Several of you have written asking exactly how much traffic has spiked this week, and what it might mean in terms of a rally.

Its a little complicated, but here are the details:

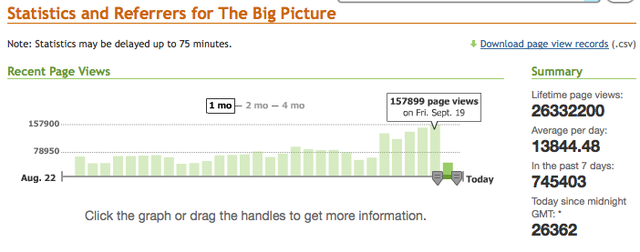

As noted last week, September 15th was our first 100k+ day. The rest of the week was even busier: Traffic was nearly triple its usual, culminating with a 157,899 page view day on Friday. Traffic for the week — Sun. Sept. 14-Sat. Sept. 20 — was 789,935 page views, also a first. At this rate, we are likely to see 2 million page views for the month (another record).

In terms of psychology, its a mixed bag. Monday and Tuesday were clearly fear driven. Whenever the market really gets whacked, people seek information about what is going on here.

Later in the week, it was some fortunate linkage. David Leonhardt’s NYT column had some nice things to say about the upcoming book on Bailouts, and the NYT drove a ton of traffic Wednesday. On Thursday, the post on SEC waiver of leverage rules got picked up by boingboing, fark and a few other major traffic drivers.

In terms of the technical set up and market sentiment, there were 2 posts where we suggested a reversal was imminent:

• 50% Retracement of 2002-2007 Rally (9/16/08)

• Fear Returns to the Markets (9/18/08)

Combine the technical and sentiment factors with the government bailout, and you have the makings of a powerful — but likely temporary — rally.

>

Daily Statistics 9.19.08

Visitors and Pageviews, Monthly, as of 9.20.08

>~

~~~

A few caveats, however, are in order.

First, the biggest 2 day rally in the Dow since 1929 should lead to more upside — but its likely to be temporary.

And, as the Pakastani government recently learned, you cannot mandate the markets to go higher

What's been said:

Discussions found on the web: