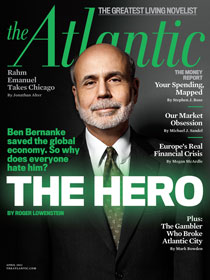

On the ride home last night, I read Roger Lowenstein’s longish piece in The Atlantic, titeld The Villain.

On the ride home last night, I read Roger Lowenstein’s longish piece in The Atlantic, titeld The Villain.

It was fascinating and engrossing:

The formative experience for the European Central Bank was the hyperinflation in Germany in the 1920s, which ever since has steeled central bankers on the Continent against the perils of printing money. In Frankfurt, the idea of “lender of last resort” wasn’t, and isn’t, embraced. For the U.S. Federal Reserve, the formative experience was a series of depressions beginning in the 19th century and culminating in the Great Depression. After the demise of Biddle’s bank in the 1830s, “money” in the U.S. consisted of whatever notes banks printed and people agreed to take. Even after the Civil War, when “money” became more uniform, currency was often a scarce commodity, and banking panics were frequent.

You come away with the sense that even if you disagree with what Bernanke did during the collapse, its hard to think of who else you would want holding Fed chair during that era . . .

>

Source:

The Villain

Roger Lowenstein

ATLANTIC MAGAZINE April 2012

http://www.theatlantic.com/magazine/archive/2012/04/the-villain/8901/?single_page=true

What's been said:

Discussions found on the web: