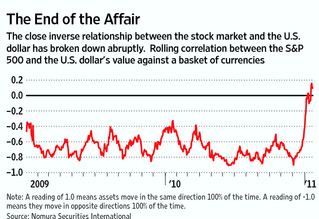

The WSJ has an article today looking at the ending of highly correlated asset classes. It seems that Equities are no longer correlated to the US Dollar and Gold as closely as they have been over the past 2 years. If history holds, this is positive for both the economy and markets longer term. It suggests a return to normalcy in investing.

Consider: Way back in the fall of 2008, just as the collapse in banks was picking up speed, the markets gave a fascinating warning sign: Many different asset classes that were normally non-correlated — equities, dollars, gold, fixed income, commodities, convertible bonds, real estate — suddenly became extremely correlated. This is typically a very strong warning sign.

Why? These assets classes normally trade on primarily differing inputs. They are the at core of a diversified asset allocation model specifically because they all trade so differently.

When all of these different asset classes suddenly start moving in lockstep, it is because the same too factors were driving them: Liquidity and Fear.

In the past, this high correlation occurred prior to major dislocations. (I have a study I need to dig up that shows exactly when and how this happens).

Here’s the WSJ:

“After a long stretch in which macroeconomic hopes and fears dictated the rise and fall of stocks, bonds and commodities—known in the market as the risk-on, risk-off trade—there are tentative signs that more-traditional concerns are reasserting their power.

In recent weeks, for example, moves in stocks and the U.S. dollar have had little connection—a breakdown of the trend during much of 2010, when they were virtual mirror images of each other. Stocks were considered risky and would rise when investors were feeling confident, while the dollar was a haven, benefiting when investors were worried.

Commodities, too, have broken away from rising and falling with risk perceptions. Now more old-fashioned concerns, like the weather, are having an impact. Corn, soybean and wheat prices jumped this month after supply estimates were cut due to dry weather in South America and floods in Australia.”

I am not sure I would agree with the title — it is not that markets are rediscovering the fundamentals, it is more that the sentiment trade is fading, and fund managers seem to be slowly getting over the trauma . . .

>

Source:

Markets Rediscover the Fundamentals

MARK GONGLOFF

WSJ, January 24, 2011

http://online.wsj.com/article/SB10001424052748704115404576096510662027504.html

What's been said:

Discussions found on the web: