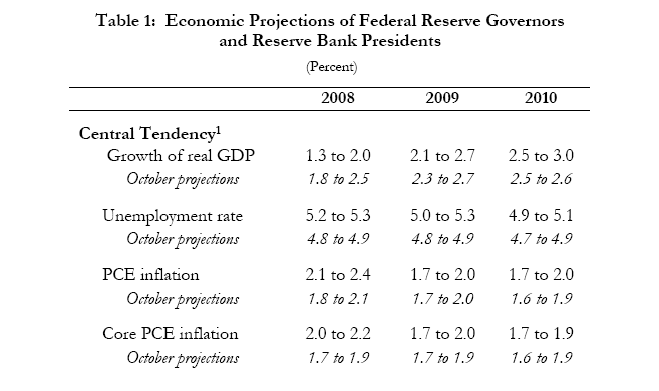

Good Thursday morning. We are seeing Markets lower in Europe and Asian after Uncle Ben and the Fedettes lowered their perennially over-optimistic forecasts for growth in the US. Global Markets reversed their modest gains and sold off yesterday, and there seems to be follow through in the futures this morning.

From Sub-prime being contained (James Grant quipped “Yes, contained to planet earth”) to the panicked end of the world forecast during the crisis (thus preventing a Swedish pre-packaged bankruptcy for insolvent banks) to the over-optimistic recovery, the forecasts of the Fed in general and BB specifically have been little short of awful.

Then again, the forecasts of 90% of the economic community ain’t worth a plug nickel. Beyond the institutional habit of being excessively optimistic, the Fed’s economic forecasts have been working off the wrong data set, stubbornly refusing to recognize that this is a credit driven crisis, and not your run of the mill business cycle contraction. They have either been unwilling or unable to recognize this. I am not sure which I find more galling: The lack of acumen or missing sense of humility for the failures.

Trader’s lack the luxury of being that wrong over and over again. The best career advice for any trader with the Fed’s forecasting track record would be to learn the phrase “Would you like fries with that, sir?”

This is the savage tragedy of giving a group of economists this much influence and authority. I disagree with Ron Paul — its not that we should End the Fed, it is that we should replace much of its ruling economists with mathematicians and engineers. Applied Physics (and its empirical-based scientific method) should drive monetary policy, and not the squishy, cognitively challenged economists who suffer from the human foibles of believing they have a clue about the future. As history as shown, with few exceptions, economists do not seem to comprehend the recent past, much less the next few quarters. I maintain a private list of economists who actually do understand the recent past as well as the present, and they are worth their weright in rapidly appreciating gold.

The first step to fixing the Fed is for them to get a firmer grasp on understanding their own lack of understanding. I am beginning to suspect we have a case of Dunning-Kruger Syndrome at work. Perhaps they might focus more on the probabilistic nature of forecasts, and place less emphasis on declarative opinions. Some error tracking and more frequent corrections would be nice as well.

The sooner we recognize that the field of economics is a branch of Sociology and not Mathematics, the better off we will all be.

>

What's been said:

Discussions found on the web: