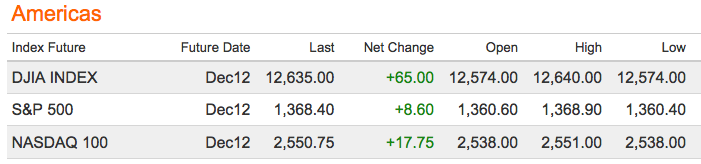

On Friday, we discussed why we might be overdue for a short term bounce. That turned out to be accurate, with a modest bounce starting later in the day. If Futures are any indication, we are going to be continuing that move further today, the start of a holiday shortened week.

I rarely venture into these sorts of market calls, because a) I am unconcerned with trading over the course of days and weeks; 2) no one seems to be especially good at it.

When I discuss these shorter term moves, it is because I am interested in potential indicia of a major change in trend. Otherwise, I try to keep my primary focus on quarters and years. Not coincidentally, that is the time horizon of our asset management clients.

Most of the commentary you will see today about the bounce will be Fiscal Cliff resolution related. Don’t believe it. The bounce is simply because markets became oversold enough that selling pressure temporarily exhausted itself enough to let stocks rise for a while. The old saw is no market moves in a straight line forever.

I find the much more interesting meta-question worth discussing: Why does it always seem that when markets become deeply oversold, politicians and the Fed seem to react? Are they closet technicians or is it something else?

Its something else: The most likely answer is that similar factors drive all these events simultaneously. Politicos note when markets are in a distressed phase; that shows up in all sorts of other psychological measures from Consumer Sentiment to Capex Spending and broad hiring trends. When markets go into freefall, politicians sit up and take notice. Even a milder correction of < 10% such as we have had recently adds pressure to public officials’ decision-making behavior.

No, Bernanke is not watching his Bloomberg concerned about the 200 day moving average, nor is he watching the DeMark indicators nor doing MACD studies. But the same sort of pain that leads investors to capitulate and puke up stocks is also at work on decision makers. We saw that at work in March 2009, when both groups overreacted to the market collapse. And we are seeing shades of that now, with the reaction (and over reaction) to this pullback.

Sometimes, it is how bottoms can be formed (March 2009) or how we can set the stage for at least a short term bounce (presently).

No one wants to lose money, no one wants to get fired, no one wants to ruin their career or reputation. An angry Mr. Market scares the bejeebus out of lots of people — and what we get from that are poor policy decisions, and even worse trading.

What's been said:

Discussions found on the web: