>

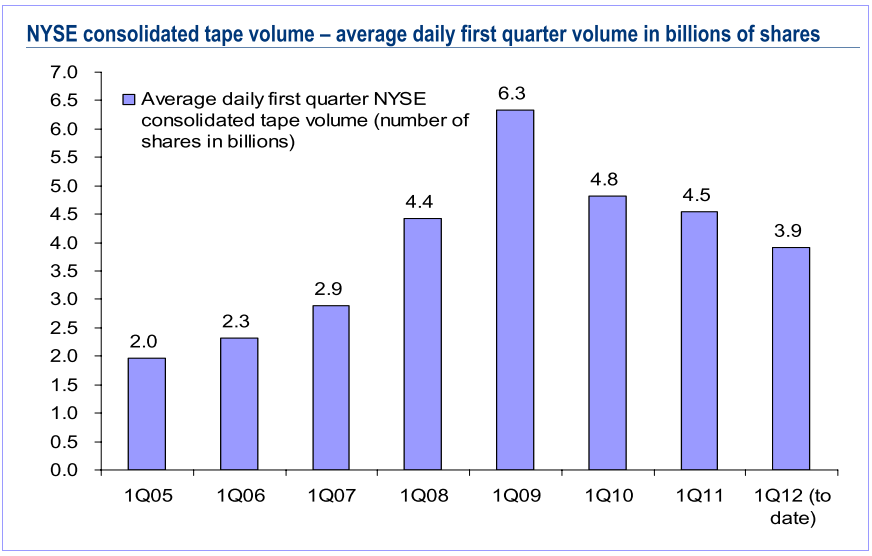

Interesting note from Merril Lynch’s Technical Analyst Mary Ann Bartels about NYSE volume. Ms. Bartels observes that the market’s Volume, anemic though it appears, is actually not all that bad when compared to similar periods in recent years (See chart above). She observes that the primary trend is upwards, and with volume and breadth confirming, she is constructive on US Equities, especially the Megacaps.

But it was her take on volume that was so noteworthy:

“There has been concern that volume is not supportive and we disagree with this view. Average daily NYSE consolidated tape volume year-today in 1Q12 is down 14% vs. 1Q11 and down 38% from peak financial crisis average daily volume in 1Q09. Since 1Q09 peak volume was associated with extreme bearish sentiment during the financial crisis, 1Q12 volume should not be compared to 1Q09 levels.

Average daily volume in 1Q12 is 36% higher than it was in 1Q07, which was prior to the financial crisis and also a period when the US equity market was rallying to new recovery highs. Taking this into consideration suggests that volume may not be as low as it seems. Additionally, our Volume Intensity Model (VIM) still has accumulation stronger than distribution which is a bullish reading for the market.”

While our earlier comments about margin were cautious, volume is not. If you are looking for an excuse to exit equities, this is not it.

>

hat tip John Melloy, CNBC

>

Source:

S&P 500 holds breakout, trend remains up

Mary Ann Bartels

Market Analysis | United States

BofA Merrill Lynch 26 March 2012

What's been said:

Discussions found on the web: