“Analysts completely missed the boat again with the subprime and credit crises. They should’ve given some early warning signs to investors to bail out, or at least lighten up their portfolios. That warning never came.”

-Jacob Zamansky, investor securities lawyer

>

Today’s Times looks at an issue that is one of our longstanding complaints: Wall Streets BUY bias.

Why is any of this still a surprise? Given the inherent conflict of interest between underwriting/syndicate and investing, it shouldn’t be.

The iBanks do not want to risk offending potential banking deals, M&A clients, or other corporate advisory.

Here’s an excerpt:

Even now, with the recession deepening and markets on edge, Wall Street analysts say it is a good time to buy.

Still.

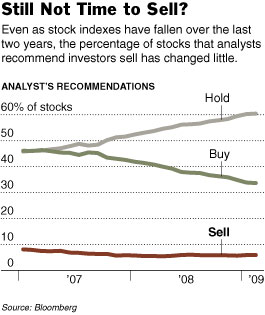

At the top of the market, they urged investors to buy or hold onto stocks about 95 percent of the time. When stocks stumbled, they stayed optimistic. Even in November, when credit froze, the economy stalled and financial markets tumbled to their lowest levels in a decade, analysts as a group rarely said sell.

And last month, as the Dow and Standard & Poor’s 500-stock index suffered their worst January ever, analysts put a sell rating on a mere 5.9 percent of stocks, according to Bloomberg data. Many companies have taken such a beating in the downturn, analysts argue, that their shares are bound to bounce back.

Maybe. But after so many bad calls on so many companies, why should investors believe them this time?

When Internet stocks imploded in 2000 and 2001, Wall Street analysts were widely scorned for fanning a frenzy that had inflated dot-com shares to unsustainable heights. But this time around, credit rating agencies, mortgage companies and Wall Street bankers have shouldered much of the blame for the Crash of 2008, and few have publicly questioned the analysts who urged investors to buy all the way down.

Does this still surprise anyone . . . ?

>

Previously:

Only 5% of Wall Street Recommendations Are “SELLS” (May 16th, 2008)

http://www.ritholtz.com/blog/2008/05/only-5-of-wall-street-recommendations-are-sells/

Analysts Belated Downgrades (November 18th, 2008)

http://www.ritholtz.com/blog/2008/11/belated-downgrades/

Source:

Why Analysts Keep Telling Investors to Buy

JACK HEALY and MICHAEL M. GRYNBAUM

NYT, February 8, 2009

http://www.nytimes.com/2009/02/09/business/09analyst.html

What's been said:

Discussions found on the web: