The Securities and Exchange Commission has proposed halting high frequency and flash trading.

In response, Nasdaq (and others) are now prohibiting flash orders. Supposedly, the NYSE is also considering banning the practice.

This was a given. The real question that remains unanswered and demands a thorough investigation is this: WHAT EXCHANGE OFFICIALS APPROVED THIS? WHO BELIEVED THAT ALLOWING FAVORED FIRMS TO FRONT RUN OTHER INVESTORS WAS OK?

Quite bluntly, the clueless dolts who allowed this to occur need to be publicly excoriated, fired from their job as exchange officials, and driven out of town on a rail. Oh, and, all the gains from this organized theft should be clawed back from all the front-running firms that stole this money — THAT’S RIGHT, ITS THEFT — one quarter cent at a time. Put the recovered ill-gotten gains into the SIPIC fund that compensates investors who have been defrauded by their stock brokers.

Stop for a moment to consider what sort of massive disregard for the investing public is required to permit this kind of trading. The sheer hubris that finds no problem in this exchange permitted encouraged theft is hard to fathom.

One of the problems with the most recent crisis is that there have been no shaming of the responsible parties, no disgorgement of ill gotten gains, no perp walks. We need to change that pronto.

The WSJ had an Op-Ed last month, In Defense of ‘Flash’ Trading, that suggested that “Flash trading is like offering to sell your house to your neighbor before you officially put it into the real estate listings.”

That description is, of course, utterly false. We have alternative exchanges where you can offer stocks privately to other willing buyers (i.e., Instinet). Flash trading is more like having access to private info from the sellers, knowing what they will accept, stepping in front of legitimate buyers, and then flipping the house to those buyers while capturing 0.001% of the transaction. No benefit to the seller, to the neighborhood or to anyone else — all at a small cost to the buyer.

Oh, and that article defending Flash Selling? It was written by Donald Luskin — so you know its utterly wrong, morally contemptible, and guaranteed to lose you money.

Quod Erat Demonstrandum . . .

>

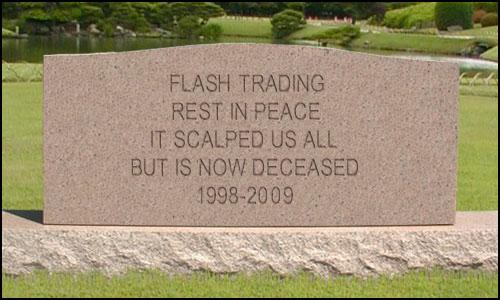

epitaph courtesy of Josh at Reformed Broker

>

Sources:

Flash Trading Halt Backed for Nasdaq, Bats as SEC Proposes Ban

Whitney Kisling and Jesse Westbrook

Bloomberg, Sept. 18 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aCHizjnQq73E

In Defense of ‘Flash’ Trading

CHRIS HYNES AND DONALD LUSKIN

WSJ, AUGUST 27, 2009

http://online.wsj.com/article/SB10001424052970203706604574374431720968204.html

What's been said:

Discussions found on the web: