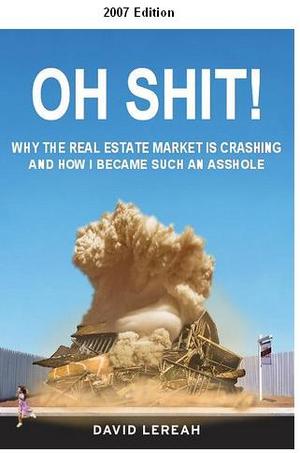

We’ve had plenty of well deserved criticism for former NAR Chief Economist David Lereah.

So you can imagine how much it tickled our funny bone to see, via Irvine Housing Blog, this updated new book from Lereah:

Old versions:

Latest Version:

Source: Irvine Housing Blog

>

That’s our Friday funny. Actually, here is the most recent (no joke) book from Lereah:

Well, at least the title isn’t a readily disprovable forecast…

I thought that levitating house had to be a joke cover. But it’s at Amazon! lol!

Too funny the 2nd slide shows the house a bit higher. lol!!

Does the last title prove that in fact real estate isn’t local anymore!?

lol

could be!

That is hilarious:) I guess there are no insurance policies in any investment but real estate used to be the “sure thing”. We are in the process of selling our house right now and we’re nervous about what we can get. I wouldn’t be worried if we could wait it out but we have to move. Crossing our fingers and hoping for the best!

Jerry

http://www.leads4insurance.com

Wow who would buy any of this crap…oh wait..

I disagree that the third title is not a prediction. Real estate may be local, but the mortgage market is not. The two markets are so closely linked that the non-local effects in the mortgage market are going to cause real estate to decline in all local US markets. That effectively makes real estate a non-local market.

read his subhead

” in a buyers and sellers market ”

WTF? A market is always a buyers and sellers market, what a blinding bit of the obvious from Mr. Lereah

I have never lost money in real estate and have barely made money in stocks.

If I had to chose between buying into a down real estate market or a down stock market it is far wiser to buy the real estate.

BWWAAHAAHAAHAA

Funniest shit I’ve seen all week.

Wow. What’s it going to take for that discredited tool to shut up?

All Real Estate is Local -DL book Title

Well, at least the title isn’t a readily disprovable forecast… -BR in reply

I beg to differ. As proof I suggest you go to your local lender for a local loan that will be judged on local conditions of economy, bank standards, your job, your relationship professional and personal with the lender, etc. Sorry but real estate has been commoditized, packaged and has for good and ill gone international.

Ken,

I have some condos in Florida I would like to interest you in. Florida real estate never goes down.

Sincerly,

Florida condo investor

Don’t forget this one:

The Rules for Growing Rich : Making Money in the New Information Economy

June 2000

Funny.

I heard an interesting statistic from a friend who worked on some LBO deals in the housing related industry over the last year. He said that last year (’06) 10% of the total housing stock turned over. The long-term historical average is 5%. Wonder if Lereah cites this one.

Alas, there is a reason this fellow’s name rhymes with a certain liquid bowel movement.

I tend to agree with Ken. GOOD real estate bought on leverage with equity in the game has always treated me well. Need to buy at replacement cost or less and have a reasonable expectation of a reliable income stream. Houses are a different matter. I too have guffhawed at the ignorance of housing market players and investors. I’ll take those condos in Florida………at my price.

Income producing R E with long term fixed financing is like betting the Federable Gummit will continue to devalue your currency. You are effectively arbitraging the stupidity of lenders against the stupidity of your Government.

My understanding is that is his old neighborhood in the DC area. His house is at he end of the cul-de-sac.

Thanks for the link. I am glad you got a good laugh from it.

Come on, lets give this guy a break… he has either mental problems or can not accept reality if it sh*t on him. This guy has been so discredited that no one will purchase this latest book. The book I’m waiting for is Lawrence Yun’s book, that one should have plenty of laughs for 2008. But seriously everyone, what can we really expect from these Realtors? … Their livelyhood depends on house sales and they have to use propoganda just like any other totalitarian regime. (I wonder if they have an office in Russian, if so then you can bet on the propaganda to get stronger and stronger… can you imagine Putin predicting a “bottom” to the U.S. Housing market? )

BTW, I work in the Real Estate & Mortgage Industries and all i can tell you is brace yourselves. The guidelines keep getting tighter and tighter. Lenders are being more quiet about certain things and are getting rid of many programs and restricting maximum LTV ratios. Subprime is basically paralyzed and FYI-they changed their name to Non-Prime now. Wall St and International Investors won’t buy any securities related to US Real Estate. And the Govt will compound the mess by adding 783 new laws that won’t help the current crisis. And Obama, Clinton, Edwards, McCain & Huckabee won’t discuss because Iraq keeps them busy. People, we’re screwed and we just have to take it. My livelyhood depends on things going well, but I’m a realist and this has a long downward way to play out. Hey, it was good while it lasted…now I actually have to earn the money that i get.

Baby boomers are already housed, and beginning to retire. Markets are overbuilt. More available houses than buyers. Classic interest rate driven housing bubble. Leverage is great when the market is moving up, but is crushing when prices drop. Prices will more than likely drop to pre-bubble 1997 price levels. Consumer spending is declining as baby boomers brace for retirement. Gold prices are rising at a frightening rate. Opening the borders and taxing illegals won’t solve the problem.