Allan Sloan, editor-at-large for Fortune magazine, is angry.

And with good reason: He is upset at a lot of U.S. corporate executives who are engaging in “inversion.” This is the process of moving the location of incorporation to a tax haven and skipping out on paying U.S. taxes (short list here). Even though the company is still headquartered in the U.S. and derives much of its revenue and profits here, the company becomes a foreign entity.

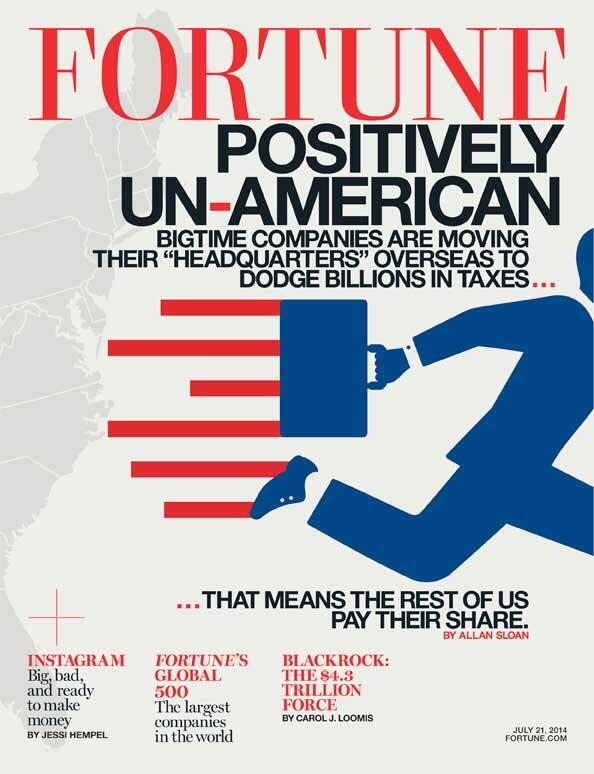

In a cover story this month titled “Positively un-American tax dodges,” he writes: “All of this threatens to undermine our tax base, with projected losses in the billions. It also threatens to undermine the American public’s already shrinking respect for big corporations.” He is as angrier at corporate America than he has been any time since the financial crisis, and you should be too. “The spectacle of American corporations deserting our country to dodge taxes while expecting to get the same benefits that good corporate citizens get” is unacceptable. continues here

What's been said:

Discussions found on the web: