Dick Arms, who 2 weeks ago warned of a correction, thinks this can still work lower, perhaps to 1330 SPX:

Arms:

“Even though it looked, based on my technical work, as though the markets were likely to drop, the slide last week was certainly sudden. Moreover, volume came in with more emphasis on the downside, trading ranges expanded and so did volatility. None of this comes as a big surprise. The clues have been in front of us for nearly two months. Important market tops are usually accompanied by tighter trading ranges and lower volume. The VIX is usually at a very low level. The Arms Index is low, especially on the longer-term measurements like the 55-day. The Market Seismograph is quiet. The APC (Absolute Percent Change) moving averages and the RSI are at or near a high area. The component lines of the MACD are near the top of the chart, but may not be crossed to the negative side.

Across a major top the volume often starts to swing toward the sell side ahead of a drop. The markets are likely to stay in a sideways consolidation for some time, building a cause for the later effect. The wider the top the longer the likely slide. Often the more speculative issues start to weaken ahead of the blue chips. All these things suggest a top, but do not tell us when the change is coming. But a successive breaking of ascending ever less steep trendlines is a clue. However, it is not until an important support level is broken with increasing volume and a widening of the trading range occurs that the red flags really go up. All of the above are now behind us.

Tops and bottoms signal themselves very well technically, but it is the in-between moves that can be difficult. At this time, having seen such a sudden drop, we have to ask ourselves if it is now over. Have we eliminated the weak holders, washed out the selling, and set the stage for a new advance? If so we should have seen very large trading ranges, extremely heavy volume, panic selling, a very high VIX reading, very bearish Arms Index moving averages, short and intermediate term, and possibly the reaching of a historically significant support level. So far I do not see that. On the next few pages we will look at a number of these factors.

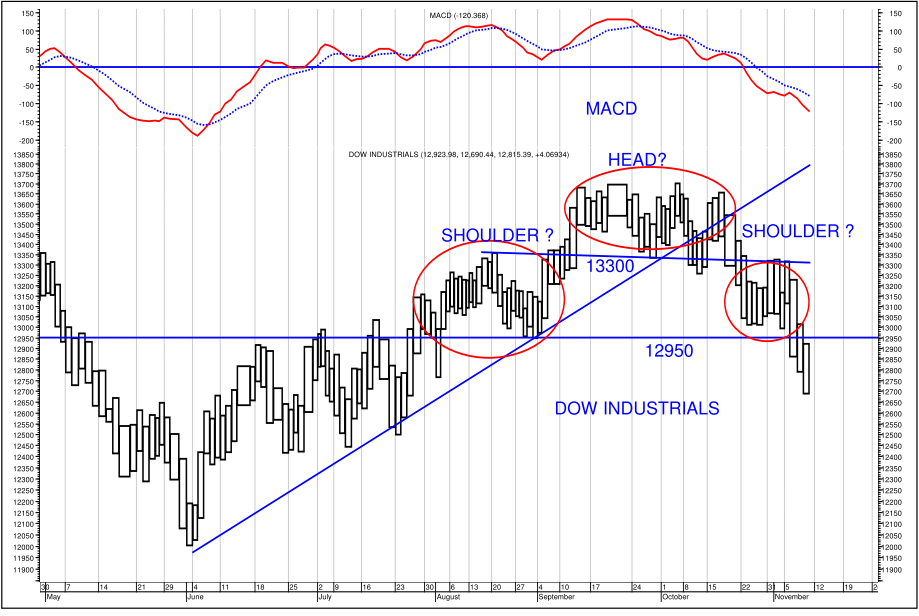

First, lets look at the chart above, on page one. I guess I could have erased the question marks I had inserted in previous weeks. We seem now to have a nearly classic head-and shoulders in the Dow Industrials. We had, in the last two weeks, been watching this pattern building, and noting that the12,950 level was the neckline. We also said that a break of that line would suggest a drop of about the same depth as the distance from the top of the head to the neckline. That could be around 12,200. That is still as long way away. That is not to say we must go there immediately, but it looks reachable in this decline. It implies that we are going to eventually see a washout that takes us to that vicinity.

Lets look too at the volume. Note the width of the Equivolume boxes in the last month. The wider boxes have been seen on the downside. The volume got heavier and the trading range expanded on the penetration of the bottom of the consolidation. But, additionally, note that it was heavy but it was not the sort of extreme volume nor the big spreads we see on major market lows The volume was heavy enough to say we are seeing money leaving the market but not so heavy as to suggest capitulation. Just the fact that we have dropped so far so quickly suggests we could see a short-term attempt to rally in here, but the lack of volume says it is not likely to be a lasting low.

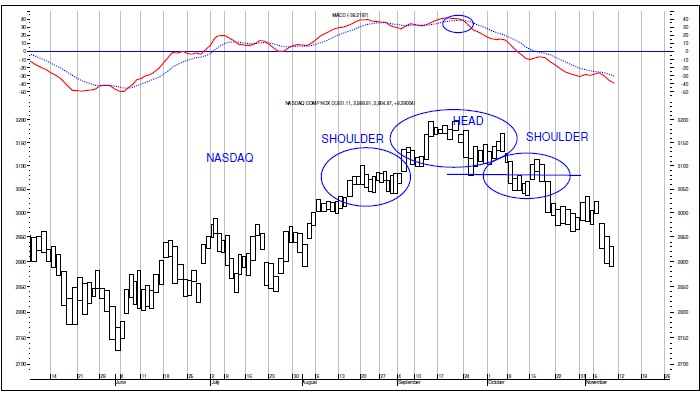

The Nasdaq chart above is again showing us that the more speculative stocks were telling, two weeks ago, of greater weakness than the Dow or S&P 500. Here too the volume has been heavier, but not so dramatically heavy as to be a sign of lasting support. We could draw a channel along the recent highs and lows and conclude that we are at the bottom of the channel, which might justify at least a holding action, but I do not think I would want to risk much money on such a rally possibility.

Source:

Probably Not Over

Richard W. Arms JR.

Arms Advisory, November 12, 2012

800 WAGON TRAIN DRIVE SE ALBUQUERQUE, NM 87123

OFFICE (505) 293-4438

What's been said:

Discussions found on the web: