Source: Stockcharts

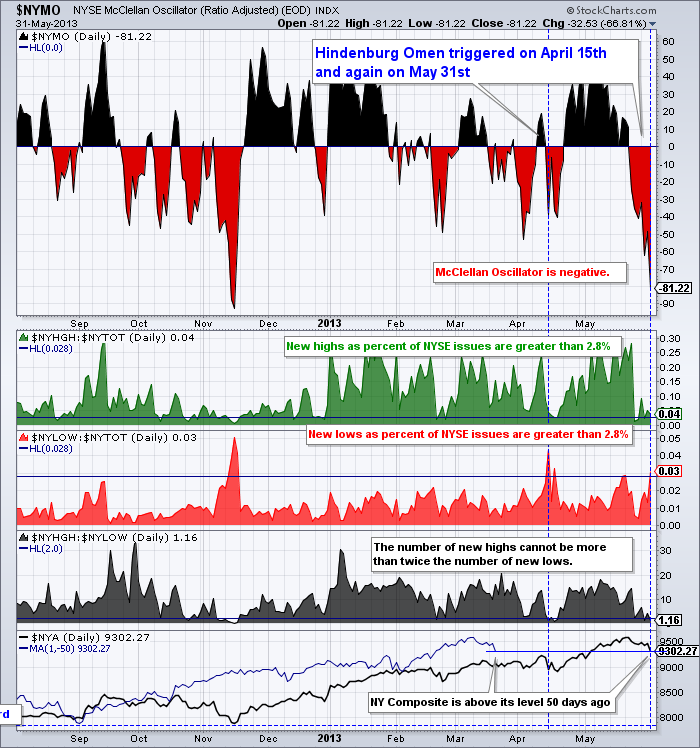

Definition: Hindenburg Omen is triggered when: (1) more than 2.2% of stocks on the NYSE are at 52-week highs AND more than 2.2% are at 52-week lows, (2) the 50-day moving average is trending higher, (3) the McClellan Oscillator is negative, and (4) new 52-week highs don’t exceed new lows by more than 100%.

Yesterday, we asked the question Why people fear the Hindenburg Omen? despite its mixed (i.e., awful) track record in forecasting crashes.

Today, I have a more specific technical question: With markets up 16% YTD as of mid-May, we obviously had a huge number of stocks making 52 week highs.

But we also have seen a spike in rates, suggesting that anything credit or bond related — closed end funds, mortgage REITs, bond funds, etc. — trading on the NYSE are going to be trading appreciably lower. Perhaps even to 52 week lows.

Then there is Japan, and the large number of ADRs and ETFs on the NYSE. These may also be trading lower; the same for various European ADRs that are faltering.

My technical question is this: What happens if we look at the NYSE US operating company only for this indicator — does it change its track record? Does removing the non equity names improve the signal’s otherwise mediocre track record?

Alternatively, when successful Hindenburg Omens have been made in the past, are bonds/ADRs/closed end funds/non operating companies a factor?

Is it possible to generate a track record using Nasdaq as the basis instead of the NYSE? What about the 500 names in the S&P500.

Inquiring minds want to know!

What's been said:

Discussions found on the web: