This morning’s outrage comes to us via the WSJ, and it discusses how our elected representatives rolled over for their overlords, the bankers, in grateful genuflection to their largesse: Huge heaps of lobbying monies:

“Not long after the bottom fell out of the market for mortgage securities last fall, a group of financial firms took aim at an accounting rule that forced them to report billions of dollars of losses on those assets.

Marshalling a multimillion-dollar lobbying campaign, these firms persuaded key members of Congress to pressure the accounting industry to change the rule in April. The payoff is likely to be fatter bottom lines in the second quarter . . .

The rule change angered some investor advocates. “This is political interference on a major issue, and it raises questions about whether accounting standards going forward will have the quality and integrity that the market needs,” says Patrick Finnegan, director of financial-reporting policy for CFA Institute Centre for Financial Market Integrity, an investor trade group.”

There was little surprise that FASB, like so many other organizations in the current mess, failed to show any testicular fortitude whatsoever. They rolled over in the face of intense lobbying and congressional pressure, so their masters could rub their bellies.

What else should we have expected from a group of neutered accountants?

>

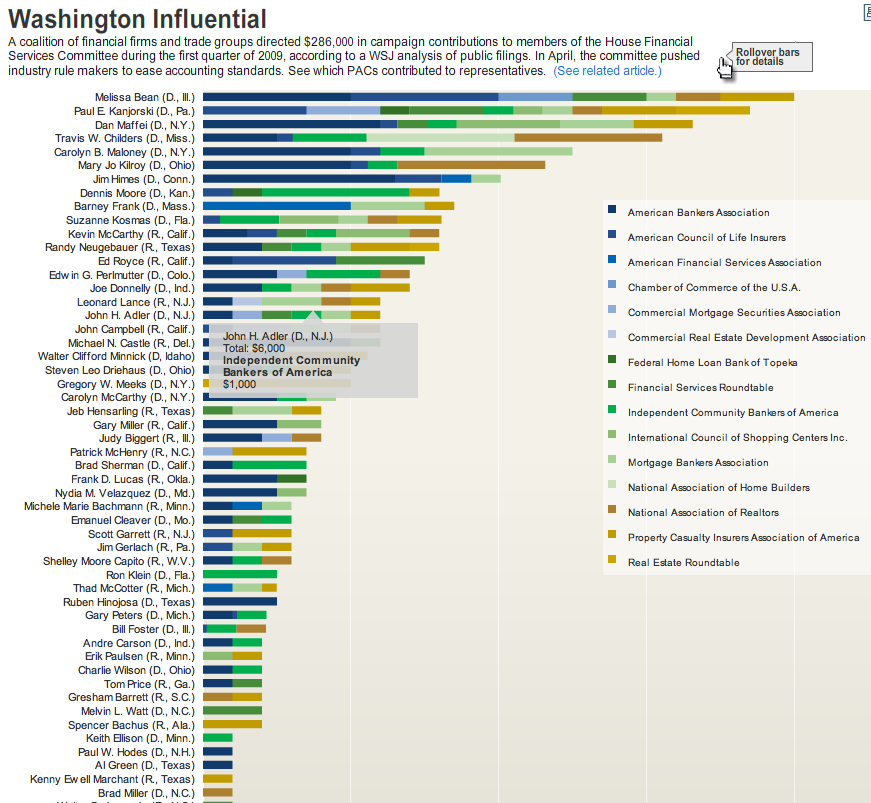

click for larger interactive graphic

>

Source:

Congress Helped Banks Defang Key Rule

SUSAN PULLIAM and TOM MCGINTY

WSJ, JUNE 3, 2009

http://online.wsj.com/article/SB124396078596677535.html

What's been said:

Discussions found on the web: