 15% error is on the 5% figure giving 4.3 to a 5.7 range!

Oct. 27 (Bloomberg) — An unexpected increase in auto production last quarter was a statistical fluke that will be reversed, making current U.S. economic growth even weaker, according to a former Commerce Department economist.

Last quarter’s annualized 26 percent increase in auto production shocked Joe Carson, now director of economic research at AllianceBernstein LP in New York. Without the gain, the economy would have grown at an annual rate of 0.9 percent , not the 1.6 percent the Commerce Department reported today.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aF5My4Z6jHiY&refer=home

It is somewhat misleading to just state that there is no statistically significant increase over last month’s number. If you assume the data has a normal distribution, there is a 70% probability that the actual number for September is higher than 1.021m (the current reported number for August). Given that the numbers have been revised downward every month, it is unlikely that the distribution is normal, but it still makes sense to assume the probability that the number is higher than 1.021m is above 50%.

Assuming it is a normal distribution again, the probability that Sepetember’s actual number is above 1.050m is about 60%. So the reasonable conlcusion is that it is more likely that the number is trending up than that it is trending down. Unless you go back to before June, which has a higher currently reported number than September.

I think the real issue with housing is that the only way the sales numbers look good is pre-revision, versus last month only. Jeepers, did you see the for-sale vacancy numbers today? It’s just not a pretty picture in housingland, and not to my mind in any way signalling bottom.

Thanks for the Bloomberg link. 1% Q3 GDP is much more what I expected to see than 1.6%.

Friday:

Markets down big on heavy selling.

Gold up.

Reminds me of May – June. There hasn’t been a day like this since July. Something changed.

From David Merkel, on RealMoney. Love the guy. He talks about insurance most of the time, but once in a while housing. He did actuary for some time, so he’s an expert on number crunching and the reality & consequences of those data.

—————————————————————-

“From the Census Bureau, the homeowner housing vacancy rate hit 2.5% for the third quarter of 2006, eclipsing the prior record of 2.2%. This is the highest rate since the Census Bureau began keeping records in 1956.

This is a better indicator of what is going on in housing than the sales numbers, the housing starts, or even the months of inventory. When 2.5% of all houses in this country are vacant, and more so in the major cities, it means that there are a lot of people who want to sell but can’t.

Echoing some of my earlier comments, I would also like to point out what one of our blog commenters, BillD, said regarding the inventory number falling:

“There are three artifacts in the new homes accounting. First, home are listed as sold when they go under contract, even though cancellations are now very high. This is why the new home sales are revised downward every month. Second, these houses from cancelled sales are not put back in the “inventory.” Thus, new home inventories may be markedly understated. Finally, incentives are not included in the price, and these incentives are worth something like 6-8%. So, new home prices are really down on the order of 16-18%. This month’s figures show that the builders are strongly undercutting the existing home sales, putting more pressure on prices. No wonder why builders are reporting that people are cancelling orders for new because they can’t sell their current home.”

The housing market is in bad shape, and getting worse, slowly but surely.”

Michael C, he pulls out some interesting figures, but I believe he’s wrong with, “First, home are listed as sold when they go under contract, even though cancellations are now very high. This is why the new home sales are revised downward every month.”

See my post above. Apparently, cacellations are never accounted for or added back into that.

I screwed up the Bloomberg link, here it is again.

stevens23 thanks for the link. As I mentioned earlier when I first read the GDP report, the autos number stuck out above all else.

“outside of phila, new construction still humming along”

Nope. Outside of Philadelphia (for two months now), Chicago, and Richmond.

Gotta keep up with those regional Fed reports!

Whoops sorry for nominal GDP, inventory was higher than I expected, no 4th quarter bounce however……Roubini betting in the lottery? The guy would be making a million bucks.

MarketWatch

“Inflation at the consumer level eased in the July-through-September period. The personal consumption-expenditure-price index increased at a 2.5% annual rate, down from 4% in the second quarter. The core PCE price index — which removes food and energy costs — increased at a 2.3% rate, down from 2.7% in the second quarter.

But the core PCE price index has increased 2.4% in the past year, up from 2.2% year-over-year growth in the second quarter. That’s the fastest pace since the second quarter of 1995.

The annual inflation rate is above the Federal Reserve’s 1.5% to 2% comfort zone. ”

MarketWatch

Roubini’s call for a recession sounds more real now

http://www.marketwatch.com/News/Story/D4bTmQF92zgHqGJB5TgVnQW?siteid=mktw&dist=TNMKTW

It’s also fair to note (and BR thanks for publishing links, for in nosing around one does get a better view of things) that any ADDITIONS to sales contracts are not noted. So if I sign a contract to build a home and I decide on ANY upgrade, to include a new garage, it is not included in the costs. I also wonder how “pure” they are in parsing out the costs of the lots.

MktManipulation: “now that the drop is here, interest is coming back slowly.”

Just wanted to point out. Whats the big deal that (negative?) savings rates are at an all time low? Because people will never want to earn 5% when they can earn 20%+ in stocks and now in real estate.

People don’t care for value. (Duh!) People need growth as soon as they no longer see its potential they run.

U.S. new home prices down almost 10% Y.O.Y.