Hoisington Quarterly Review and Outlook

John Mauldin

July 23, 2012

The relationship between high total public debt and interest rates is controversial (to some); and in today’s Outside the Box Van Hoisington and Dr. Lacy Hunt of Hoisington Investment Management tackle the subject head-on, in their “Quarterly Review and Outlook” for Q2 2012. They bring important new evidence to the debate, citing three academic studies (including an April 2012 paper coauthored by Rogoff and Reinhart) and an historical retrospective that focuses on the debt-disequilibrium panic years of 1873 and 1929 in the US and 1989 in Japan. In their view, the onus of responsibility for the “Panic of 2008” falls on the sometimes-slumping shoulders of the Federal Reserve, for making money and credit too easily available, and then “[failing] to use regulatory powers to check the unsound lending and the concomitant buildup of non-productive debt.”

The relationship between high total public debt and interest rates is controversial (to some); and in today’s Outside the Box Van Hoisington and Dr. Lacy Hunt of Hoisington Investment Management tackle the subject head-on, in their “Quarterly Review and Outlook” for Q2 2012. They bring important new evidence to the debate, citing three academic studies (including an April 2012 paper coauthored by Rogoff and Reinhart) and an historical retrospective that focuses on the debt-disequilibrium panic years of 1873 and 1929 in the US and 1989 in Japan. In their view, the onus of responsibility for the “Panic of 2008” falls on the sometimes-slumping shoulders of the Federal Reserve, for making money and credit too easily available, and then “[failing] to use regulatory powers to check the unsound lending and the concomitant buildup of non-productive debt.”

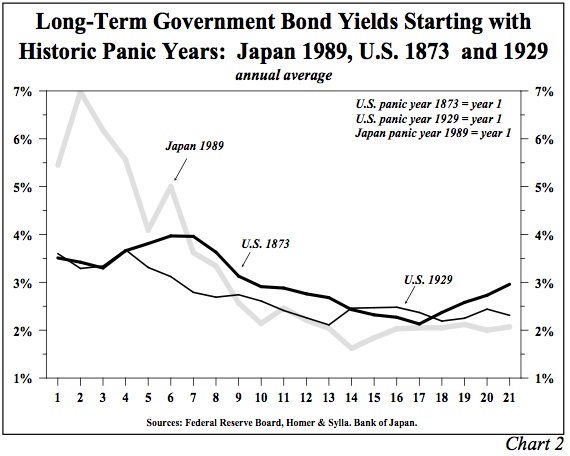

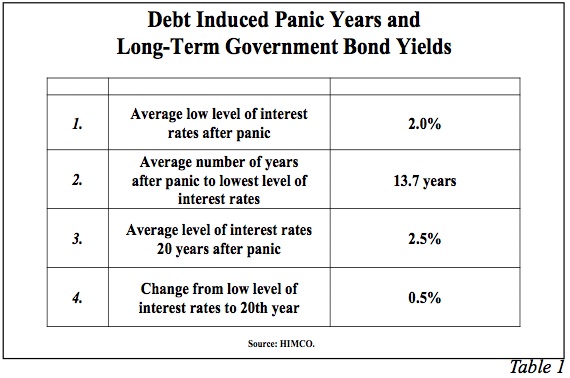

It gets worse: “The average low in interest rates in these cases occurred almost fourteen years after their respective panic years with an average of 2% … Amazingly, twenty years after each of these panic years, long-term yields were still very depressed, with the average yield of just 2.5%. Thus, all these episodes, including Japan’s, produced highly similar and long lasting interest rate patterns… The relevant point to take from this analysis is that U.S. economic conditions beginning in 2008 were caused by the same conditions that existed in these above mentioned panic years. Therefore, history suggests that over-indebtedness and its resultant slowing of economic activity supports the proposition that a prolonged move to very depressed levels of long-term government yields is probable.”

It is a constant pleasure to be able to bring work of this quality to the attention of my readers, and I thank Lacy and Van for their help in doing that. Hoisington Investment Management Company (www.hoisingtonmgt.com) is a registered investment advisor specializing in fixed-income portfolios for large institutional clients. Located in Austin, Texas, the firm has over $4 billion under management, composed of corporate and public funds, foundations, endowments, Taft-Hartley funds, and insurance companies.

I am in Newport at the Department of Defense Net Assessment Office gathering of a small group of fascinating and forward-thinking individuals working on developing alternative scenarios as to how the future will unfold. It is quite multidisciplinary. This is a very eclectic group and not what one would normally picture as military (witness that I am here). There is a group of officers from various branches, tasked with thinking about the future, as well as experts from a variety of fields. At some point, when the time is appropriate, I hope to be able to share some of what I am learning, as I am simply fascinated with the discussions and debates. Long days, though, so I will hit the send button and get on to bed. These guys believe in early mornings. As those who know me know, I really don’t like to experience what 6 AM feels like. I am more of a late-night guy. But these meetings get the juices flowing, so it is worth it.

Your seeing a much larger puzzle analyst,

John Mauldin, Editor

Outside the Box

subscribers@mauldineconomics.com

Hoisington Quarterly Review and Outlook

Second Quarter 2012

Interest Rates and Over-indebtedness

Long-term Treasury bond yields are an excellent barometer of economic activity. If business conditions are better than normal and improving, exerting upward pressure on inflation, long-term interest rates will be high and rising. In contrary situations, long yields are likely to be low and falling. Also, if debt is elevated relative to GDP, and a rising portion of this debt is utilized for either counterproductive or unproductive investments, then long-term Treasury bond yields should be depressed since an environment of poor aggregate demand would exist. Importantly, both low long rates and the stagnant economic growth are symptoms of the excessive indebtedness and/or low quality debt usage.

This line of reasoning also provides an important corollary. If the effects of excessive indebtedness (low growth and low interest rates) are addressed by additional debt, or by debt utilized for investments that cannot produce an income stream to repay the obligations, then this even higher level of debt will serve to perpetuate the period of slow economic growth and unusually low bond yields. This proposition has importance for investors since the quarter end 2.75% yield on long-term U.S. Treasury bonds may, in the future, look as attractive as the 5% yields registered back in 2007.

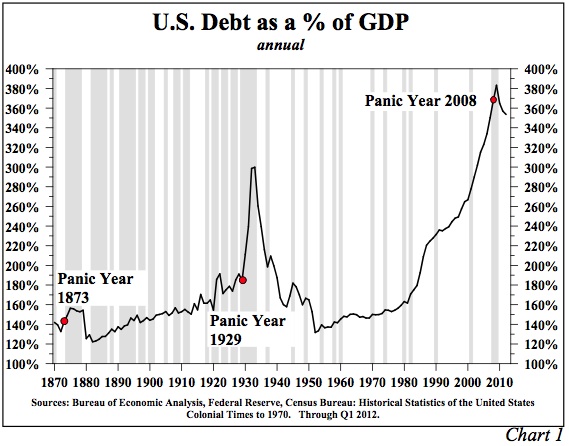

The support for this thesis is derived from inferential judgments relating historical interest rate movements to the debt disequilibrium panic years of 1873 and 1929 in the U.S. (Chart 1) and 1989 in Japan. Second, a review of three recent scholarly studies on this subject is particularly instructive, as the research includes the first systematic evidence of the association between high public debt and real interest rates, findings that may be very surprising to some.

Excessive Debt Leads to Extended Episodes of Low Interest Rates

After a massive buildup of debt to finance the railroads, supplier industries, asset speculation and over-consumption in the late 1860s and early 1870s, the bubble burst in 1873. The panic of 1929 resulted from an even higher debt to GDP ratio than existed in the 1870s. The cause of the debt buildup in the 1920s was different, yet similar to the one four decades earlier. The earlier panic was prior to the creation of the Federal Reserve, yet government incentives and guarantees greatly encouraged overbuilding of the railroads.

In the 1920s, the new central bank unwisely made money and credit available, and then stood idly by as questionable lending financed over-investment and consumption, as well as rampant asset speculation. In Japan, public and private debt surged from 357% of GDP in 1979 to above 540% in 1989. This 183-percentage point escalation far outstripped the 100-percentage point rise in U.S. debt to GDP ratio from 1998 to 2008. In these ten years the Bank of Japan followed the same type of policy the U.S. Federal Reserve did in the 1920s, and again from 1998 to 2008. These earlier episodes have many parallels to the circumstances in the U.S. during the mid to late 1990s. Unable or unwilling to see these similarities, the Federal Reserve made money and credit overly ample, and then failed to use regulatory powers to check the unsound lending and the concomitant buildup of non-productive debt.

Part of the problem was two federally sponsored housing agencies that openly encouraged massive extension of housing related debt, just as governmental institutions played a central role in the creation of excessive railroad debt in the 1860s and 1870s. The debt disequilibrium panic years of 1873, 1929, 1989 and 2008 are uniquely important because each of these events resulted from extreme over-indebtedness, as opposed to lack of liquidity or some other narrower precipitating factors. For example, in 1907 the third largest U.S. bank, Knickerbocker National Bank, failed, causing a severe lack of liquidity. This event is credited with leading to the establishment of the Federal Reserve, but the underlying cause of the panic of 1907 was not over- indebtedness, so this and other panic years are excluded from our historical evaluation.

In the aftermath of all these debt-induced panics, long-term Treasury bond yields declined, respectively, from 3.5%, 3.6% and 5.5 % to the extremely low levels of 2% or less in all three cases (Chart 2). The average low in interest rates in these cases occurred almost fourteen years after their respective panic years with an average of 2% (Table 1). The dispersion around the average was small, with the time after the panic year ranging between twelve years and sixteen years. The low in bond yields was between 1.6% and 2.1%, on an average yearly basis. Amazingly, twenty years after each of these panic years, long-term yields were still very depressed, with the average yield of just 2.5%. Thus, all these episodes, including Japan’s, produced highly similar and long lasting interest rate patterns. The two U.S. situations occurred in far different times with vastly different structures than exist in today’s economy. One episode occurred under the Fed’s guidance and the other before the Fed was created. Sadly, there is no evidence that suggests controlling excessive indebtedness worked better with, than without, the Fed. The relevant point to take from this analysis is that U.S. economic conditions beginning in 2008 were caused by the same conditions that existed in these above mentioned panic years. Therefore, history suggests that over-indebtedness and its resultant slowing of economic activity supports the proposition that a prolonged move to very depressed levels of long-term government yields is probable.

Recent Academic Evidence

Three recent academic studies, though they differ in purpose and scope, all reach the conclusion that extremely high levels of governmental indebtedness diminish economic growth. In other words, deficit spending should not be called “stimulus” as is the overwhelming tendency by the media and many economic writers. While government spending may have been linked to the concept of economic stimulus in distant periods, such an assertion is unwarranted, and blatantly wrong in present circumstances. While officials argue that governmental action is required for political reasons and public anxiety, governments would be better off to admit that traditional tools only serve to compound existing problems.

These three highly compelling studies are: (1) Debt Overhangs: Past and Present, by Carmen M. Reinhart, Vincent R. Reinhart and Kenneth S. Rogoff, National Bureau of Economic Research, Working Paper 18015, April 2012; (2) Government Size and Growth: A Survey and Interpretation of the Evidence, by Andreas Bergh and Magnus Henrekson, IFN Working Paper No. 858, April 2011 and (3) The Impact of High and Growing Government Debt on Economic Growth – An Empirical Investigation for the Euro Area, by Cristina Checherita and Philipp Rother, European Central Bank, Working Paper Series 1237, August 2010. These papers reflect serious research by world-class economists from the U.S., Europe and Sweden.

Debt Overhangs Past and Present

Reinhart, Reinhart and Rogoff identified and examined 26 post 1800 economic episodes of advanced economies that met the criterion of having public debt to GDP levels exceeding 90% for at least five years (a standard the U.S. has not yet met). Such a standard, therefore, serves the highly important role of eliminating purely cyclical or other temporary increases in debt that are quickly reversed. They confirm that debt overhangs are associated with a 1.2% lower GDP growth rate than during the low debt periods. The new finding is that the duration averaged 23 years, and that negative growth effects are significant, even in many cases when debtor countries were able to secure “continual access to capital markets at relatively low real interest rates. That is, growth-reducing effects of high public debt are apparently not transmitted exclusively through high real interest rates.” This finding seems entirely reasonable since debilitating effects of the debt arise from taking on debt that either does not increase the future income stream, or even reduces the flow of income. This reduces GDP growth, widens the output gap, slows inflation, and thus lowers long-term interest rates.

They write: “The long duration [of the debt overhang] belies the view that the correlation is caused mainly by debt buildups during business cycle expansions. The long duration also implies that the cumulative shortfall in output from debt overhang is potentially massive.” Indeed, they find that at the end of the 23-year average episode, real GDP is 24 percent lower than for the baseline. To drive home the adverse consequences, they quote from one of the most famous passages in literature, T.S. Eliot’s The Hollow Men: “This is the way the world ends, not with a bang but a whimper.” This reference is entirely appropriate since excessive indebtedness serves to hollow out economies.

Reinhart, Reinhart and Rogoff also document the first highly organized link between high public debt and real interest rates. Their conclusion: “Contrary to popular perception, we find that in 11 of the 26 debt overhang cases, real interest rates were either lower, or about the same, as during the lower debt/GDP years. Those waiting for financial markets to send the warning signal through higher interest rates that governmental policy will be detrimental to economic performance may be waiting a long time.”

Government Size and Growth

Reinhart, Reinhart and Rogoff dealt with the idiosyncrasies of countries of different sizes and their abilities to engage in different policy actions (such as devaluations and subsequent inflation) by limiting their samples to advanced countries. In the second study “Government Size and Growth”, Bergh and Henrekson found that to the extent there are contradictory findings of the relationship between the size of government and economic growth they are explained by variations in definitions and the countries studied. The Swedish economists focused their study on the relationship in rich countries by measuring government size as either total taxes or total expenditures relative to GDP. Using a very sophisticated econometric approach under this criterion, they revealed a consistent pattern showing government size has a significant negative correlation with economic growth. Their results indicate “an increase in government size by ten percentage points is associated with a 0.5% to 1% lower annual growth rate.”

The Impact of High and Growing Government Debt on Economic Growth

In the third study, Checherita and Rother investigated the average effect of government debt on per capita GDP growth in twelve euro area countries over a period of about four decades beginning in 1970. They confirm and extend the finding by Reinhart and Rogoff in their 2010 NBER paper that recognized a government debt to GDP ratio above the turning point of 90-100% has a “deleterious” impact on long-term growth. In addition, they find that there is a non-linear impact of debt on growth beyond this turning point. A non-linear relationship means that as the government debt rises to higher levels, the adverse growth consequences accelerate. The Checherita and Rother results “show a highly statistically significant non-linear relationship between the government debt ratio and per-capita GDP for the 12 pooled euro area countries included in our sample.”

In addition to their finding concerning non- linear effects beyond the turning point, they find that, “Confidence intervals for the debt turning point suggest that the negative growth effect of high [government] debt may start already from levels of around 70-80% of GDP, which calls for even more prudent indebtedness policies.” Checherita and Rother make a substantial further contribution when they identify channels through which the level and change of government debt is found to have an impact on economic growth. These channels are (1) private saving, (2) public investment, (3) total factor productivity and (4) sovereign long-term nominal and real interest rates. They write, “Overall, a robust conclusion of our paper is that above a 90-100% threshold, public debt is, on average, harmful for growth in our sample.” The question remains whether public debt is indeed associated with higher growth below this turning point. For the first two channels – private saving and public investment – their evidence suggests that the turning point seems to occur much below the range of 90-100%. They find that government debt depresses economic growth. Accordingly, it is our interpretation that government debt is negatively correlated with long-term interest rates. This is entirely consistent with Reinhart, Reinhart and Rogoff’s point that those waiting for the detrimental aspects of extreme government indebtedness to be apparent in interest rates will have to be very patient indeed.

These three recent academic studies, accompanied with the empirical observations of the panic years of 1873 and 1929 in the U.S. and 1989 in Japan lead us to the proposition that economic growth is destined to be subpar in the next several years.

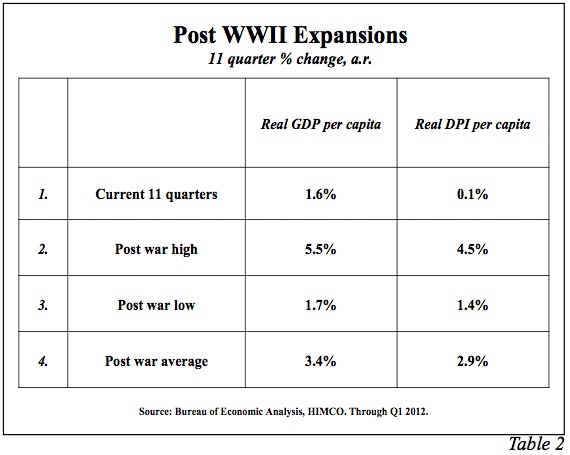

Abysmal Times Confirm the Research

In the eleven quarters of this expansion, the growth of real per capita GDP was the lowest for all of the comparable post-WWII business cycle expansions (Table 2). Real per capita disposable personal income has risen by a scant 0.1% annual rate, remarkably weak when compared with the 2.9% post-war average. It is often said that economic conditions would have been much worse if the government had not run massive budget deficits and the Fed had not implemented extraordinary policies. This whole premise is wrong. In all likelihood the governmental measures made conditions worse, and the poor results reflect the counterproductive nature of fiscal and monetary policies. None of these numerous actions produced anything more than transitory improvement in economic conditions, followed by a quick retreat to a faltering pattern while leaving the economy saddled with even greater indebtedness. The diminutive gain in this expansion is clearly consistent with the view that government actions have hurt, rather than helped, economic performance.

Economic conditions have been worse in euro-currency zone countries, the UK, and Japan. All three of these major economies have also resorted to massive deficit financing and highly unprecedented monetary policies, and all have substantially higher debt to GDP levels than the United States. The UK and much of continental Europe is experiencing recession to some degree. Whether Japan is in or out of recession is a pedantic point since the level of nominal GDP is unchanged since 1991. Even such prior stalwarts of the global scene such as China, India, Russia and Brazil are plagued with deteriorating growth. In such circumstances a return to the normal business cycle of one to two rough years, followed by four to five good years, remains highly unlikely in the United States or in these other major economic centers.

Based upon the historical record of effects of excessive and low quality indebtedness, along with the academic research, the 30-year Treasury bond, with a recent yield of less than 3%, still holds value for patient long-term investors. Even when this bond drops to a 2% yield, it may still have value in relation to other assets. If high indebtedness is indeed the main determinant of future economic growth and further government “stimulus” is counterproductive, then a prolonged state of debt induced coma may so limit returns on other riskier assets that a 30-year Treasury bond with a 2% yield would be a highly desirable asset to hold.

Van R. Hoisington

Lacy H. Hunt, Ph.D.