News events have a range of risk and uncertainty in their essence:

a. Some news events are reasonably known in advance if you do your homework, like results in quarterly GDP reports. In these cases, conventional technical analysis can be of some, if not a lot of, benefit in discerning the outcomes and, even more so, the various capital markets’ all-important reactions to the outcomes.

b. Some news events are known or approximately known by the report date, but have a wide range of possibilities, like the report next Wednesday (Nov 23) by the Congressional Supercommittee on their recommendations for federal deficit cuts, and the Supreme Court’s decision next June on so-called Obamacare.

However, in both of these cases there could be a postponement: an extensive to Nov 23 deadline for the Supercommittee, although unlikely, and a deferred final decision by the Supreme Court until the tax/penalty becomes effective in 2015, also unlikely, but possible. And then there are the accounting gimmicks behind the headline(s), surely with attempts to cover them up.

http://patriotupdate.com/14782/sessions-warns-of-budget-gimmicks-in-last-minute-super-committee-deal

Not only do their deliberations have to be largely wrapped up this weekend, any debt-reduction proposal they approve need to be scored by the nonpartisan Congressional Budget Office, so that sets the actual deadline for a deal to be at least 48 hours ahead of the official deadline of midnight Wednesday. Also next Wed’s deadline only applies to the dozen members of the panel; neither chamber is required to vote on any deal for weeks.

http://patriotupdate.com/14746/press-hypes-phony-supercommittee-deadline

In these type of news events, conventional technical analysis is usually of very little benefit, since the supposedly collective wisdom of investors usually can’t narrow the possible outcomes, especially when the probabilities are asymmetrical.

For example, the odds of the Supercommittee arriving at a grand bargain of $4 trillion, or even $4+ trillion in federal budget spending cuts would undoubtedly be immediately very bullish for the stock market. The various capital markets’ expectations are very low fed because the gridlocked parties have incessantly repeated their ideological positions, so that they can ultimately say they won on balance, or that the opposing party lost more or caused the failure to agree.

However, relative strength (ratio) analysis of the defense and healthcare sectors and industries, which would supposedly suffer the most with a lack of political agreement because a sequester or cutback in government expenditures in these areas would result, is somewhat useful in this particular case. By the way, on balance, these indicators are at least modestly bullish, which is factored into our best case and worst case outcomes discussed below.

c. Some news events are unknown shocks, like Greece’s surprise referendum on the then politically negotiated austerity plan. Although this was probably only known to a few Greek politicians, and possibly known only a few days before it was publicly proposed, the capital markets certainly thought it was a bearish shock. Clearly, conventional technical analysis was of no assistance in anticipating this.

However, our Growth Cycle Projector Algorithm (GCPA) does assist greatly in all of these uncertain and/or risky cases, often invalidating conventional technical analysis. For example, we warned in advance to ignore the supposedly bearish breakdown to a new low, which then occurred on Oct 3, and other times like a bearish reaction before and/or after the Supercommittee report next Wednesday.

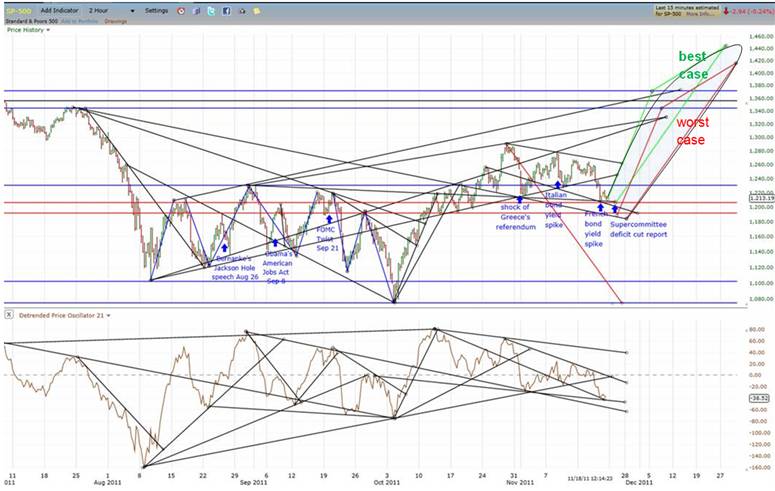

The chart below shows our best case (green up-sloping wedge) and worst case (red up-sloping wedge) based on our GCPA, which most importantly conforms to our fundamental analysis of the situation (too lengthy and not relevant to our report here). These wedge patterns in combination constitute the target-path area that we expect for the U.S. stock market over the short term (weeks). We believe the consequence of the Supercommittee report, even in a worse case scenario, would be a very short term bearish reaction (days) and would complete a downtrend C in the up-down-up, zigzag ABC pattern since the Oct 3 false bearish breakdown to a lower low.

Our ongoing three-month countertrend hedge recommendations are certainly relevant, and we still fully expect it to be doubly profitable in both the short term long position and the offsetting long term short position in the NDX, as explained further below, which is an expanded explanation from what we sent six days ago.

If your browser is in HMTL mode, you can expand or contract the following picture by dragging your cursor when it’s clicked on one of the small circles in the corners.

Of course, no one shorted the stock market at its intraday high on May 2 and then closed out that position at the Oct 3 intraday low, which would have resulted in a 20.7% gain in the S&P 500 (SPX).

Millions of investors with fully diversified U.S. equities portfolios suffered that drawdown, and probably most of them realized losses by selling out or trying to time the stock market unsuccessfully during that 154-day period.

We offered advice that was both profitable and easy to execute, as explained and illustrated in the chart below.

First, we recommended shorting the NDX (100 largest Nasdaq stocks), which could have easily been done during more than one- third of the time in the five months from February through August.

This is illustrated by the high-low-close bars above the upper blue line drawn horizontally through Friday’s (November 11) close in the chart.

Second, just a few days before the Aug 9 mini-crash low, we then recommended a long position in the NDX fully hedging the short position, which we confirmed with an email advisory to you that very day.

This exactly offsetting hedge position was also easy to execute, as illustrated by the 20 full or partial four-hour price bars below the arbitrarily drawn lower blue line in the chart.

This effectively locked in a gain of most of the NDX decline and it has virtually eliminated all stock market related volatility since then, which has plagued investors and dominated the financial news on a daily, if not hourly basis.

Third, several days before the SPX made a lower low – for thirty minutes – on Oct 3 compared to its Aug 9 intraday low, we sent you an email fully warning that it was a “false breakout” bullish setup, which is exactly what it turned out to be. Note that the relatively stronger NDX did not make such a new low.

Fourth, the countertrend hedge also created a perfectly balanced cover for the NDX long position profitable since then. It is still unrealized because we expect a bigger gain in the days and/or weeks ahead. We expect the NDX will get a lot of media attention when it probably makes new highs over the next few weeks.

Fifth, that gain will be realized when the long position is closed out, leaving the original short position in the NDX to profit from that point on – hence a double profiting hedge – as the stock market decline resumes in what we expect will be a Supercycle Bear Market. (See our description of this in earlier emails to you, or request that information if you didn’t archive it or are new to our private email list.)

We know of no private account manager, mutual fund or hedge fund that has achieved gains in the equity part of their portfolios during the past six to nine months and avoided a drawdown of greater than 10% (computed on a daily basis), which we find unacceptable. If you have counterevidence, please forward that information, as we are more than simply curious.

But our subscribers who are private account managers who take advantage of our advanced advisory services have made money for their clients with these recommendations, with no post-hedge volatility over the past three months whatsoever.

If you would like to see our recently updated short term working model for the stock market, and/or very long term working models for the stock market, bond market (i.e., long term interest rates), gold and/or U.S. dollar, don’t hesitate to make those requests.

What's been said:

Discussions found on the web: