I began my career in finance as a trader. Our compensation was based on a combination of trade volume and performance gains. We were given little in the way of training — pretty much thrown into the deep end of the pool, while the head trader screamed “Swim!”

These were the early days of multi-player gaming. I would spend the day scratching out small gains, before going home flat. (Carrying an overnight position involved more risk than we were allowed to assume).

Then came Quake. After the close, we would hijack a price server, and a dozen or more guys would jack into the trading floor network for a quick round of blast and run. Although mid 1990s game might appear crude compared to today’s HD rendered graphics and 3D physics engines, these were totally immersive experiences. You would get completely lost in the nether world; what was supposed to a quick hour to blow off some stress fragging the guys you sat shoulder-to-shoulder with. The RPG/Nail Gun/Hammer driven shoot ’em up often lasted deep into the night. It was where I first understood what the phrase “glorious kill” meant.

Then came Quake. After the close, we would hijack a price server, and a dozen or more guys would jack into the trading floor network for a quick round of blast and run. Although mid 1990s game might appear crude compared to today’s HD rendered graphics and 3D physics engines, these were totally immersive experiences. You would get completely lost in the nether world; what was supposed to a quick hour to blow off some stress fragging the guys you sat shoulder-to-shoulder with. The RPG/Nail Gun/Hammer driven shoot ’em up often lasted deep into the night. It was where I first understood what the phrase “glorious kill” meant.

The parallels between trading and the shoot ’em ups was obvious: You feel your way around a shadowy world where perils and rewards lay around each turn. In the beginning, you get toasted regularly by people with superior kno0wledge and firepower. After a while, you develop a familiarity with the lay of the land, learn where some power ups and weapons were hidden, and start to out shoot your competitors.

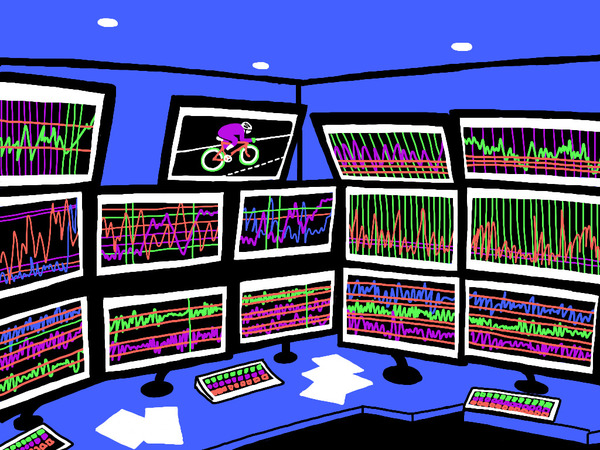

I was reminded of those early days reading a piece in The Atlantic about the daily work of traders at a bulge bracket firms. Although a trader’s actual job is quite specific — a “complex combination of rules and triggers” to generate specific monthly returns relative to risk and volatility — the work itself increasingly resembles MMOGs:

“Mind you, the game the traders play is nothing like Mario or Zelda or Megaman. It’s not a shoot-em-up or racing game. What it is is more like Starcraft or maybe TradeWars: an intense, cerebral, massively multiplayer real-time strategy game. It’s a game grounded in information: prices, mostly, but also all kinds of news and rumors and oblique signals, whether by way of balance sheets or CNBC. It’s the kind of game that requires the player to immerse himself in data, distill from it a sort of strategical gestalt, and convert that high-level battle plan into a series of discrete maneuvers, in this case trades on the open market.

The difference here being, of course, that it’s all real.”

Situational awareness and the ability to juggle are not only required skills:

“What stands out instead is a whole lot of fine-grained maneuvering: flitting from an open chat window over to a spreadsheet to run quick scenarios based on a new idea; backing off from a trade to see where his risk is at for the day; tracing counterfactuals (“if I do this and the market does this and I do this…”); catching a position on the verge of a critical price, diving into “crisis mode” for two minutes, eyes fixed on a few specific numbers, poised to react with a chord of contrapuntal trades; leaning back to watch the market for certain thematic trends; shouting to one of the senior traders on his desk when he’s confused about something; blocking half an hour to drill down into the details of a contract’s code; working out a low-level tactical “line”; jotting quick calculations and graphs; executing a series of rapid trades, running through a mental checklist to avoid mistakes; kibitzing with colleagues; responding to e-mails; eating; and keeping an eye on the news.

He says that his attention span has shortened but that in return he’s picked up two abilities: broad situational awareness, i.e., the ability to juggle lots of disparate facts in working memory; and the pre-scandal Tiger-Woodsian knack for blocking out distractions when something big is on the line.”

I would imagine most traders can confirm similar sensations between gaming and trading.

I would imagine most traders can confirm similar sensations between gaming and trading.

When I shifted from, trading to research, I experienced two difficulties: The first was pulling the needle out of my arm. Trading is a drug that involves lots of dopamine. All of the psychological discussions we have here, at least in part, trace to an early recognition that trading for an adrenaline high is not a formula for making money.

The second? The end of those late night Quake games . . .

>

Source:

On the Floor Laughing: Traders Are Having a New Kind of Fun

James Somers

The Atlantic May 9 2011

http://www.theatlantic.com/technology/archive/2011/05/on-the-floor-laughing-traders-are-having-a-new-kind-of-fun/238570/

What's been said:

Discussions found on the web: