The Financial Times – Expect no let-up in dash for equity yield

Last year, dividend income investing was all the rage. Buying stocks with a high yield was virtually the only way to make money in most major equity markets. Plenty of funds, both active and passive, opened in an attempt to cash in on the interest. As it is an item of faith, following Modigliani and Miller, that investors should not care whether their cash is paid out to them in a cheque or remains in the company, that sounded like a good moment to try selling the whole phenomenon short. Demand for yield ultimately came down to an extreme (if not unjustifiable) loss of trust in managers to look after their shareholders’ cash. And indeed, as markets rallied on false hopes for the eurozone crisis in the first months of this year, so high-yielding funds began to underperform. Not any more. Buoyed by the separate but related

phenomena of extreme pessimism (which prompts investors into the kind of defensive stocks that tend to produce big dividends) and historically low yields on government debt and cash, those high-yielding funds are now ahead of the market for the year. Investors regard them as a safe bet, as does the investment industry.

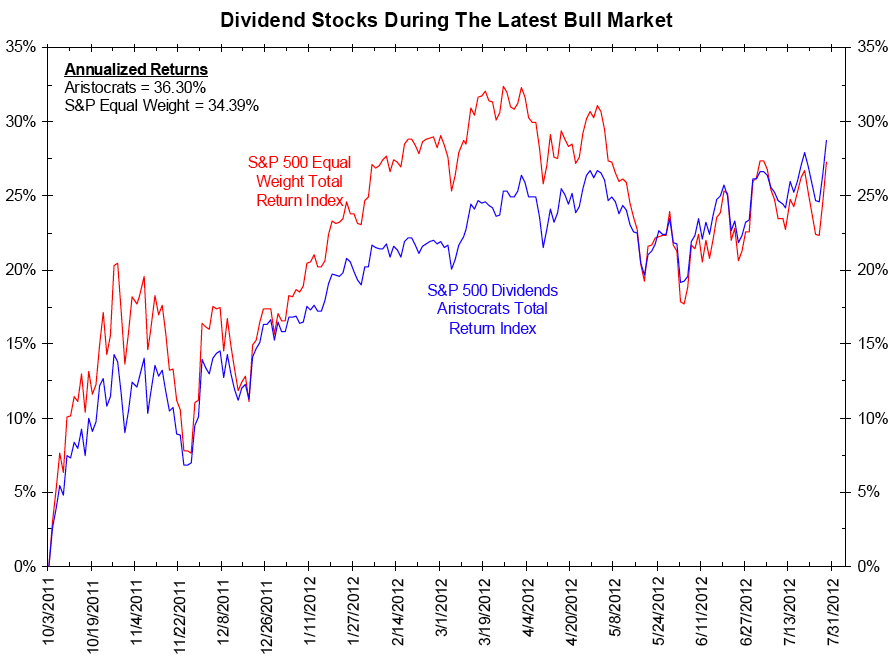

From October 3, 2011 through July 27, 2012, dividend-paying stocks outperformed the S&P 500 Equal Weight Index by 1.47%. On an annualized basis, dividend payers returned 36.30% versus an annualized return of 34.39% for the S&P 500 Equal Weight Index. Although dividend-paying stocks underperformed while the stock market was rising during the first half of this period, the opposite became true once the market reached its April 2, 2012 peak. We believe this is due to there being no real sense of direction in the stock market. If the bull market continues, we can expect to see equal weight index outperform dividend-paying stocks.

Click to enlarge:

Source:

Bianco Research

Charts of the week

August 1, 2012

For more information on this institutional research, please contact:

Max Konzelman

max.konzelman@arborresearch.com

800-606-1872

What's been said:

Discussions found on the web: