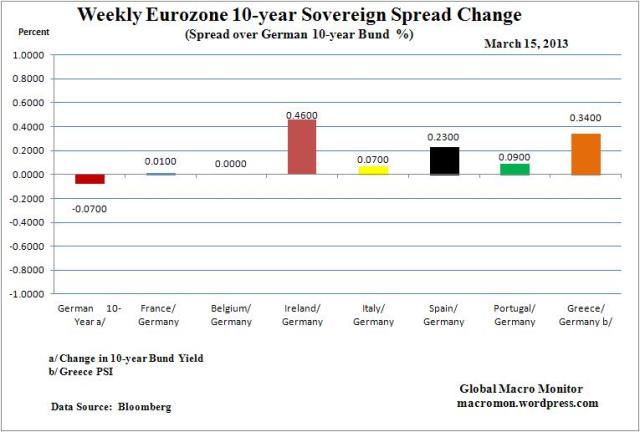

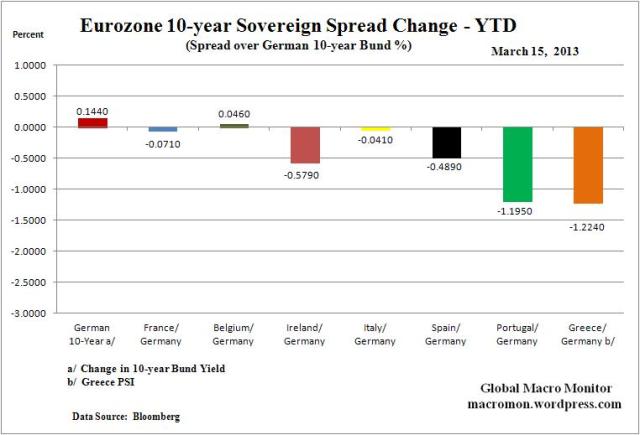

Key Data Points

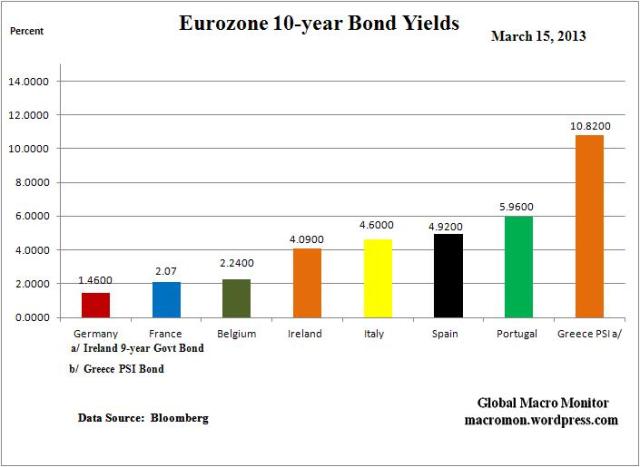

German 10-year Bund 7 bps lower;

France 1 bp wider to the Bund;

Belgium unchanged;

Ireland 46 bps wider; *

Italy 7 bps wider;

Spain 23 bps wider;

Portugal 9 bp wider;

Greece 34 bps wider;

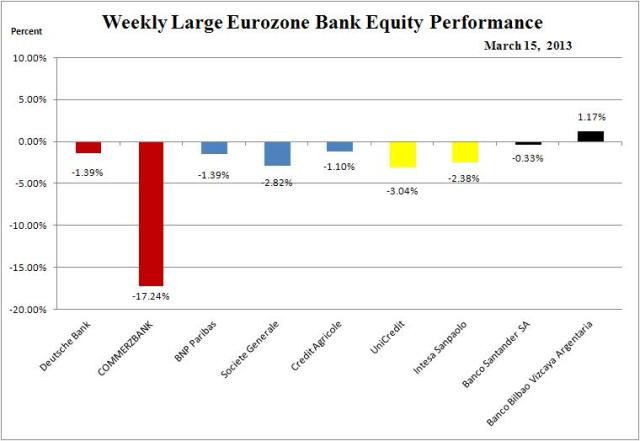

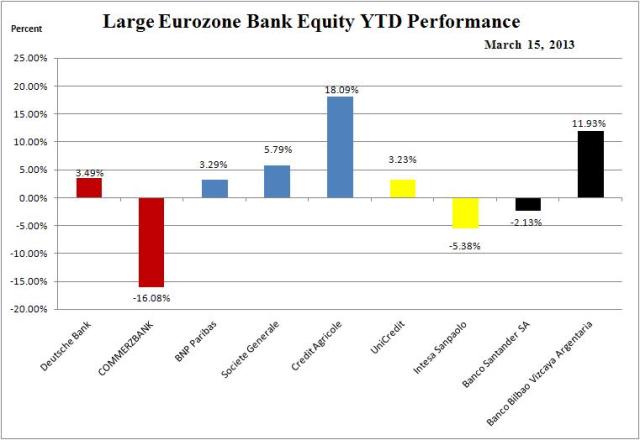

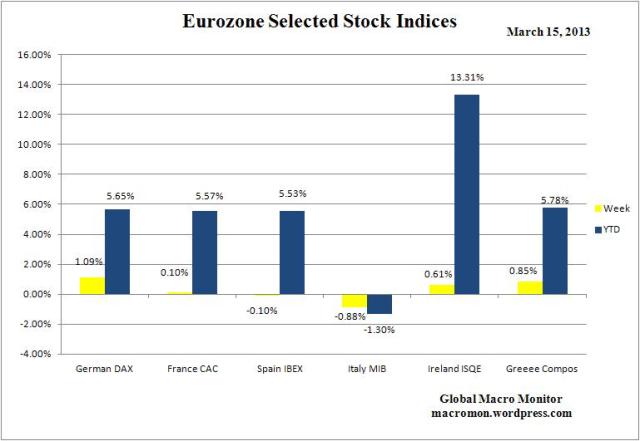

Large Eurozone banks weekly change, 1.17 to -17.24 percent;

Euro$ down 1.26 percent.

Comments

– * Ireland‘s hopes of becoming the first eurozone country to emerge from a financial crisis bailout received a boost on Wednesday following a successful €5bn (£4.33bn) bond sale that will meet the country’s financing needs until well into 2014. – Guardian

– Italy’s borrowing costs rose at an auction of €5.32bn worth of three-year and 15-year bonds on Wednesday, underscoring investor concerns over the prospect of lasting political uncertainty in one of the world’s largest bond markets. – FT

– Lawmakers representing the anti-establishment Five Star Movement have taken up their seats in Italy’s parliament in the first session to be held since last month’s inconclusive elections, with the first votes of the day predictably ending in deadlock. – FT

– Italy‘s outgoing prime minister has warned European leaders that the rigid austerity policies of the past three years have generated mass disaffection with the EU and a populist political backlash. – Guardian

– Commerzbank said on Wednesday that it would repay a taxpayer bailout and ask shareholders for more capital, moves that would reduce the German government’s influence over the bank but also dilute current shareholders. – NY Times, Dealbook

***********************************************************************************’

EU leaders agree to a balance of growth and strict budgets

***********************************************************************************’

Not only has Italy not requested any extra time to perform its adjustment, but it did not request any financial assistance from the EU or any other international organisation. On the contrary, Italy has contributed to the financial assistance of other EU countries in need.

– Mario Monti, Italy’s outgoing prime minister

***********************************************************************************’

(click here if charts are not observable)

(click here if charts are not observable)