Invictus here, folks, with a smattering of items that caught my eye last week. Food for thought on what will likely be a quiet Columbus Day trading session (famous last words).

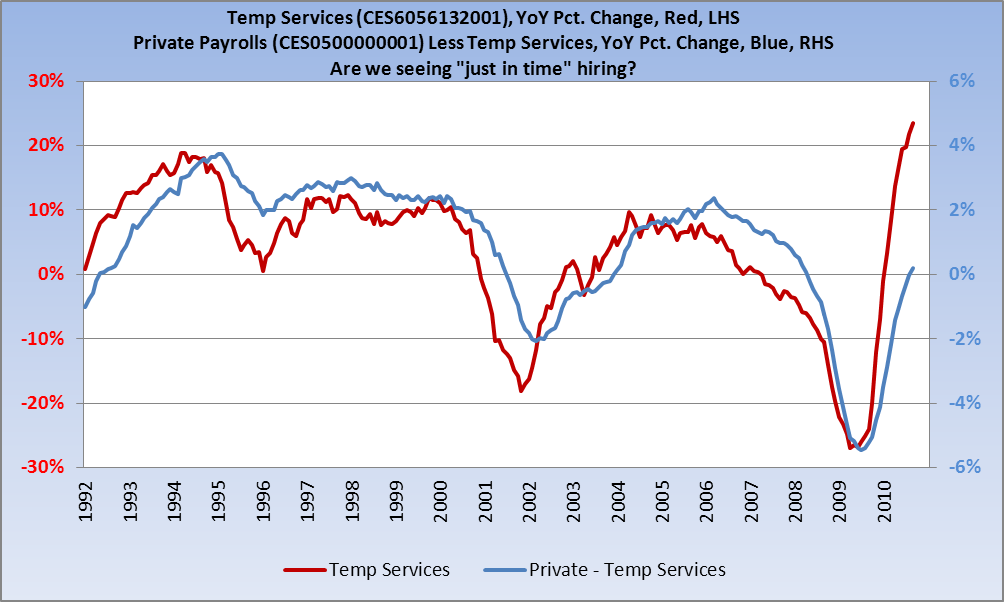

Revisiting a theme I introduced here in July, I continue to follow the trend of Temporary Services jobs vs. Private Sector jobs less Temps. As Temps has always been a leading indicator for overall nonfarm payrolls, it should have a story to tell. What’s interesting in the updated chart below is the rate at which Temps has continued to outpace the year-over-year growth in private sector jobs less Temps, something we’ve not seen in the almost 20 years the Temps metric has been recorded. I suspect that, with continuing economic fragility and a fairly cloudy outlook, employers have taken a “just in time” hiring posture, and using temporary workers is the best way to execute on that plan. Remember that “Poor Sales” is the largest concern (by far) expressed by small business members of the National Federation of Independent Business (NFIB) in its monthly Small Business Economic Trends (SBET) (.PDF), and has been for quite some time. Temps is up 23.4% year over year while Private Payrolls – Temps has just cracked through zero and now sits at +0.2% year over year (the first positive print since April 2008, a 28 month negative streak).

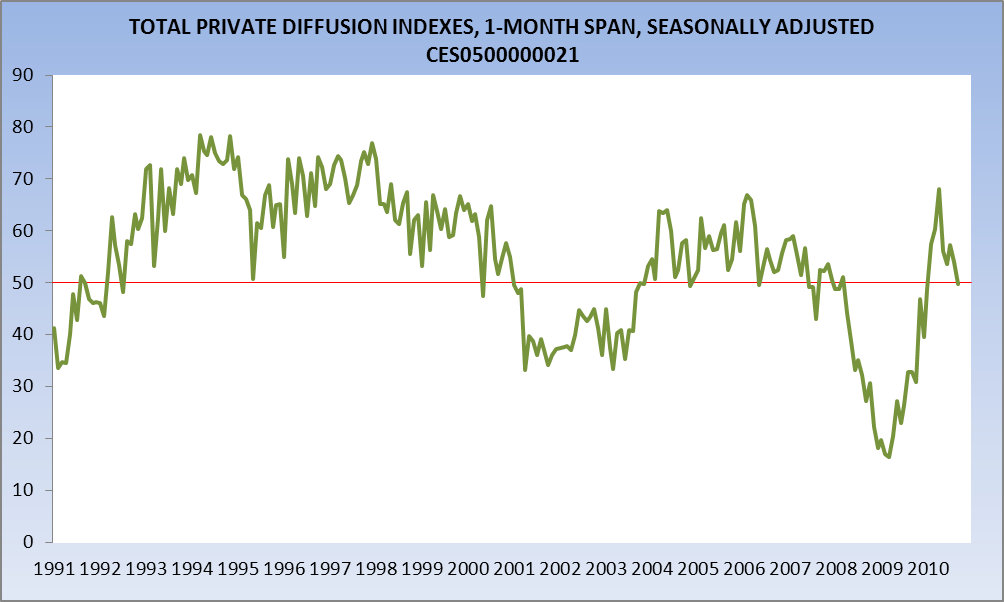

The preliminary read on the diffusion index for the month broke under 50 for the first time since January, which is to say that more companies are cutting payrolls than adding to them (i.e. above 50 = good, below 50 = bad). This metric was actually higher in December 2007 — at 50.6 — when the recession started, than it is now.

To help me visualize the amount of slack in the labor market, I created this chart some time ago over at FRED. It shows the Unemployment Rate and the Year Over Year percent change in Average Hourly Earnings for Private Industries. As one might expect, high(er) unemployment results in stagnant (or lower) wages, while low(er) unemployment results in higher wages. Simple supply and demand at work. The bad news is that, as far as the labor market is currently concerned, there is way too much supply and way too little demand, as evidenced by the yawning gap we’re currently experiencing. (On second thought, I probably should have indicated “minimal” slack instead of “no” slack, but the point remains.)

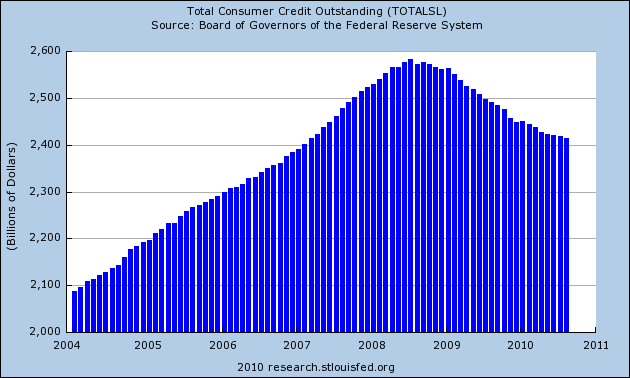

Consumers continue repairing their balance sheets, deleveraging, and reducing their credit. Consumer credit (ex-mortgages) is down some $168 billion since its peak in July 2008. Some of the decline is borrower paydown, some is lender writedown. In either case, I’d venture a guess that a new credit cycle is still not close at hand.

The Dow Jones Industrial Average has very stealthily, and to virtually no fanfare, charted another Golden Cross (50-day MA crosses the 200-day MA from below). The S&P500 is on the brink of following suit, barring a significant short term sell off. The Golden Cross was, if memory serves, much more widely publicized when it occurred last year. Not being trained much in technical analysis, I’m not sure quite what to make of two Golden Crosses occurring within 18 months of each other, so I’ll leave it to the technicians to figure out what this means.

Moving on, I would throw in that I think New Jersey Governor Chris Christie’s decision to scrap a new rail tunnel between New Jersey and New York is wrong in every possible way. I’m not even sure the most ardent austerian can deny the need to continue trying to ease congestion in and around New York City in any way possible. There are reports that he is reconsidering his decision, and I sincerely hope he sees the light (insert balance of idiom here).

Lastly, to the folks running the Metropolitan Transit Authority, who just approved the third set of fare hikes in as many years, listen up: Your repeated fare hikes are beyond offensive and are, at this point, making driving a very competitive alternative. I kid you not. Between the newly approved fare hike and the monthly charge to park at the station, driving is becoming a serious alternative and, should I find a neighbor with whom to commute, it’s an absolute money-saving no-brainer. If I needed a MetroCard, which I don’t, the MTA would have already seen the last of me.

As State Senator Carl L. Marcellino put it in a letter to MTA CEO Jay H. Walder (annual salary: $350,000 plus “living allowance”) in August of this year:

Take a Huntington rider for example. The monthly cost to ride the LIRR will increase from $274 to $299 a month, a $300 yearly increase to an astronomical $3588 a year. Add to that a proposed monthly $130 Metrocard and that Huntington resident will pay over $5,000 a year just for the privilege of using the MTA to get to work. For someone making $50,000 a year, that is more than 10% of their income. That cost is simply unaffordable and totally unacceptable.

Marcellino’s point is well taken, but the bottom line is this: Anything in the vicinity of $400/month to commute is simply outrageous, no matter one’s earnings. Commuters have gotten nothing — nada, zilch, naught, cipher — in exchange for ponying up more and more for a monthly commutation. In fact, we’ve faced nothing but cuts. Keep it up and the mass exodus of employers (and their employees) from New York will continue unabated. Please, stop the insanity. (As an aside, and a final thought: Is there a bigger joke than the pretense that anything anyone says during the requisite “public comment” period will be taken seriously?).

What's been said:

Discussions found on the web: