I am no fan of Core Inflation measures; Stripping out inflationary items because they are volatile is not helpful.

In today’s NYT, however, Floyd Norris makes the argument that comparing the US with Japan’s battle with inflation, then disinflation than deflation might be instructive. It is a rather compelling counterpoint to John Mauldin’s O Deflation, Where is Thy Sting?.

Excerpt:

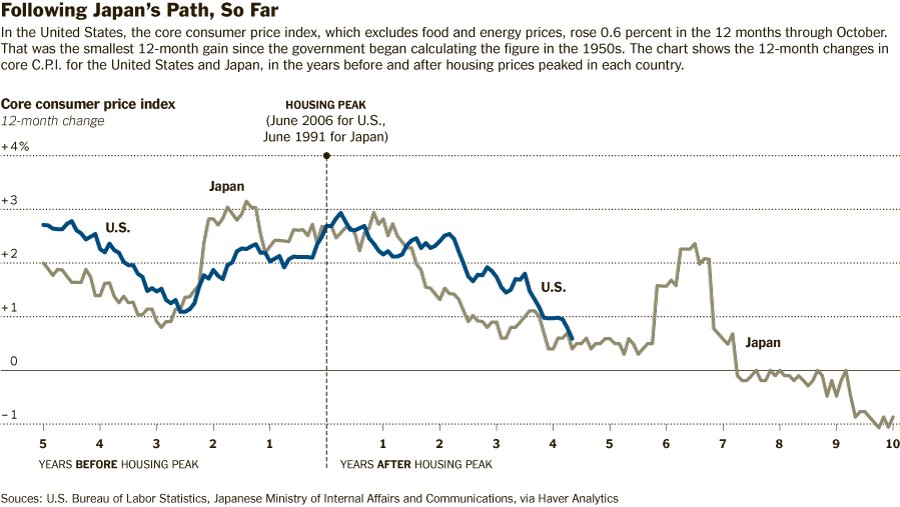

“Since the collapse of the housing market in the United States and the beginning of the global financial crisis, the Federal Reserve has made avoiding deflation a major priority, recalling the experience of Japan after its bubble burst in the early 1990s. The Fed has set an annual inflation target of 2 percent or a little lower, but is not getting it.

The latest figures, released this week, showed that overall inflation in consumer prices was 1.2 percent in the 12 months through October, while the core inflation rate — excluding food and energy — rose just 0.6 percent. The previous low for that index, of 0.7 percent, came in the 12 months through February 1961, when the economy was in recession.

The core inflation figures are charting a path roughly similar to one shown in Japan 15 years earlier. That has been true despite a much stronger reaction by the American central bank, which was determined not to make the same mistakes the Japanese made.”

>

Inflation?

chart courtesy of NYT

>

Source:

After the Fed’s Action, Watching Inflation’s Trajectory

FLOYD NORRIS

NYT, November 19, 2010

http://www.nytimes.com/2010/11/20/business/economy/20charts.html

What's been said:

Discussions found on the web: