David J. Merkel is a CFA, FSA. His forthcoming equity asset management shop is tentatively called Aleph Investments. From 2008-2010, he was the Chief Economist and Director of Research of Finacorp Securities.where he researched a wide variety of fixed income and equity securities, and trading strategies. Until 2007, he was a senior investment analyst at Hovde Capital, responsible for analysis and valuation of investment opportunities for the FIP funds, particularly of companies in the insurance industry. From 2003-2007, he was a leading commentator at the investment website RealMoney.com.

~~~

Recently I decided to spend some time analyzing the insurance industry. It’s a different place today than when I became a buy-side analyst nine years ago. Why?

First, for practical purposes, all of the insurers of credit are gone. Yes, we have Assured Guaranty, and MBIA is limping along. Old Republic still exists. Radian and MGIC exist in reduced states. The rest have disappeared. In one sense, this should not have been a surprise, because the mortgage and credit guaranty businesses never had a scientific model for reserving. I’m not even sure it is possible to have that.

Second, the title insurers are diminished. Some, like LandAmerica are gone. Fidelity National seems to be diversifying itself out of insurance, recently buying up a restaurant chain.

Third, health insurers face an uncertain future. Obamacare may disappear, or Obamacare could slowly eliminate insurers. It’s a mess.

But beyond all of that, valuations are depressed across the insurance industry. Part of that may stem from ETFs. Insurers as a whole are smaller than the banks, but not as much smaller as they used to be. Now, if you are a hedge fund, and you want to short banks, you probably have the best liquidity shorting a basket of financials, which shorts insurers as well.

That may be part of the issue. There are other aspects, which I will try to address as I go through subindustries.

Offshore

By “Offshore” I mean P&C reinsurers and secondarily insurers that do business significantly in the US, and who list primarily on US exchanges, but are not based in the US. Most of them are located in Bermuda.

In 2011, many of them were challenged by the high levels of catastrophes globally. But the prices of the reinsurers did not fall because pricing power returned, and investors expect higher future earnings as a result.

Before I go on, I need to explain that what I will use to give a rough analysis of value is a Price-to-Book vs Return on Equity analysis [PB-ROE]. For more details, you can read my article here. The short explanation is that companies in the insurance business (and other financials) are constrained by the amount of equity (net worth) that they have. The ability to earn a return as a percentage of the equity [ROE] drives the market valuation as a fraction of the equity [P/B].

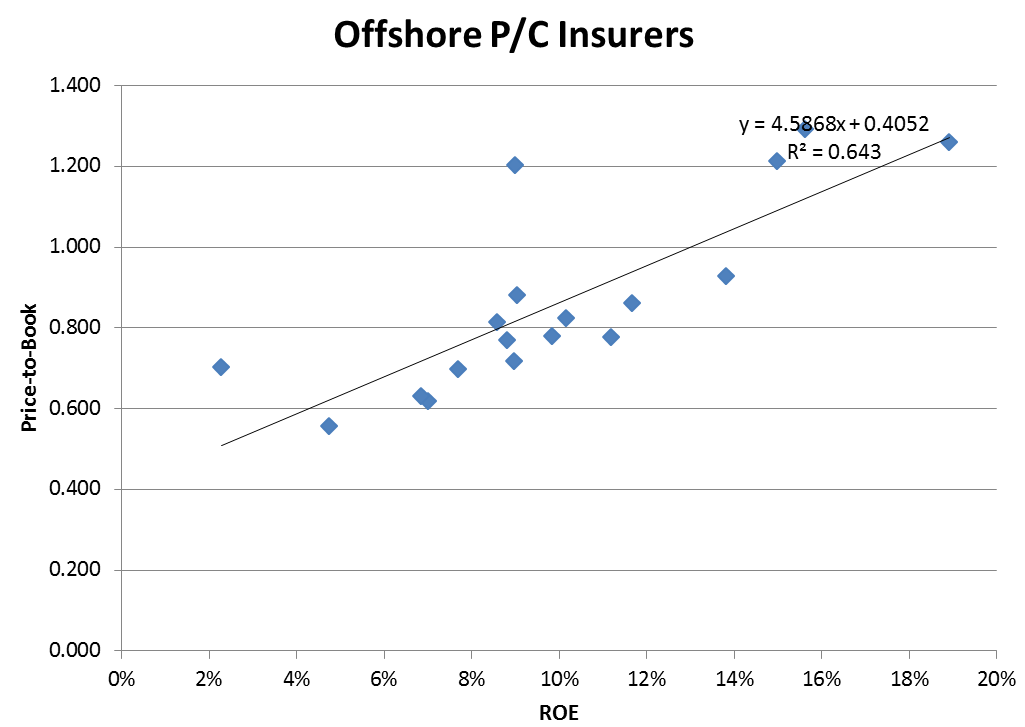

Here is a scatterplot for PB-ROE for the Offshore group:

Companies above the line may be overvalued, and companies below the line may be undervalued. ROE is what is expected by analysts for the next fiscal year, not what has been obtained in the past.

The fit is fairly tight, and indicates mostly logical valuations for this group. The companies that are possibly overvalued are: Arch Capital [ACGL] and Global Indemnity [GBLI]. Possibly undervalued: Everest Re [RE] and Endurance Specialty [ENH].

Now, this simple model can fail if you have an intelligent management team that has a better model. Arch Capital may be that. But with an expected ROE of less than 10%, it is hard to justify their valuation, when the average stock in this group needs an expected 13% ROE to be valued at book.

Why such a high ROE to get book? Earnings quality. Reinsurers have noisy earnings due to catastrophes. You don’t give high valuations to companies that run hot or cold. But the trick here is to see who is accumulating book value the fastest – they tend to be the stars over time.

Life

The life insurance business would be simple, if it indeed were only life insurance. Much of the industry is handed over to annuities, and all manner of asset gathering. Even life insurance can be made more complex through variable and variable universal life, where assets are invested in stocks, and do not receive a rate from the company.

Part of the trouble is that variable products are not simple, but the insurers offer guarantees for a fee. When I see those products, my reaction is usually, “How do they hedge that?!”

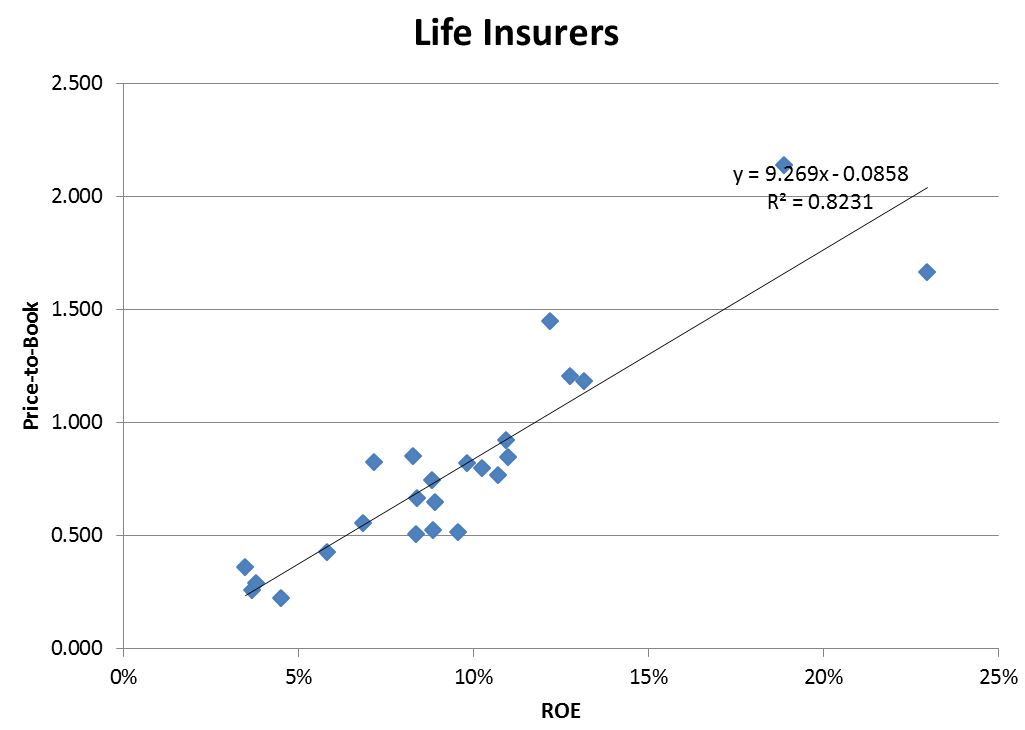

Thus I am concerned for insurers that are “equity-sensitive” as I reckon them. Here is the PB-ROE scatterplot:

A very tight fit. The insurers that are undervalued are equity-sensitive ones: Phoenix Companies [PNX], American Equity Investment {AEL] , Lincoln National [LNC], and ING [ING]. Those that are overvalued are FBL Financial [FFG], and CNO Financial [CNO]. CNO has issues from long-term care, a coverage I dislike a great deal. FBL is worth exploring.

One more note: to get book value in Life Insurance, you need an 11.7% ROE on average. That’s high, but I expect that is so because investors are skeptical about the accounting.

Property & Casualty

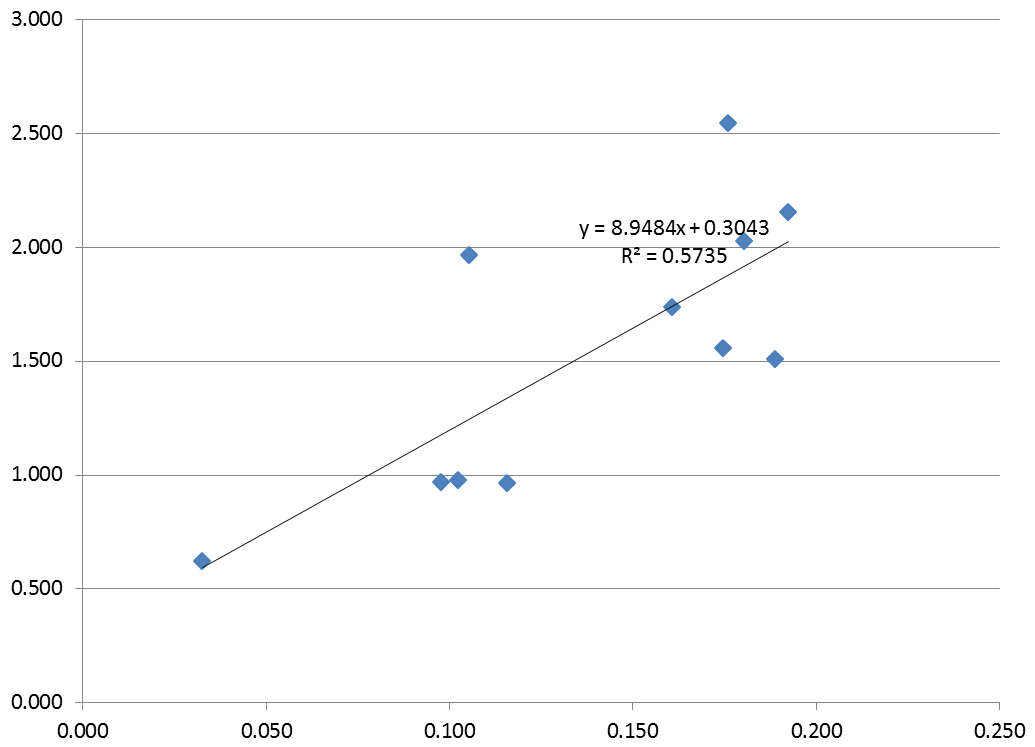

This graph gives PB-ROE for the entire onshore P&C insurance industry:

It’s a good fit. Again, the casualties of the last year weigh on the property-centric insurers, but for the most part, this is logical.

Potential underperformers include Hallmark Financial Services [HALL], Hilltop Holdings [HTH], Eastern Insurance Holdings [EIHI], Old Republic International [ORI], and Erie Indemnity [ERIE]. Below the line: Hartford Financial Services [HIG], Allstate [ALL], Tower Group [TWGP], and Horace Mann [HMN].

Because of the lower risk in P&C insurers, a firm only needs to earn an ROE of 6.6% to have a book value valuation.

Health

With Obamacare, I don’t know which end is up. It could end up being a giant sop to the health insurers, or it could destroy the health insurers in order to create a government single-payer model, rather than the optimal model for cost reduction, where first parties pay directly, or pay insurers. You want reductions in medical costs, get the government out of healthcare, and that includes the corporate deduction for employee health insurance.

There are many models for profitability here, which makes things complex, but here is the present PB-ROE graph:

It’s a pretty good fit, with the idea that the following companies might be undervalued: Wellpoint [WLP] and CIGNA [CI]. And the following overvalued: Molina Healthcare [MOH] and Wellcare Health Plans [WCG].

I don’t regard myself as an expert on the health insurance sub-industry, so treat this with skepticism. I include it for completeness, because I think the PB-ROE concept has value in insurance. One more note, the PB-ROE model thinks of this as a safe investment subindustry, because to have a book value valuation, you have to have an ROE of 7.8%.

Other Insurers and Insurance-Related Companies

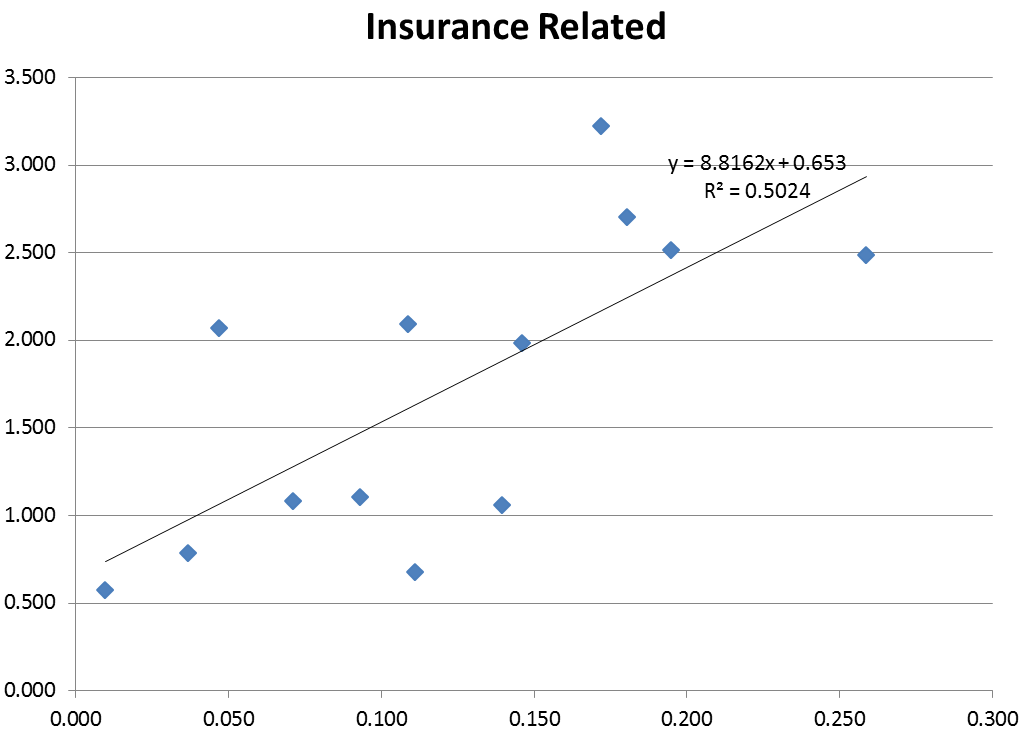

This is a group that is a non-group. It comprises brokers, service providers, title and financial insurers. Here’s the PB-ROE graph:

Pretty tight for a non-group. Perhaps it is because it derives off of a much larger group, some of which has died off, leaving behind profitable entities.

As it is the potential outperformers include Assured Guaranty [AGO], the largest remaining financial guaranty insurer, Fortegra Financial Corporation [FRF] a third party administrator of sorts, and what remains of the title insurance industry, Fidelity National [FNF], First American [FAF], and Stewart Title [STC]. That is one beaten-down group, and, one that would benefit a lot if housing bounced back. There is a lot of potential earnings power there, and it trades for little above book value.

Potential underperformers include AJ Gallagher [AJG] and E-Health [EHTH]. I’ve dealt with AJ Gallagher professionally, and have respect for their management team, but maybe the valuation is stretched there. E-Health is a health insurance broker, and over its existence hasn’t done anything deserving of a premium valuation.

And, for this non-group, it is riskless enough that you only need a 4% ROE to have a book value valuation. This is one beaten-down sector of the market, and one that I do not own any of, but that I will eventually return to, because I have owned I in the past. Should residential real estate finally normalize, many of these companies will fly.

I write this as one that was bearish on housing-related stocks since 2005. There is potential here.

Summary

Insurance is complex, and the accounting is doubly complex, which is a major reason why many stay away from it. But insurers as a group have had reliable and outsized returns over the rememberable past, which should encourage us to do a little kicking of the tires when so much of the industry trades below its net worth and is still earning money with little debt.

In my opinion, this is a recipe for earnings in the future, and why I own a lot of insurers for myself, and for clients.

Full disclosure: long ENH, but I may take other positions for clients in the next month

Source:

David Merkel

What's been said:

Discussions found on the web: