There is a gushing article in BusinessWeek on Tyler Cowen, America’s Hottest Economist. It is interesting in a wonky kinda way.

Way back in 2008, I had a problem with one of Cowen’s NYT articles Tyler Cowen: “Predatory Borrowing The Bigger Problem”. I thought that he was ignoring the role the Fed and lenders played in the crisis, and blaming ignorant borrowers who took on too much debt/leverage. As former Fed Governor Ed Gramlich showed, Predatory lending was the problem. As to “predatory borrowing,” it is now more accurately described as “bank origination fraud.”

I have since warmed up to more of his writing, especially things like this 2009 piece: Why Creditors MUST Suffer Also. We share similar views on Moral Hazard, and why bad investments and lenders need to suffer the consequences of their actions.

As to the Business Week piece, I have two wholly unrelated thoughts:

1) Cowen seems like a genuine, nice and smart guy. It is a bit of a shame that his world view has been blinkered with the standard economist’s myopia, being based in large part on fundamentally flawed assumptions about how human beings behave in the real world.

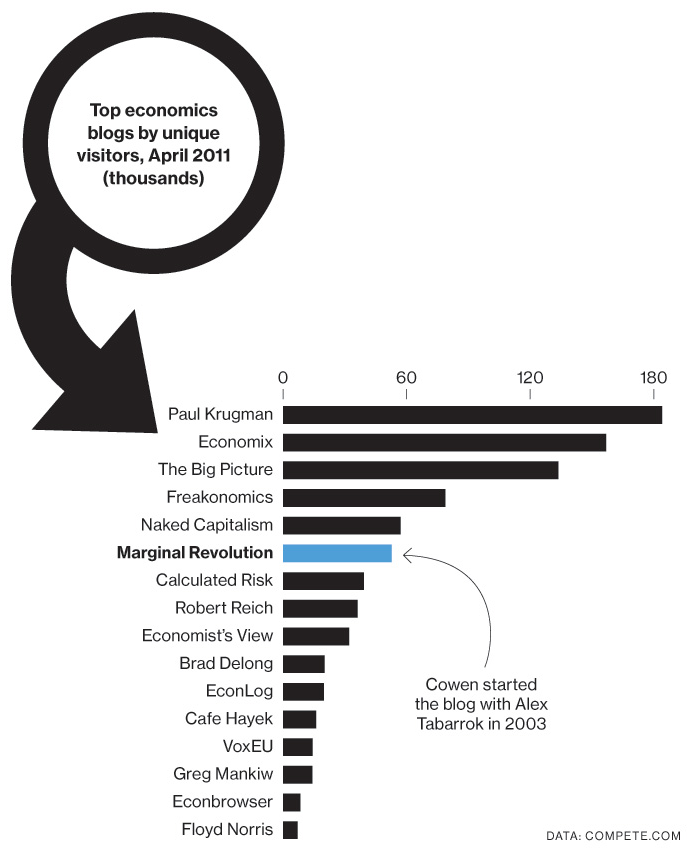

2) The second thought: The graphic that accompanied the article was really, really awesome (see if you can guess why):

>

>

Previously:

Tyler Cowen: “Predatory Borrowing The Bigger Problem” (January 13th, 2008)

Bad Precedent: The Long-Term Capital Bailout (December 28th, 2008)

Why Creditors MUST Suffer Also (April 5th, 2009)

Missing Radical Deregulation As a Cause of Crisis (September 13th, 2009)

Source:

Tyler Cowen, America’s Hottest Economist

Brendan Greeley

Business Week, May 26, 2011

http://www.businessweek.com/magazine/content/11_23/b4231066695798.htm

What's been said:

Discussions found on the web: