No surprise here: Even amongst the most credit worthy borrowers — aka “Prime” — defaults are rising rapidly. Job losses, debt problems, loss of income are the primary causes.

Prime borrowers at least 60 days behind on mortgages — “Delinquent” is the official term for this period — rose from 497,131 in December to 743,686 in January, according to the Federal Housing Finance Agency. This is almost double the total for October.

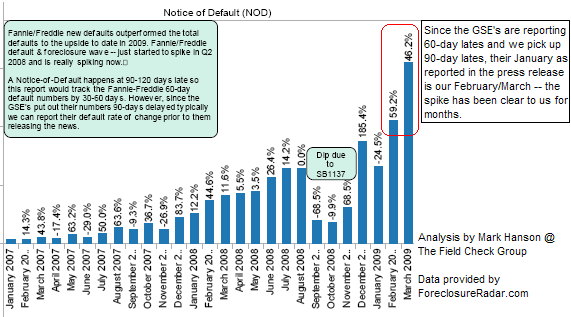

The 3 step process is delinquency (60 days late), default (determined by the terms of the mortgage itself — but usually 90 or 120 days behind), leading to foreclosure.

Bloomberg:

“Fannie Mae and Freddie Mac mortgage delinquencies among the most creditworthy homeowners rose 50 percent in a month as borrowers said drops in income or too much debt caused them to fall behind, according to data from federal regulators . . .

Of all borrowers who ended up in default, 34 percent told Fannie and Freddie they were earning less money, about 20 percent cited excessive debt as a reason for missing mortgage payments, and 8.1 percent blamed unemployment, FHFA said.”

Note once again these are not Sub-prime or alt-A — they are Prime, the highest quality borrowers possible.

>

Chart via Field Check Group

>

Source:

Fannie, Freddie Defaults Rise as Borrowers Cite Lower Income

Dawn Kopecki

Bloomberg, April 21 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aw4.u4ryoAq0&

What's been said:

Discussions found on the web: