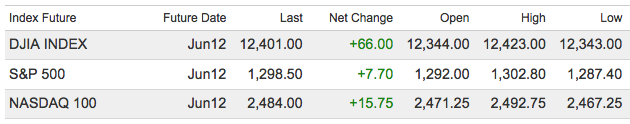

Good Monday morning. Following last week’s down 4% mess, markets are set to bounce. Investors are advised to watch the quality of this bounce to discern any insights about what the near futures might hold.

Negative headlines have been driving sentiment issues — start with the Greek Exit (Grexit? Blecch) from the EU, add more chatter about the U.S. “fiscal cliff,” and not a whole lot of good news. That set up is likely enough negativity to encourage a counter trend bounce.

As to whether this is the end of the down leg or a mere interruption in the process has yet to be determined. My guess is this is merely a pause in the process, given the substantial technical damage that has been done.

As of Friday’s close, we were deeply oversold. The OB/OS oscillators, the Equity Put/Call Ratios were both heavy negative (a contrary sign). AAII’s Bear/Bull Ratio also reveals too much negativity at a 46/24 ratio. As the nearby Chart Store graphs show, a head & should top has formed. And several technicians noted a close below a significant uptrend line. Its worth watching the volume on rally attempts relative to the past 60 days.

Short term, we still have some downside work to do, with Valuation being the most bullish aspect of equity markets.

Beyond the technicals, the macro picture is another likely determiner. Watch what Policy makers responses are to ongoing weakness and credit problems. While the ECB and Angela Merkel fret, the European voters are (intelligently) tossing out advocates of the recession inducing Austerity. The problem is, they are being replaced with equally ruinous Free Lunch advocates. How the powers that be thread this needle will determine whether the Eurozone has a short sharp recession or something much much worse.

In the US, the Fed is debating itself as to whether it can do more to stimulate the economy. So far, the stimulus has fallen primarily to risk assets. The impact on actual GDP is more debatable. It is realistic to assume that, at the very least, without ZIRP, Housing would be appreciably worse, with lower prices, more foreclosures, and substantial stress on the still heavily Real Estate exposed banking sector.

Perhaps the most significant aspect of the Fed’s policy is what it has prevented: A cleansing bottom as Home prices drop below fair value and markets clear.

Be back shortly . . .

S&P500 Cap and Equal Weighted

click for full size charts

Source: Chart Store

What's been said:

Discussions found on the web: