20 States Document Year-Over-Year Increases in Foreclosure Activity Illinois Posts Nation’s Highest State Foreclosure Rate for First Time Since Jan 2005

IRVINE, Calif. – Sept. 13, 2012 — RealtyTrac®, the leading online marketplace for foreclosure properties, today released its U.S. Foreclosure Market Report™ for August 2012, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 193,508 U.S. properties in August, an increase of 1 percent from July but down 15 percent from August 2011. The report also shows one in every 681 U.S. housing units with a foreclosure filing during the month.

“Bucking the national trend, deferred foreclosure activity boiled over in several states in August,” said Daren Blomquist, vice president of RealtyTrac. “In judicial states such as Florida, Illinois, New Jersey and New York, this was a continuation of a trend we’ve been seeing for several months now. The increases in Florida and Illinois pushed foreclosure rates in those states to the two highest in the country — supplanting the non-judicial states of Arizona, California, Georgia and Nevada. Previous to August, the nation’s top two state foreclosure rates have been from those four non-judicial states every month since December 2010.

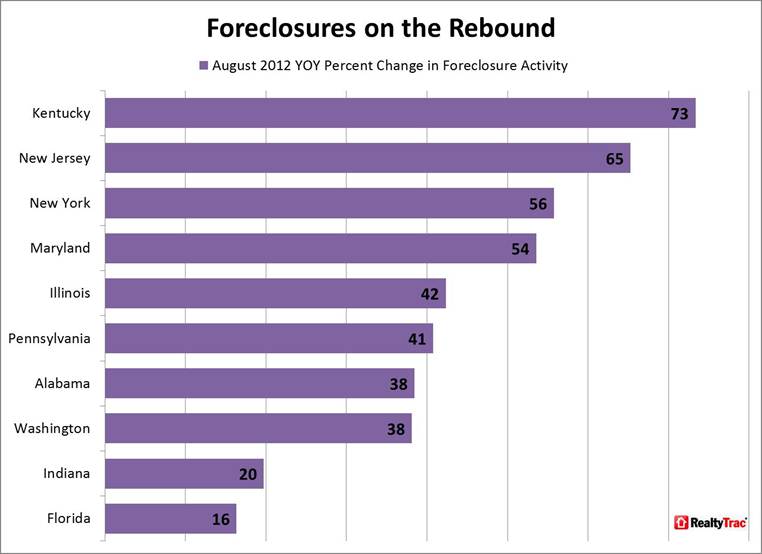

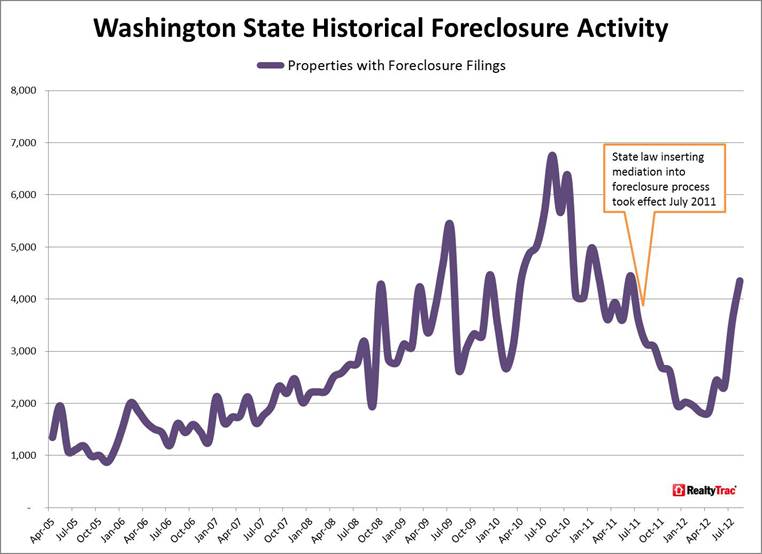

“Meanwhile foreclosure activity in most non-judicial states stayed on a downward trajectory in August, with a few exceptions,” Blomquist continued. “Most notably, Washington state documented a 38 percent annual increase in foreclosure activity in August after 16 straight months of year-over-year declines. The rebounding activity in Washington state is likely the result of lenders catching up with foreclosures delayed by a state law that took effect in July 2011 and allowed homeowners facing foreclosure to request mediation. This rebounding pattern will likely be repeated in the coming months in other states that have passed legislation delaying the foreclosure process.”

High-level findings from the report:

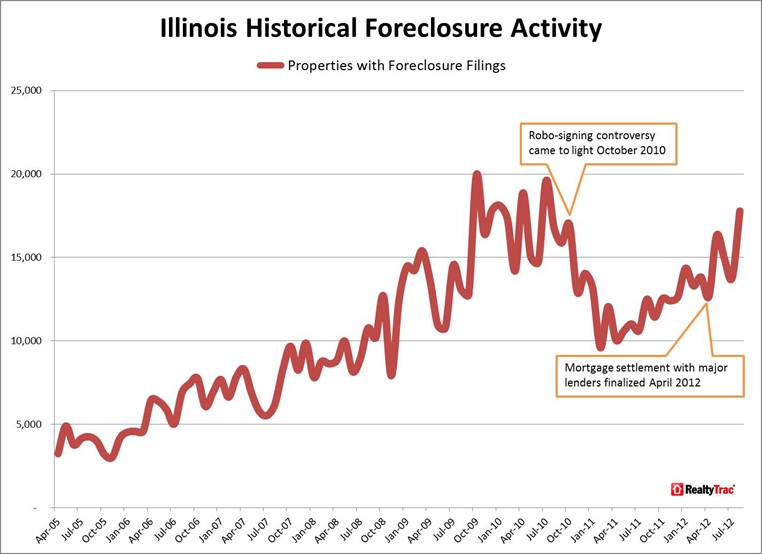

• Illinois posted the nation’s highest foreclosure rate, one in every 298 housing units with a foreclosure filing. August was the first month that Illinois has ranked No. 1 since RealtyTrac began issuing its report in January 2005.

• Twenty states registered year-over-year increases in foreclosure activity, led by judicial foreclosure states such as New Jersey, New York, Maryland, Illinois and Pennsylvania.

• Foreclosure activity in the 24 non-judicial states and District of Columbia combined decreased 31 percent annually, although 15 non-judicial states and DC posted monthly increases in foreclosure activity, including Arkansas (61 percent), Utah (41 percent), Colorado (25 percent) and Washington (23 percent).

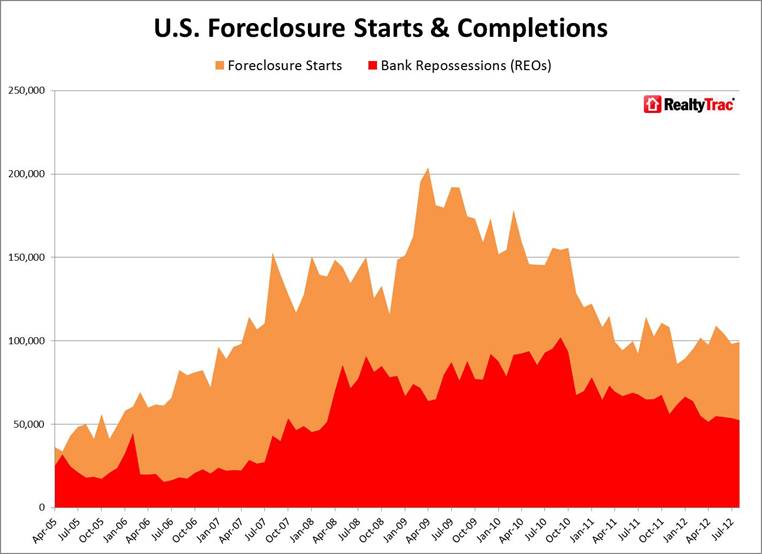

• Following three straight months of year-over-year increases, U.S. foreclosure starts in August decreased 13 percent from a 17-month high in August 2011.

• U.S. bank repossessions (REO) in August decreased 2 percent from the previous month and were down 19 percent annually — the 22nd consecutive month with a year-over-year decline in REOs.

Foreclosure starts down after three straight monthly increases Foreclosure starts — default notices or scheduled foreclosure auctions, depending on the state — were filed for the first time on 99,405 U.S. properties in August, a 1 percent increase from July but down 13 percent from August 2011, when foreclosure starts hit a 17-month high.

Foreclosure starts increased annually in 18 states, including Washington (143 percent), Pennsylvania (129 percent), Alabama (102 percent), New Jersey (101 percent) and New York (63 percent).

Other states with sizable annual increases in foreclosure starts included Minnesota (42 percent), North Carolina (36 percent), Maryland (29 percent), Florida (26 percent) and Illinois (18 percent).

States with some of the biggest annual decreases in foreclosure starts included Oregon (89 percent), Nevada (64 percent), Utah (57 percent), Massachusetts (47 percent), California (42 percent), Arizona (41 percent) and Georgia (31 percent). Recent legislation or court rulings in Oregon, Nevada, Massachusetts, California and Georgia could be contributing to a slowdown in those states.

Bank repossessions decrease annually for 22nd straight month Lenders completed the foreclosure process on 52,380 U.S. properties in August, a 2 percent decline from the previous month and a 19 percent decrease from August 2011 — the 22nd consecutive month with a year-over-year decline in bank repossessions.

REO activity decreased annually in 35 states and the District of Columbia. Some of the biggest state REO decreases were in Nevada (76 percent), Oregon (57 percent), Virginia (56 percent), Washington (46 percent), Utah (46 percent), Massachusetts (43 percent), Pennsylvania (43 percent), and Colorado (43 percent).

States with some of the biggest annual increases in REO activity included Kentucky (44 percent), Illinois (41 percent), Wisconsin (32 percent) and Maryland (23 percent).

Illinois, Florida, California post highest state foreclosure rates Illinois posted the nation’s highest state foreclosure rate in August thanks to a 29 percent jump in overall foreclosure activity from the previous month. A total of 17,781 Illinois properties had a foreclosure filing in August, one in every 298 housing units and an increase of 42 percent from August 2011. Illinois foreclosure activity was up across the board — foreclosure starts increased 18 percent annually, scheduled foreclosure auctions were up 116 percent annually, and bank repossessions were up 41 percent annually. August marked the eighth consecutive month where Illinois foreclosure activity increased on a year-over-year basis.

Florida foreclosure activit in August increased on a year-over-year basis for the seventh time in the last eight months, helping the state post the nations’ second highest foreclosure rate: one in every 328 housing units with a foreclosure filing. Florida foreclosure starts increased 26 percent annually while scheduled foreclosure auctions were up 4 percent and bank repossessions were up 12 percent.

Despite a 32 percent year-over-year decrease in overall foreclosure activity in August — the ninth consecutive month with an annual decrease — California still posted the nation’s third highest state foreclosure rate. One in every 340 California housing units had a foreclosure filing in August — twice the national average.

Other states with foreclosure rates among the nation’s 10 highest were Arizona (one in every 360 housing units with a foreclosure filing), Nevada (one in 402 housing units), Georgia (one in 431 housing units), Ohio (one in 556 housing units), Michigan (one in 593 housing units), Delaware (one in every 610 housing units) and Colorado (one in every 617 housing units).

Foreclosures increase from previous month in eight of 10 hardest-hit metros Foreclosure activity in August increased from the previous month in eight of the 10 cities with the nation’s highest foreclosure rates among metropolitan areas with a population of 200,000 or more.

Foreclosure activity increased from the previous month in the California cities of Modesto (14 percent), Merced (50 percent), Bakersfield (62 percent), Fresno (178 percent) and Chico (87 percent). In Merced, foreclosure activity increased 13 percent from August 2011 after 33 months of year-over-year decreases.

Other top 10 cities with an increase in foreclosure activity from the previous month were Chicago (28 percent) and Rockford, Ill. (15 percent) and Miami (49 percent).

Modesto, Calif., posted the nation’s highest metro foreclosure rate, one in every 172 housing units with a foreclosure filing in August — nearly four times the national average — and the top seven metro foreclosure rates were in California.

What's been said:

Discussions found on the web: