If profanity is the weapon of the witless then how does one best describe something profane? Global policy makers are meddling in markets so that the economies they feel responsible for can achieve what seems to be a consensus objective of muddling through. A policy of meddling to muddle, if you will. Today’s meddling policy, broadly defined as manufacturing and distributing new base money, is a necessary follow-up to yesterday’s meddling policy, broadly defined as aggressively promoting when-issued base money (i.e. credit). In other words, policy makers must now rob Peter and Paul to pay Jamie, which is only slightly more acceptable than the previous policy of robbing Peter’s and Paul’s children to pay Lloyd. We have children, including young girls (sugar and spice and all that), but quite honestly the only apt response for this vulgar state of affairs is: “WTF?”

The entire display of hubris among global economic policy makers is almost too repulsive to bear – even more so than the leap year sporting event commonly known as “letting Americans believe their plutocracy is a democracy” “The Great American Media Buy” the “U.S. Presidential Election”. To quote a headliner in this year’s quadrennial circus, it “is as close to despicable as anything (we) can imagine”.

We are humble investors and it is not our occupation to sling judgmental Shinola. But it is undeniable that we exist, as do you, and therefore have a stake in the actions of fired-up world improvers oddly wired to believe unequivocally that motion is progress while demonstrating great finesse in assuring a minimum gets done. As you opened this piece not for a cynical (and increasingly trite) rant about the absurdities of contemporary authority but, we imagine, for a somewhat reasoned assessment of macroeconomic circumstances and how they may relate to makin’ money, we will try to calm our Tourette’s for a couple of thousand words. No guarantees, of course.

It is the Currency, Stupid.

Whether or not Greece will meet its debt obligations in March and beyond has little to do with Greek wherewithal and output. Everyone knows Greece is insolvent and cannot meet its March 20 payment. Nevertheless, bets are being made quite aggressively in the capital markets handicapping sovereign bailouts. As it stands today the debate surrounds how much to haircut Greek debt and through which entities the bailout would pass.

Were Greece the only insolvent sovereign then most would think it would have already been bailed out. But the dubious balance sheets of other sovereigns like Portugal and Ireland (and Italy and Spain) demand that both sides, creditors holding Greek debt and solvent sovereigns like Germany ostensibly on the hook to pay them, try to find acceptable terms. The parties involved are not only negotiating about Greek debt. They are no doubt posturing for future negotiations as well. Many if not most Greek creditors, (and certainly the most active investors in negotiations), bought their bonds and CDS in the secondary market in anticipation of this workout. Both sides are concerned with establishing precedent. Whatever discount-to-par creditors take on the March 20 sovereign Greek debt payment would establish benchmark terms for other struggling Euro sovereigns as well.

Thus, it is possible that the valuation of sovereign debt across all Euro nations will be established in relatively short order. This would conceivably indicate how much new currency the ECB would have to manufacture, which in turn would allow a more knowable valuation of the Euro vis-à-vis other major currencies. Perhaps this is why all those EURUSD shorts we keep hearing about have not succeeded in taking the Euro down? (And it still amazes us that media still do not understand that for every seller there is a buyer. Maybe they should learn to report which side, buyers or sellers, is most vociferous or has the shortest time horizon?) Nevertheless, we think ongoing currency exchange rates have been more or less accurately discounting the outcome and timing of the Greek debt workout, which in turn would establish a benchmark for sovereign debt haircuts across the Eurozone.

Strange too that public attention seems focused on the players rather than the process, as though it is a multi-front knife fight, a scatological war between politicians, taxpayers, hedge fund speculators, the ECB, IMF, and acronym-laden conduit vehicles. It is much simpler than that, in our view. The whole affair reduces to bond holders on one side and central banks on the other. After all, central banks are the only entities that can ultimately print the necessary money to service the debt and repay the creditors.

The ECB, Fed, PBoC, BOJ, BOE, SNB, Bundesbank & Banque de France have the biggest stakes in exerting austerity on profligate societies because they manufacture the world’s benchmark currencies through which all wealth and power is commonly judged. As central banks enjoy unilateral monopoly power over manufacturing the world’s money with which to repay sovereign (and corporate and household) debt, they have omnipotent control over establishing terms over indebted societies. (For those arguing Plutocracy! here is the basis of your claim.)

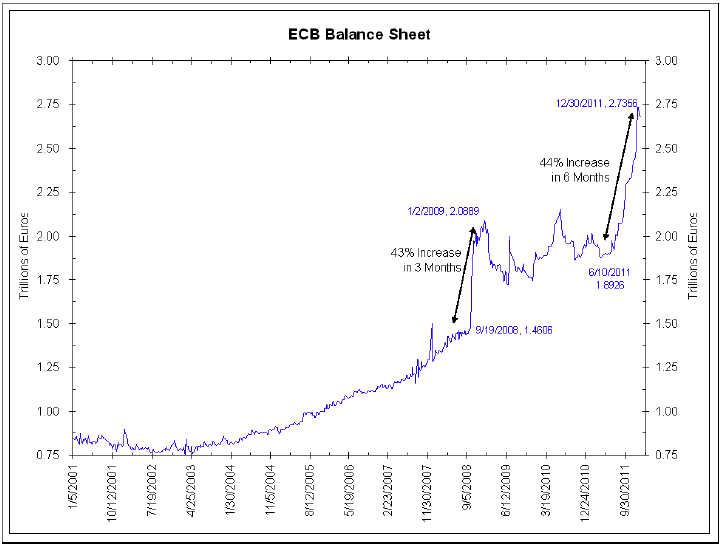

To be sure, central banks with insolvent sovereigns are the ones with the highest balance sheet growth rates. We thank James Bianco for the graph below showing the ECB’s balance sheet grew 44% over the last six months:

Click to enlarge:

Source: James Bianco; “Living in a QE World”; January 27, 2012; posted at The Big Picture

As everyone knows, the EU lacks fiscal unity which means the ECB is the focal point of intense public scrutiny when it comes to money printing for member nations. (As our friend Marshal Auerback informs, actual money printing is still done at the national central bank level, but the “orders” are placed by the ECB.) The problem for The Bank of Greece is that it must appeal to the ECB for help and the ECB is controlled by Germany, an economy in surplus. According to the BOG’s website, it “is responsible for implementing the Eurosystem’s monetary policy in Greece and safeguarding the stability of the Greek financial system”. We note the BOG has no mandate to reverse an already destabilized EU or Greek financial system.

The critical debt problems today are not just European, as most seem to believe. As we have written at length, the global monetary system is debt based and the amount of debt denominated in all currencies still dwarfs the actual amount of base money in the world. This leverage means that if global policy makers remain unwilling to de-lever the global monetary system by allowing debt to deteriorate, then they must de-lever it through continued base money creation (which shifts the debt to public accounts through the process of sovereign debt monetization).

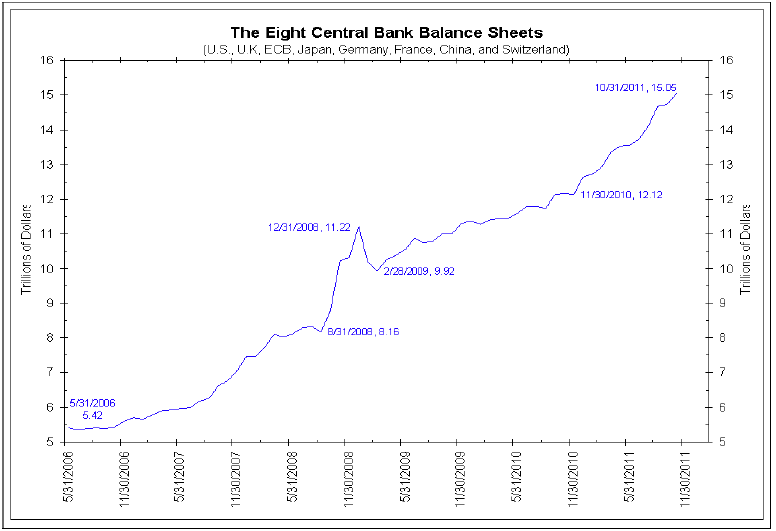

And so it shall be. All major central banks are manufacturing base money. (We must draw your attention to our friend Michael Panzner’s latest book, Modern Central Banking: Simplified, which is available on Amazon. You’ll laugh, you’ll cry…but mostly you’ll laugh.) The public debate has become how fast or slow central banks should print, not whether they should. (We argue they should just go ahead and get it over with! De-lever the system already!) The graph below shows global base money growth is a firmly established trend.

Source: James Bianco; “Living in a QE World”; January 27, 2012; posted at The Big Picture

The Fed has our Back(side)

In today’s global monetary system exchange rates are contingent upon popular confidence that equilibrium price levels can be agreed upon across currencies for goods, services and assets. Printing an excess of one particular currency would threaten the perception of that currency’s purchasing power value vis-à-vis other global currencies. It is okay, so believe overseers of the global banking system, for FX cross rates to fluctuate, but it is unacceptable for a major currency to fail. This would expose the dirty little secret that contemporary debt currencies cannot mathematically store purchasing power over time.

Whether or not it is officially proclaimed “a failure”, the global monetary system is already failing in real terms. Anyone can see this in the costs of global goods, services and labor across all currencies, which are rising much faster than global demand, and in the long established trend of debt deflation.

The problem for most investors today is that they no longer know how to invest with a real return objective. For forty years they have been taking the banking system at its word that the paper it produces stores value. Consider last month’s press conference held by Fed Chairman Ben Bernanke, in which he formally announced the Fed would target 2% inflation in the US. The Fed chose as its inflation benchmark the Personal Consumption Expenditures (PCE) index, calculated by the Bureau of Economic Analysis within the Commerce Department. Unlike the CPI, which is currently running at a 3% annual rate (even core CPI, which strips out food and energy prices, is running at 2.2%), the PCE was reported on January 30 to be running at 2.4% (1.8% core). Quick inspection of the PCE index (Bloomberg ticker “PCE DEFY” we kid you not!) shows it was “rebased to 2005” and that “to see this index with a base year as (of) 2000” we should “refer to the ticker PCE DEYO”.1 Alas, Bloomberg did not have the data for base year 2000 when we tried.

We are comforted that Chairman Bernanke and the Commerce Department are sanguine about something they are calling “inflation” not eating into the purchasing power of US dollars or into real returns on dollar-denominated assets. We would be happy to go along with the Fed except that we are investing to increase our future purchasing power and, frankly, we do not trust the Fed to watch out for our purchasing power. It seems obvious the Fed is not only changing policy by officially “targeting inflation”, (and framing the change as greater transparency which is in the public good), it is also shifting benchmarks to be able to better control the perception of low inflation so that it may manufacture more base money.

Merriam-Webster defines profane as follows: “to treat (something sacred) with abuse, irreverence or contempt, or to debase by a wrong, unworthy or vulgar use”. We do not think measuring inflation should be considered sacred but we do think policy makers are deliberately, without ego or malice, managing monetary affairs as it suits the banking system. If by massaging the perception of inflation they are breaching the public trust and displaying contempt for laborers and unlevered savers, (not to mention investors), well then it is just business. WTF.

Absolute Power

Such economic manipulation is to be expected. Mr. Bernanke represents a power structure with deep roots that supports the general theory that those that control a nation’s money control the nation.

“Let me issue and control a Nation’s money and I care not who makes its laws. The few who can understand the system will be either so interested in its profits, or so dependent on its favours, that there will be no opposition from that class, while, on the other hand, that great body of people, mentally incapable of comprehending the tremendous advantage that Capital derives from the system, will bear its burden without complaint and, perhaps, without even suspecting that the system is inimical to their interests.” 2

– Mayer Amschel Rothschild, 1838

It is becoming increasingly obvious today within developed economies that ultimate power remains with the monopoly issuer of our fiat currencies, much as it has for centuries. Sometimes power must exert itself, as this 1819 discussion in the British Parliament shows:

Commons Secret Committee: dddddd“In what line of business are you?”

Nathan Rothschild:dddddddddddhdd “Mostly in the foreign banking line.”

Commons Secret Committee:ggggggg “Have the goodness to state to the Committee in detail, what you conceive would be consequence of an obligation imposed upon the Bank (of England, which Rothschild owned) to resume cash payments at the expiration of a year from the present time?”

Nathan Rothschild: dddddddddddddd“I do not think it can be done without very great distress to this country; it would do a great deal of mischief; we may not actually know ourselves what mischief it might cause.”

Commons Secret Committee: ddddddd“Have the goodness to explain the nature of the mischief, and in what way it would be produced?”

Nathan Rothschild:ddddddddddddddd “Money will be so very scarce, every article in this country will fall to such an enormous extent, that many persons will be ruined.”

Are we mad to compare old history with today’s monetary system? Well, let’s just say that nothing has changed in the structure of central banking and we have never been high on “this time is different” thinking. (We think even Rogoff & Reinhart who wrote the wonderful book of the same title would instruct that private central banks maintain the same control over the monetary system today). So, we should expect central banks to manufacture mass quantities of currency to ensure bank system solvency. Knowing this in advance is an even bigger gift for unlevered real asset investors than Ben Bernanke’s gift to levered carry-trade investors by promising to keep US interest rates zero bound through 2014.

We have not reached the end of history. Mankind evolves, as does capitalism and its many brands. But not that much. An objective look at our modern economic ecosystem shows clearly one unified global banking system that is actually made stronger by predictable, publicly aired tensions among competing political and economic theorists and practitioners. As long as lawmakers and we, the people that must obey them, continue quarrelling among ourselves, those that control money are free to do as they like. When the people revolt against the symbols of political power (storm the Bastille, storm the winter palace), then the people succeed in forcing those that control money to alter the political structure. Only when lawmakers take steps to limit bank system access to the nation’s resources by indenturing the factors of production (dumping tea overboard, storming the Eccles Building), can the nation’s capital shift back to the people.

Today we have an oligopoly of central banks issuing the world’s baseless currencies and, by having successfully promoted substantial household and sovereign debt assumption, can now dictate resource allocation and fiscal policy terms. Against this power there is fragmentation — (mostly) democratically elected officials overseeing republics of generally obedient populations. Lenin knew; “by continuing the process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens”. John Maynard Keynes himself agreed: “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose”.

We argue that indebted governments have ceded that power to banking systems without conscience or public accountability. If the global banking system has ultimate power over how global wealth is perceived, (as it does), and it is the only institution powerful enough to keep indebted governments in control of their societies, (which it is), then the only reasonable strategy for an independent investor is to think like a Rothschild. Don’t fight the Fed – bet on it.

We will put more meat on the bones in a follow-up report, An Adult Approach II (Relative Real Value), and provide a truer sense of current and future US inflation and our sense of relative value within such an environment.

Kind regards,

Lee Quaintance & Paul Brodsky

pbrodsky@qbamco.com

1 Bloomberg; PCE DEFY Index

2 Mayer Amschel Rothschild (1774-1812); written in a letter from London to Rothschild agents in New York; 1838.

What's been said:

Discussions found on the web: