The bad news for investors pursuing positive real returns is obvious – the first half of 2011 was painful. The good news is that a set of conditions now exist that we think sets the stage for meaningful structural change…and it may occur soon.

After three years of Western governmental economic heavy-handedness in the markets, the global commercial marketplace seems to be asserting its priorities. While politicians and policy makers retain mandated authority to intervene into public markets, it seems obvious that they are quickly losing their power to incentivize private wealth and capital. This is a stark change from the recent conventional perception of free markets leavened only occasionally with necessary policy stimulus.

Very recent events show clearly that Western bureaucrats are panicking, struggling to regain control over the global marketplace. They are fighting small battles and losing the war. Sovereignty is shifting from governments to commercial and individual incentives, from managed financial markets back to the marketplace. Three events in June made this clear: 1) the IEA’s surprise release of 60 million barrels of crude oil, 2) US congressional deliberations to change how the CPI is calculated in an attempt to reduce government spending, and 3) the EU/Greece situation. (We discuss these events in more detail below.)

There is a palpable loss of overall confidence and in institutions implicitly set up to provide economic and social confidence to the masses. According to a recent CBS/NY Times poll, nearly 40% of Americans think the US economy will not recover in their lifetimes to prosperity level of a few years ago. Banks have started foreclosure proceedings on 15% of all US mortgages but cannot actually foreclose due to sloppy paperwork, robo-signing, legal challenges, etc. Volume across stock, bond and derivative markets is way down and Wall Street has begun significant lay-offs. Congress remains at loggerheads over raising the debt ceiling. President Obama is powerless to improve the situation and admitted so on TV.

Wealth and capital holders around the world have increasing incentive to “get real”. The widespread conversion away from fiat-sponsored debt-money and the levered financial assets denominated in them into scarcer supplies of precious metals and natural resources with inelastic demand qualities is upon us. We think global wealth holders will soon crowd into relatively small precious metal and consumable commodity markets as they recognize the limited economic power of sovereign nations and international policy bodies to provide lasting economic solutions or even temporary cushions.

Cynical Gimmicks

Last month’s announcement by the International Energy Agency that it would release 60 million barrels of oil at a time when there was no public outcry for it was a watershed event in our view. Not only did this action imply that $100pb – $130pb is base equilibrium pricing, rather than “speculator-driven bubble” pricing (more on this in a moment); it also displayed publicly that “global economic managers” are willing to use preemptive intervention to control pricing. This is a big deal.

Official justifications behind the surprise intervention were multiple, including a way to make up for Libya’s lost oil production (whatever happened to “days, not months” in Libya anyway?), and that a declining oil price would pressure Iran to negotiate with Saudi Arabia so OPEC could reach an equilibrium range acceptable to the West. Whispered justifications included the politics of keeping gasoline prices down in the US as the driving season commenced. Whatever the reason, last month it became overt state policy across all domains to maneuver the price of global energy. Desperate times call for desperate measures.

This preemptive action was very different from foreign exchange intervention commonly executed by one or two central banks when the markets steer FX currency values away from best interests of implied trade policies. The IEA’s intervention was coordinated among State and Energy Ministries in the US, Europe and Asia (including China). The reason for the intervention seems to have been overtly political and geopolitical, and occurred when energy prices were already well-below their highs.

The day before the IEA’s announcement, researchers at Strategic Energy Research and Capital produced the following insight:

“According to the IEA STEO release on Absolute OECD Storage, comparative inventory, as we calculate, is already in deficit at -19 million barrels. If we are to believe the IEA, for the balance of 2011…comparative inventory (of Brent to WTI) will decline further to a deficit of -85 million barrels, with the largest net decline occurring next month. As we can see, in U.S. Dollars, this should increase the price of Brent relative to WTI, and it has. The interesting aspect of the OECD trend in comparison to the U.S. is that the markets are both responding to respective available supply as reflected in Absolute Inventories calculated into Comparative Inventory (i.e., the market is rational, at least to us). The OECD is net short, that is a fact, and that includes the U.S. barrels, while the U.S. separately is still in surplus. So we are not surprised to see the Brent-WTI spread widen, as so many are fixated on lately. From our seat, the regional market gears are working smoothly. The globe is still short to the tune of 1.0-1.5 million barrels per day and no new meaningful supply will be added before 2015, as we forecast it.”[1]

Although WTI crude is stored at Cushing and used as the basis for futures trading in the US, making it the benchmark oil price for most financial asset investors, the price of Brent crude greatly influences gasoline prices across the world (including the US due to refining channels). So then an imminent price spike of Brent in particular and global crude in general seems to have been temporarily averted by the IEA intervention, which served to frighten weak hands out of the market.

The perception among some financial asset commentators that recent oil prices contained a significant speculative premium seems a bit off the mark. Unlike past bubble pricing in financial assets, crude oil futures potentially have an element of reality to them because arbitrage opportunities exist between notional and delivery pricing when spreads get too wide. Within this context, consider the long term trend. WTI futures reached a peak of $145/barrel in 2008 before plunging to $45/barrel, traded mostly above $80/barrel since June 2009, above $90/barrel since December 2010, and above $100/barrel from February through mid-June of this year. Crude oil is in the midst of a multi-year bull market based on fundamentals. It should not be surprising that it took only two weeks for WTI and Brent crude futures to rise back to the levels at which they were trading before the IEA’s intervention.

What are the fundamentals? When the US and Europe began printing base money in earnest three years ago, equilibrium pricing for crude oil has risen consistently. As we have argued, there is a direct correlation linking the process of base money growth to higher resource pricing because resource manufacturers demand equal relative value for their products and services (the nominal prices of their goods are determined in relation to the ongoing purchasing power of the currency they receive in exchange). The marketplace is implying that a price range of $95 to $130/barrel is where supply meets demand (WTI & Brent) at the current level of global base money. Unenlightened market speculators are anchored by past nominal pricing – pricing unadjusted for past currency debasement.

The fact remains that the magnitude of the IEA’s intervention was relatively trivial. Sixty million barrels amounts to only about 70% of daily production. While crude oil pricing is established by each marginal barrel over demand, the fact that it is to be released over time suggests there might be a million barrel daily surplus for a couple of months. All things equal, it would seem reasonable to expect a change in WTI pricing to, say, $105 – $115 (the middle of our assumed equilibrium range) as the IEA surplus runs off. (Of course, the IEA can always intervene again.)

It should be obvious to all that “speculation” does not drive prices higher in any meaningful way. For every buyer of crude futures there is a seller. If one wants to blame financial markets for higher gas prices at the pump then one should blame high levels of overall market sponsorship, which derives directly from high levels of investor leverage, which in turn is generated directly by banks through their lending and prime brokerage divisions, which ultimately derives from easy global monetary conditions.

Blame the Fed and the BOE.

So we think that the global marketplace for crude oil is naturally biased to trend towards pricing that global policy makers find problematic (too high vis-à-vis wages), and that global policy makers are desperately applying short-term fixes. They will lose. The marketplace reigns supreme over time whether or not there is temporary froth in futures markets.

We think that the impact of discrete policy interference on market pricing is declining and increasingly short-lived because it pales next to the dominant (and necessary) policy of base money creation. The global financial markets weakened over the last two months as it became clear that the Fed was going to suspend direct quantitative easing. Crude oil prices did not “play ball” (weaken) because demand is inelastic and equilibrium pricing was fair. It took a cynical gimmick by policy makers to make a temporary impact. Confidence in the global public sector’s ability to manage near-term resource pricing is declining and perhaps that much closer to being ignored. Investors looking for freer markets can only migrate to one place – hard assets.

Investors in shares of energy companies, which are ultimately financial asset expressions of the true cost of energy in the global marketplace, are subject to the vagaries of changing sentiment of fickle and poorly-funded financial asset players without strategic conviction who are influenced by daily news flow. This beta risk is diminishing. The longer energy and other commodities show resilience, the more sponsorship resource shares will gain in the equity markets. True investors are biting the bullet, and more and more are not being shaken out of positions while fundamentals are on their side.

Infellation

Speaking of cynical gimmicks, Dow Jones reported last month that congressional aides for Democrats and Republicans were close to an agreement that would save up to $220 billion over the next decade by “changing how the Consumer Price Index is calculated”. (It is difficult to know where to begin with this one.)

First, if there was ever any question in serious economists’ or investors’ minds about whether the CPI is accurately calculated presently, then this news should completely dispel any doubt. It should be obvious to all that calculations ostensibly produced by the Bureau of Labor Statistics are corrupted by political maneuvering and budget negotiations and that its output is economically worthless. Looking forward, it is inconceivable that serious observers expect the CPI to be an honest and objective indicator of “inflation”.

The Bureau of Labor Statistics

(Inflation is kept in a secret compartment.)

Fred Sheehan, offered the following: “I think Sir John Cowperthwaithe, Britain’s financial secretary to Hong Kong in the 1950s, was on to something. He did not allow his government to collect statistics for fear the statistics themselves would define policy. In the U.S., this is seen in our infatuation with “growth” no matter the human and material wreckage choking in the gutter, a sure sign of our government’s and of the economic establishment’s senility.”[2] Fred’s comments were in response to the following note from a reader of his blog:

“In 1977 I accidentally ran into a high school friend of mine who had taken an advanced degree in mathematics and statistical analysis. He was working for Federal Reserve Chairman Arthur Burn’s Fed. He informed me that he was working on a new methodology of calculating the inflation rate. When I asked what it was based on he demurred saying it was “Classified Secret.” I was truly stunned. He did imply that, when done, the new methodology would greatly reduce the reported value. Sure enough, during the Volcker Fed, the new methodology was introduced and has been modified since then to greatly reduce the reported numbers. It made the Volcker effort at controlling inflation seem much more effective than it actually was.

However, if one takes 1965 as the starting year for the present acceleration of inflation it can be shown that, on average, the cost of living has gone up about 1400%. And, the total money supply has also grown – up to 2008 – about the same. So, a person willing to do the research can always by-pass short-term obfuscation and see the truth through widely available published costs of living.” [3]

l

We cannot confirm the veracity of the reader’s claims above. Regardless, since everyone agrees with Milton Friedman that “inflation is always and everywhere a monetary phenomenon”, the synchronicity of his numbers makes perfect sense.

So Congress is determining the US “inflation rate”. Perhaps it feels that purchasing power loss is subject to interpretation and that Congress knows best how to calculate that? Or maybe the members of Congress collectively believe it is in the public’s best interest to be lied to and that the public is either too stupid to figure it out or too lazy to care? (They might be right.)

Whatever the case, we are glad we do not have jobs with salary increases tied to the CPI; glad we are not retired and collecting social security; and glad we are not relying on TIPs to protect us from “inflation”.

The next time someone of ostensibly good economic pedigree suggests that inflation is not a problem, cut him off and ask him he means CPI, and then ask him if he is talking about pre- or post-Kennedy, Clinton or Bush era CPI, and then pre- or post-2011 budget negotiation CPI. Then ask him how much he paid for his degree.

Greek Tragicomedy

Despite empty pockets

Greece sat down

And played poker

Open hands, bluffs, loses

Mon dieu; wir verlieren

Rollover.

The European Union can only wish it had more cynical gimmicks remaining to get out of its current quandary. There is nothing left to do except extend and pretend — to rollover debt by extending Greek obligations now, (Portuguese and Irish debt later), and pretend the problem is solved. Like the delusion of the CPI fix, all sentient beings will not acknowledge that the debt still exists and is in default. It will be suspended in a state of perpetual animation, where no one will be ungracious enough to notice it, so that new debt can be layered over it.

The only other option for the political dimension would be to pick winners and losers — Greek borrowers or French and German lenders. The state of play is not at that point yet. (We would think European politicians actually do have one more option left, which would be to do nothing – to let the courts sort it out. This will occur, but not yet. Creditor banks would not allow that to happen and it seems that politicians are dancing to the tune of their largest banks presently. Only once the debt is safely in the hands of non government-insured investors will politicians be able to pick winners. More on this below.)

Greece had and will have far more power in negotiations than politicians and media care to admit. Stripped of all edifices, this drama is ultimately a confrontation between the French, German and Greek people. Greek politicians will answer to the Greek people first because Greek banks are no longer on the hook. . (We already declared the Greek banks “insolvent” in our minds.) It is important to realize that Greek deposits must be kept somewhere and Greece will continue to exist. Conceivably Greece could convert domestically-held Euros into Drachmas (or USDs?) and charter new banks for Greek deposits, or it could continue to negotiate to allow French and German banks to continue to collect Greek deposits. We would think the potential precedent of converting to another currency and starting a new banking system would lead to an unraveling of the Euro.

Like Russia and Argentina before it, Greece played international banks’ game, it didn’t work out, and it can now walk away unscathed because of its sovereign status. Despite the recent vote in the Greek parliament we do not expect Greek austerity to be practically implemented. French and German banks are ultimately the problem of French and German taxpayers. Greece will eventually default in some way, shape, or form and French and German politicians will then have to choose between satisfying the best interest of their banks or their electorate. (Sound familiar?)

We have no doubt they will try to roll the debt over again, and so on and so forth. If and when the whole proposition becomes too frightening for even the dullest of Euro holders, we would think French and German banks would have to propose write downs and work outs. However, we do not think it will ever come to this. Why? Because banks on the hook for Greek debt now will spend the coming months off-loading their remaining Greek liabilities. (Look for “sophisticated” distressed-debt hedge funds and others to “take advantage” of regulated banks by reaching for yield in PIIG sovereign debt.) Private investors will ultimately take the hit. The tightrope French and German politicians have to walk today is getting the French and German masses not to worry about PIIG debt (because only the elites among them that invest directly in Greek and Iberian debt will ultimately take the hit), while not polluting the bid among those “savvy predators”.

Germany and France like the Euro because, without it, the D-Mark and the Franc would trade rich in exchange with other global currencies, thereby weakening their exports and output. The exact opposite may be said for peripheral economies that would otherwise have weak currencies. Why then would Greece, Ireland, Portugal or even Italy want to stay in the Euro today? And if they do not stay, what reason would Germany and France have for trying to maintain its existence? So the PIIGs have much more negotiating leverage than is generally acknowledged.

As best we can tell, the Euro was a debt scheme cooked up by major European banks and politicians to lift all European boats by drawing capital to its member states. It seemed to work, but it was done through the issuance of debt, backed by debt money, which would someday have to be repaid (sorry to keep coming back to this). Ten years of debt-driven nominal growth will have been a great trade for the PIIGS if they choose to bail from the Euro now because they would stick the “more solvent” European countries with the liabilities. Doing so would expose the ruse – aggregate Euro-denominated debt levels are so high across the Eurozone that none of its members is currently solvent in real terms.

Nothing good can come from the current situation. Our grand thesis has always been that all debt must be repaid, either by the debtor or the creditor. We would not be surprised if taxpayers across all European domains come to the same conclusion about their politicians: “let them eat cake”. The clock is ticking on the Euro, as it is ticking on the US dollar and all other baseless currencies.

Keeping our Bearings

A baseless monetary system by its very nature leads to the relative undervaluation in money terms of all things not money (until that system fails). In other words, to the extent that market participants hold paper money as a temporal claim on wealth, their claim is withheld from the marketplace. When one who wants widgets tomorrow chooses to hold money today, (rather than stockpiling widgets today for tomorrow’s consumption), then market clearing prices are lower today than they would otherwise be. The act of saving distorts price levels.

When someone chooses to save, it is a two-step process. First, the decision to forego consumption today for consumption tomorrow is the fundamental essence of saving. Second, the aspiring saver must decide in what form that savings takes place. For the consumer of corn tomorrow, he can choose to hold wheat today to exchange for corn tomorrow if he anticipates that the exchange rate tomorrow will have moved in his favor. The same logic applies to deciding whether to hold money today. The purest form of saving today for consumption of corn tomorrow would be simply to stockpile today the corn which the consumer plans to consume tomorrow. Thus, any other form of saving is speculation.

If the decision to save in the media of wheat rather than corn is made, then this would cause the wheat/corn exchange rate to appreciate today. Likewise, if the decision to save in money today rather than corn is made, then the money/corn exchange rate is elevated (i.e. the price of corn today is lower than it would be if the decision to save directly in corn were made). As we apply this theory to the current situation, faith in a baseless currency leads to valuation distortions and, ultimately, leads to tears once wayward confidence in that currency is dispelled. (Again, the baseless currency regresses to its intrinsic value while the intrinsic value of all things not-money is stable.) In a sense then, for every unit of baseless currency in float there is a commensurate over-estimate of aggregate wealth and a simultaneous undervaluation of the terms of exchange for all things not-money. This is the grand distortion we are arbitraging.

The reason we believe we must win, and win big, is because fractionally-reserved banking systems, by their very nature, are systematically short the currency(s) in which their “assets” are denominated. This is an inherently unstable system by design that requires either the expansion of aggregate nominal indebtedness to maintain the illusion of system solvency, (via the rolling of outstanding debts and the creation of new ones to fund the interest burden on those existing), or, as a last resort, the monetization of debts via base money creation. Of course the latter option is net deleveraging and shrinks the aggregate “tax base” from which the banks feed. It does, however, restore nominal solvency such that the system survives to re-leverage itself another day. As unreserved credit expands, banks win. As base money expands, banks draw. Analogously, savers draw or lose respectively. Banks never lose and savers never win.

Finally, consider this: it is mathematically impossible for future labor to pay off existing debt in real terms. Thus, existing debt will be paid off by past labor – with the net surplus in fiat money erroneously stored in debt. As our friends at FOFOA argue;

“Debt is the very essence of fiat. As debt defaults, fiat is destroyed. Hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today’s dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! Worthless dollars, of course, but no deflation in dollar terms! We will have hyperDEflation in everything measured against real money, GOLD, and we will have hyperINflation in everything measured against paper dollars.” [4]

This sentiment may be applied to the political contortions occurring today across the globe, all intended to delay, suspend and sort out an untenable systemic debt situation.

Theory Applied

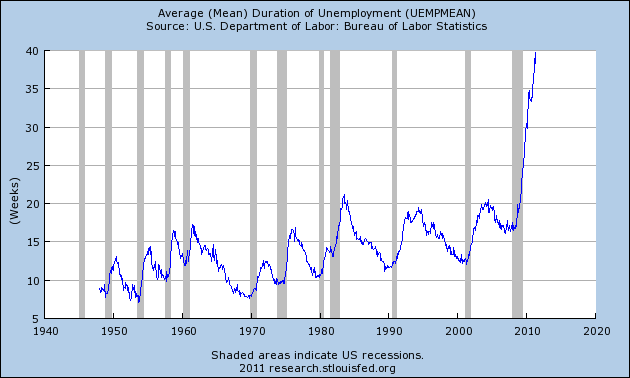

As the graph below shows, the mean duration of unemployment in the US has risen far beyond all precedent. In a hypothetical free-functioning economy, the marketplace would continually adjust so that unemployment could not remain high for very long. Were unemployment to increase and stay elevated, then unemployed workers would be willing to work for lower wages. The general price level of goods and services would decline to a level where commerce would again become profitable (see “Phillips Curve”). However, the price level is not declining today because it is accepted monetary policy to target 2% “inflation”.

Unemployment AND the price level are safely ensconced in well-established bull markets because monetary policy makers are actively intervening in ongoing economic functions. As we have been discussing for years, inflation (money printing) produces ever-increasing price levels. This direct consequence was hidden when systemic credit was low enough and could expand enough to temporarily grow the real economy. This triumph of politics could not last and, as we see from the graph, has already broken down in a way the policy makers are having difficulty ignoring.

The travails of Greece encapsulate the problem: too much debt vis-à-vis the amount of money in the system to repay it and relative to the level of current GDP with which to service it. The only way to raise nominal GDP to service it is to increase debt further. It is a debt trap, just like the one in the US economy. Greece has to borrow from others merely to service its debt. The US and EU are too big to borrow from other economies so they must borrow future revenues from themselves.

Enter the Congressional debt ceiling debate. Presently, fecal matter is meeting the oscillation device. We have no doubt that, like EU’s treatment of Greek debt, Congress will come to terms and continue trying to rollover US debt by raising the debt ceiling. However, we also know that the marketplace will not be able to avoid facing the truth much longer – that either credit must deteriorate or the US dollar must be destroyed through base-money printing.

Risk On/Risk Off

Let’s review the popular “Risk-On/Risk-Off” (RORO) metric as the driver of current market pricing. Immediate market discounting of near-term geopolitical events and economic data seem to be confirming or refuting outstanding risk positions taken by levered market participants. This RORO mentality has become a day-to-day mode of operation for marginal price setters in the capital markets.

We think Risk-On/Risk-Off is a manifestation of a predictable transformative process from functional over-leveraged markets to dysfunctional over-leveraged markets. It is entirely rational that long-term speculative capital (true investment capital) has largely left the financial markets, leaving short-term risk capital of levered players to dominate. Leveraged asset players are being funded overnight; meaning equity and term-note valuations are beholden to the increasing availability and decreasing cost of overnight credit. The reliability of such mismatched market sponsorship over any serious period of time is dubious, yet remaining market participants are dedicated market players (they are paid to participate) and so they are incentivized to continue. It is a trader’s market, and traders are betting on the size of the ripples in baby’s bathwater as the tub is overflowing.

We think the way to produce significant nominal returns over time (positive real returns in a highly inflationary environment) is to position capital according to a far more reliable investment metric. Whereas the consensus of current market participants see stocks and commodities as “risk assets” and cash and bonds as “non-risk assets”, we see scarce resources as non-risk assets and paper currencies and the levered financial assets (stocks and bonds) denominated in them as highly risky. In the current environment leveraged assets equal risk and de-leveraged assets equal non-risk (the crux of our multi-year strategy).

We like a teeter-totter analogy wherein commodities are at the fulcrum — the no-risk bucket, while financial assets are the leveraging wing and cash is the deleveraging wing. In this model, cash can clearly outperform both commodities and financial assets via unreserved debt deflation pressures. (To be sure, one could also argue that leveraged commodity market positions are financial asset proxies.) Unlevered stocks of commodities are the constant (i.e. it does not matter whether systemic leverage is increasing or decreasing). Increasing leverage tilts the see-saw up at the financial asset end and down at the cash end. Decreasing leverage does the opposite. Commercially-exchanged commodities are indifferent.

This model does not incorporate monetary metals like gold. That would be a separate overlay (gold vs. paper), which is simply a process of handicapping the monetary monopolists’ responses to periods of leveraging/deleveraging. When responding to a leveraging economy, there is really no need to proactively supply credit. However, there is a clear incentive to offer unreserved credit to the marketplace at lower and lower rates during a systemic deleveraging. When this fails, as we assert it ultimately must and is presently, monetization/devaluation is the only tool remaining in the tool kit. Very few investors will generate positive real returns because they are looking at the world through financial asset glasses and they have bought the illusion that volatility equals risk. Brace yourself.

Lee Quaintance & Paul Brodsky

[1] Strategic Energy Research and Capital, LLC; kellstrom@strategicenergyresearch.com

[2] Fred Sheehan; Au Contrarian; www.aucontrarian.blogspot.com

[3] Ibid

[4] FOFOA; 2001; http://fofoa.blogspot.com/2011_04_01_archive.html