Welcome back to a holiday shortened work week. By the time you read this, I will be winging West to Seattle, but no worries: We have your hand curated morning train reads ready to go:

• Barron’s Roundtable: Masters of the Game (Barron’s)

• The State of the Economy, in Eight Charts (Real Time Economics) see also Update: Predicting the Next Recession (Calculated Risk)

• Six in Ten Mom-and-Pop Currency Traders Lose Money Each Quarter (MoneyBeat)

• It’s time to market forecasters to admit the errors of their ways (Washington Post)

• Obama Proposes New Muni Bonds for Public-Private Investments (Bloomberg)

• Since antiquity, moneymen have been the target of vitriol. (History Today) but see also Global Wealth Is Flowing to the Richest, Study Finds (NY Times)

• Lunch with the FT: Marc Andreessen (FT)

• The coming revolution in much cheaper life-saving drugs (WonkBlog)

• Why GOP leaders are reckless on global warming (Post-Partisan)

• At Oscars, They Coulda Been Contenders: The films of the past that should have been invited to the Best Picture party (WSJ)

What are you reading?

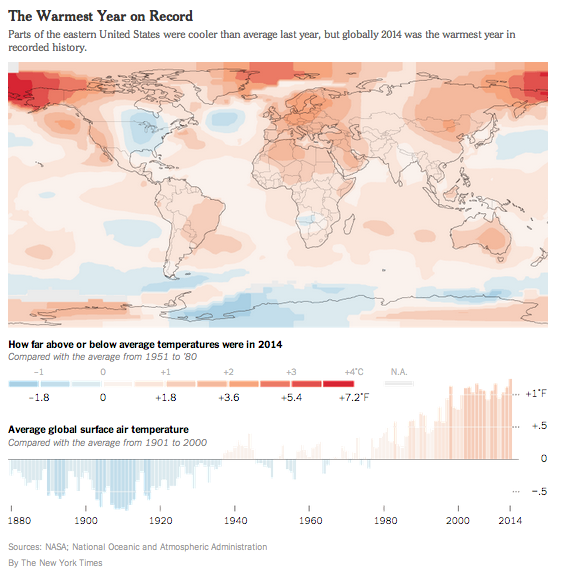

2014 Was the Warmest Year Ever Recorded on Earth

Source: NY Times

On CNBC this AM Larry Kudlow says that cutting taxes for the middle class is “class warfare” because you don’t want to hike taxes on the rich to pay for it… and that the stagnant wages in THIS recovery can be solved with tax cuts for the rich. THEN he says He was there when Reagan did it…

Reagan’s legacy is he STARTED the thirty year stagnation in middle class incomes. And part of it was Reagan CUT taxes for the rich and RAISED them for the Middle class.

http://capitalgainsandgames.com/blog/bruce-bartlett/2154/reagans-forgotten-tax-record

Kudlow is a liar. And if you think he’s not, you’ve been suckered by the GOP Media Machine.

Indeed it’s only called class warfare by the corporate media and their assorted stooges when the middle class get thrown a few scraps. As I believe Warren Buffett said not long ago, it is class warfare, and the rich are winning.

It’s hard to believe how short-sighted many if not most of these billionaires are. Do they not realize that with a stronger middle class their wealth is likely to grow even faster? Perhaps they care more about relative wealth and influence than absolute wealth.

Call me cynical, but I’m not impressed by Obama calling for these much-needed changes precisely when he has 0% chance of achieving them. More talk and no possibility of action. Add to this the fact his administration has done nothing to bring justice to corrupt bankers and little to combat growing wealth inequality and it’s been a disappointing administration. He’s arguably been more Republican than Democrat in his actions.

We can’t have tax cuts for the middle class! What about the deficit?

1) “…Add to this the fact his administration has done nothing to bring justice to corrupt bankers…” the fines on the income statements of the banks are a glaring data point against this claim. Dodd-Frank is a glaring data point as well. House prices back above water. Gas prices halved. Dollar stronger. These are all things Obama has had a hand in.

AIG was the main problem. If AIG leveraged off-shore London CDS operation was something you think you can do a class action lawsuit against, why don’t you? Why don’t all the wronged people sue “the bankers” via a class action? C’mon hair-trigger class-action lawyers, time to make money and sue “All the bankers.”

2) “..little to combat growing wealth inequality …”: has been a problem since Reagan’s tax cuts for the rich were pared with tax hikes on the middle class. This legacy is something Obama has slowly overturned in the face of an intransigent Congress. As we sweep away the Reagan Legacy, our nation will become as just as possible where equal outcomes are not guaranteed.

This administration has done an excellent job.

I think it’s easy to believe how short-sighted billionaires are. For those that created their own wealth, they are very susceptible to make assumptions about the world as it is, i.e. it’s not the same as it was when they made their bones. For those that didn’t, they aren’t in touch with anyone who isn’t very, very wealthy.

Guns to heads, the prevailing mindset is very possibly protectionism…of wealth, reputation, status quo.

I won’t call you cynical if you don’t call me cynical!

Correct me if I’m wrong VennData, but is Holder not on record as saying he didn’t prosecute the banks because he thought it could harm the economy and it would be too expensive? How can you possibly defend an administration that takes that attitude? That’s the Attorney General basically saying there’s one set of rules for the megacorps, and another set for everyone else.

As for jurisdictional issues, last time I looked the UK and other western European nations were close allies that were equally if not worse affected by the meltdown. You don’t think they would have cooperated if America took the lead? Don’t forget Obama had huge popularity and political capital when he came into office.

I agree completely that Republicans/Tea Baggers are in the pocket of the 1% and have been totally obstructionist. That doesn’t excuse Obama not tackling these issues in his first two years with a Democratic Congress, nor caving time and again to Republican demands since then. Why, for example, were the “temporary” Bush tax cuts extended time and again?

Venndata, fines on the companies only hurt the average investor. Fines and even jail sentences for the managers who committed the crimes would have been justice. Instead, Obama (and Congress) rewarded them with bonuses via TARP.

This administration has done a fine job for the 1%. Don’t let your partisanship cloud your perception of reality.

re: ‘Obama has done an excellent job’; VD@11:13am

http://jackrasmus.com/2015/01/19/republicans-change-rules-democrats-change-stripes-obamas-sotu-address/

I am correcting you CN, Holder disavowed that remark. A Misinterpretation perhaps. Billions in fines were collected while the GOP used any means necessary to get consumers who lied on their loan applications. Of which none are in jail.

Helps to have the facts.

Give me a break VennData. It’s very clear what Holder said:

http://www.huffingtonpost.com/2013/03/06/eric-holder-banks-too-big_n_2821741.html

And it took him months to backtrack, and the backtrack was incredibly weak. It reads more like a reaffirmation of his original remarks, just in softer language.

http://www.huffingtonpost.com/2013/05/15/eric-holder-too-big-to-jail_n_3280694.html

The fact remains this administration has done next to nothing of consequence to bring justice to the architects of this crisis. Sure some banks have been fined, but that’s merely a small cost of doing business.

You and I probably share more political views in common than you might think, but your uber partisanship is showing here. I consider this an indefensible aspect of this administration’s record.

Jack Rasmus is a Far Left who is invested in turning Obama into a conservative. Obama’s a technocrat. He is maximimizing over the long run based on the facts.

I know the GOP will not raise taxes on the rich to give a tax cut to anybody. Obama is the first President to propose something he wants? Obama is the first person to suggest ways to shift tax burdens that may not pass?

It is the continuation of a political dialogue. The GOP wasn’t talking about inequality a year ago. That is how you start.

How does Clint Eastwood’s America Sniper deal with Chris Kyle’s Lies? It Ignores them.

http://www.slate.com/articles/arts/the_movie_club/features/2014/the_movie_club_2014/worst_movies_of_2014_american_sniper_glosses_over_chris_kyle_s_lies.html

Artistic license. Just don’t base your political beliefs on it, unless you want to be a dumb-ass Republican.

Another interesting article on the civil asset forfeiture law and its implications for law enforcement. One interesting thing about perverse incentives is that the cash forfeiture reward means that police have an incentive to pull over suspected drug couriers after they have dropped their drugs off, instead of before. Catching them with the drugs would mean criminal charges, but no cash. Afterwards, they get the cash but often don’t press criminal charges.

http://www.washingtonpost.com/news/the-watch/wp/2015/01/19/more-fallout-from-eric-holders-changes-to-civil-asset-forfeiture-law/?tid=pm_opinions_pop

As we continue to sweep away the Reagan legacy our nation can only improve.

The irony about Republicans not reacting to climate change is that it will be the red and purple states that will probably get hit the hardest. We are already seeing significant drought impacts across the south and southwest.

its not like Florida is is disappearing under waster is it? or LA has lost a lot of the states dry land is it? but like a lot of other threats to us, we will likely wait till the last minute to do any thing about it

GOP kook, Bobby Jindal makes up stuff.

http://www.cnn.com/2015/01/19/politics/jindal-no-go-zones-london/

If the Democratic, Obama, science world is so bad why not point out the facts instead of the GOP incessant fantasy brigade?

How about instead of those public-private munibond investments we give each state its own bank with access to the Fed. Why should “we the people” pay fat profits to Wall Street rather than simply getting loans directly from “we the people’s” Federal reserve bank?

Google did their public offering from a web site. There’s no reason people can’t look at the IPO and decide for themselves. That fact that they need salesmen just makes it pricier. Another middleman destine for the dustbin of history

What are Illinois pension bonds going for?

High-Speed Trading Fills Void Left in Proprietary Desks

http://www.bloomberg.com/news/2015-01-20/high-speed-trading-fills-void-left-in-proprietary-desks.html

Free markets provide solution to the bond desks who hide information, refuse to computerize, and are not capitalized enough due to Bush’s Ownership Society rules, revered by Dodd-Frank.

And if I hear one more person lament about the few liquidity because we have fewer “market maker” inventory… where were they in the ’87 crash? This is a total red herring. If the prices drops enough, you will make a lot of money buying similarly if the price goes too high you will make a lot of money selling. We don’t need big institutions sitting in the middle not hooked up to computers making phone calls to each other.

When the “liquidity dries,” get in their and buy, set yourself up for a generation and laugh at the talking heads. I’ve been doing it since ’08, and ’87 before that. Be the change you want to see. Wait in the weeds, when the bond market “collapses,” Buy.

And another thing!

A new antibiotic that appears not to produce resistance. Too good to be true, my guess is yes it is too good to be true. But it is very interesting and certainly worth pursuing.

http://www.businessinsider.com/teixobactin-a-new-antibiotic-2015-1

“Scientists have discovered a new antibiotic, teixobactin, that can kill serious infections in mice without encountering any detectable resistance, offering a potential new way to get ahead of dangerous evolving superbugs.”

It’s good news but you’re right: caution is justified. Article should have stated, “…without encountering any detectable resistance currently.” It buys some badly needed time and efficacy in the teeth of a growing population of highly resistant superbugs but as long as extensive use or overuse of antibiotics continues then resistant strains of bacteria will be selected for; that mechanism is the ground state of biological systems.

Indeed, caution and patience are needed, but definitely good news.

North Atlantic Bond Markets and the Near-Term Macroeconomic Outlook

…over the past six months the market has come to believe:

1. The FOMC’s policies are and will be too tight for it to hit its 2%/year inflation rate target over the next five years.

2. Rather, the FOMC’s policies will produce an average inflation rate of 1.3%/year over the next five years–a cumulative undershoot in nominal demand by an additional 3.5%-points.

3. But because the FOMC will not realize its policies are too tight–will explain away the quarter-by-quarter undershoots as due to special factors until late in this decade–investments in 5-Year Treasury notes will produce positive real returns, an expectation not held since 2010.

….

Threepeet from Huffington

Fusion is the future…..

http://www.huffingtonpost.com/2015/01/20/fusion-energy-reactor_n_6438772.html

What Middle Class..

http://www.huffingtonpost.com/2015/01/20/middle-class-charts_n_6507506.html

WTF?

http://www.huffingtonpost.com/2015/01/20/two-planets-solar-system_n_6503706.html

I expect that a primary outcome of Davos will be more lectures from the 0.1% about how the 99.9% should burn less fossil fuel:

http://money.cnn.com/2015/01/19/luxury/davos-private-jet-flight/

Apparently companies don’t realize their work force is getting older with more of their skilled employees about to retire. They also don’t appear to care. I assume that their beating about their inability to find skilled employees is really just a concern that the best people won’t work for minimum wage.

http://www.marketwatch.com/story/retirement-brain-drain-could-blindside-us-employers-2015-01-20?link=MW_TD_popular

while they rake in the profits from it. noticed that another oil spill, this time in Montana, causing a few folks to not be able drink water again. seems like thats become part of using fossil fuels, the part nobody talks about

Just another externality. Those don’t matter. Who needs water anyway?

The cows come home for S&P (the organization that would rate deals structured by cows).

http://www.bloomberg.com/news/2015-01-20/sec-to-suspend-s-p-from-rating-part-of-cmbs-market-for-year.html

I wonder how many layoffs this will turn into if they can’t rate a bunch of securities for a year.

wonder which one will do that next

Kansas Center for Economic Growth

http://realprosperityks.com/kceg-blog/

GOP’s laboratory of democracy.

Be glad you don’t live there.

anisomycin

anything longer than 3 words, your optonline.net address is permanent failure