Yesterday’s ugliness has the pundits looking at numerous explanations, correlations and motivations for what was the causation of the 2+% market sublimation.

All those “-ations” leave out the most important one: Rationalization. For that is what all of these tales actually were.

Consider the following “causes” trotted out for the move:

-Federal Reserve failed to deliver QE3

-Global economic slowdown

-Moodys downgrade of banks

-Spain/Greece/Italy (choose up to 3)

-Commodity bear markets

-Euro currency concerns

-Middle Eastern unrest

-US Election jitters

-“Uncertainty”

-All of the above

I have a different view:

The day-to-day action is nearly all noise. It contains a surprising degree of randomness, but its not as totally random as some academics would have you believe.

Why? Sometimes we see price continuation, leading to distinct trends. This is often acted on, reflected in the trading behavior of both Momentum traders and Trend followers. Occasionally, a move in either direction gets over-extended. Hence, Contrarians and Sentiment watchers try to anticipate the counter-trend reaction move. Third, the market internals can shift, become aberrational. Technicians try to discern what this is telegraphing behind the scenes in the activities of the biggest institutions as they impact the stock supply demand battle.

Or not.

All of these cross currents described above are hardly reliable guide posts. They occasionally provide a modicum of insight, but just as often lead to confusion. Typically, they make day-to-day trading exceedingly challenging. The shorter your timeline, and the greater your assumptions, the far less reliable your investment strategies become.

The exception, ironically, are those folks who measure their holding periods in fractions of a second. High Frequency Traders (HFT) — a/k/a “cheaters” — mostly know the outcome of their trades in advance, courtesy of the information provided to them by the exchanges. Their high probability front-running is not available to ordinary investors, from whom their profits are derived.

~~~

What investment decision have you rationalized today?

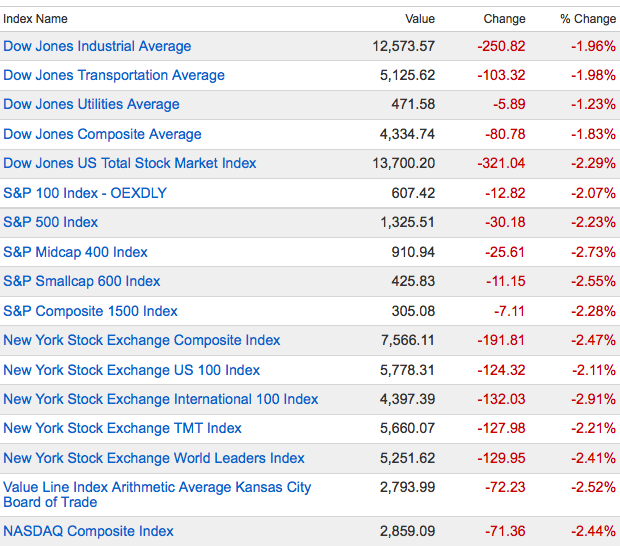

click for updated market data

Source: Bloomberg

What's been said:

Discussions found on the web: