In light of the California bankruptcies and the usual belated downgrades comes this nice overview on Municipalities from UBS analysts Thomas McLoughlin and Kristin Stephens, titled Municipal Bonds: City credit quality reconsidered.

They did a screen of credit quality via the Merritt Research database of 284 cities, and note come to the oft overlooked conclusion that all cities are not in the same financial position. Some are healthy, some are middling, and a some are in various degrees of distress. “Most city governments are performing reasonably well in spite of the financial challenges posed by lower property valuations, rising employee benefit costs, and lower state aid.”

To identify the municipalities with the greatest potential for trouble, look for “the weakest liquidity position as of the most recent available audited fiscal year.” This is because a “weak liquidity position is a reasonably reliable indicator of financial stress among city governments and increases the probability of a rating downgrade.”

Of the 284 cities in their sample, approximately 10% exhibit characteristics which may indicate “lower level of financial flexibility” and future downgrades from rating agencies.

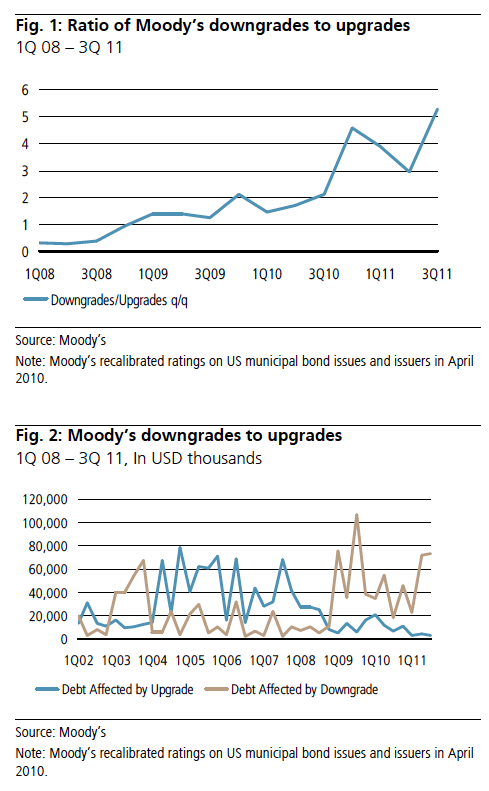

Note that downgrades have been outpacing uporades for some time now:

Source:

Municipal Bonds: City credit quality reconsidered

Thomas McLoughlin, Kristin Stephens

UBS Wealth Management Research 13 December 2011

What's been said:

Discussions found on the web: