The Association of American Railroads has begun publishing “Rail Time Indicators,” their monthly look at Rail Transport related data.

Here’s an excerpt from their most recent report:

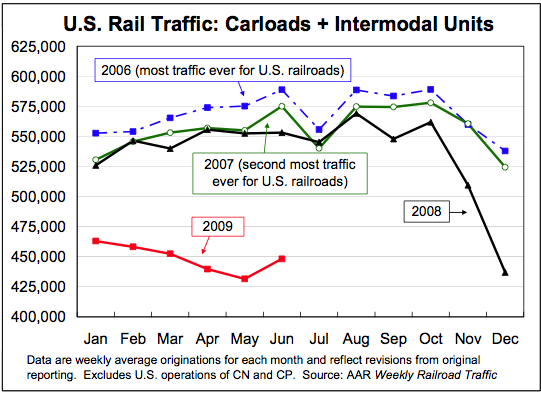

• Carloads originated on U.S. railroads in June 2009 were down 19.5% (252,078 carloads) from June 2008 to 1,037,928 carloads. June 2009 was the eighth straight double-digit monthly carload decline, but it was a smaller decline than the previous two months. Average weekly carloads in June 2009 (259,482) were 10,311 carloads higher than in May 2009.

• U.S. intermodal traffic (which is not included in carloads) was down 18.2% (168,031 trailers and containers) in June 2009 to 755,000 units. (See table next page.)

• For the second quarter of 2009, U.S. rail carloadings were down 22.2% (945,652 carloads); second quarter intermodal traffic was down 18.3% 538,345 trailers and containers).

• For the first six months of 2009, U.S. rail carloadings were down 19.3% (1,573,998 carloads); intermodal traffic in the first half of 2009 was down 17.0% (950,147 trailers and containers).

And of course, a chart — 2007, 08 and 09 — note the seasonality around June each year:

>

>

From their report:

“AAR combines rail traffic data with more than 15 key economic indicators (such as consumer confidence, housing starts, and industrial production) in a non-technical snapshot of the U.S. economy. By assembling this information in a single place, and presenting rail traffic in the context of the broader economy, Rail Time Indicators provides a convenient, clear look at the key trends that can reveal where the economy — and, therefore, rail traffic — are going.”

Weekly AAR data detail rail carloadings for 19 major commodity categories, as well as intermodal

trailers and containers, for the previous week for a group of railroads that collectively account for the vast majority of total U.S. and Canadian rail traffic.Freight railroading is a “derived demand” industry — demand for rail service occurs as a result of

demand elsewhere in the economy for the products that railroads haul. Thus, freight rail traffic is a useful economic indicator, both for the overall economy and for specific sub-sectors.

Interesting to see something that’s not pure spin from a trade group . . .

>

Source:

Rail Time Indicators

A Review of Key Economic Trends Shaping the Demand for Rail Transportation

Association of American Railroads July 21, 2009

http://www.aar.org/Home/AAR2/NewsAndEvents/RailTimeIndicators.aspx

Rail Time Indicators July 2009

http://www.aar.org/Home/AAR2/NewsAndEvents/~/media/AAR/RailTimeIndicators/Rail%20Time%20Indicators%20July%202009.ashx

What's been said:

Discussions found on the web: