>

My Sunday Washington Post Business Section column is out. This morning, we look at What’s gone up won’t always come down. The print version had the headline You might think the markets are ready for a breather after last year’s gains, but . . .

Here’s an excerpt from the column:

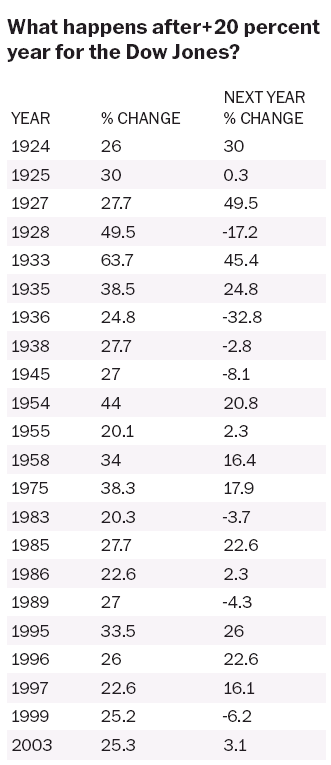

“You might think that after such a strong year, the markets might be due to “take a breather.” Perhaps a flat year is in order so last year’s gains can be “digested” — or so goes the popular assumption. And indeed, markets this year have ranged from flat to down a few percent. Some would go further and, because of the “Gambler’s Fallacy,” assume that markets are bound to go the other way and sell off.

Those assumptions would be wrong. The data strongly suggest that very good years in the U.S. stock market are followed by more good years. When we review both the Dow Jones Industrial Average and the S&P 500, we learn that the years that follow a 20 percent gain (or greater) are typically stronger than average.

There have been 22 instances where the Dow has risen 20 percent or more. In the year after, returns average 8.4 percent, beating the average 7.8 percent of the 90 years from 1924-2013.”>

There were a couple of great charts in the dead tree version of the paper:

Source:

What’s gone up won’t always come down

Barry Ritholtz

Washington Post, April 20 2014

http://wapo.st/1phgDGC

What's been said:

Discussions found on the web: