Emerging-Stock Bargain Seen in Commodity Users: Chart of the Day

By David Wilson, Bloomberg

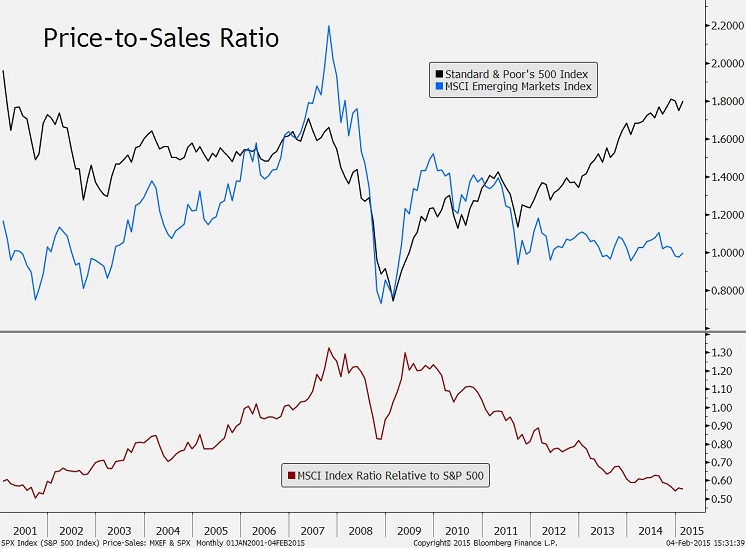

The CHART OF THE DAY illustrates how Emerging-market stocks are becoming cheap enough relative to U.S. shares.

Jack Ablin, chief investment officer at BMO Private Bank compared the price-to-sales ratios for the MSCI Emerging Markets Index, which tracks shares of companies in 23 developing countries, and the Standard & Poor’s 500 Index. The top panel, which resembles a chart he cited in a report last week, shows both ratios since 2001 on a monthly basis.

At the end of last year, MSCI’s index had a 46 percent lower ratio than the S&P 500, according to data compiled by Bloomberg. This amounted to the biggest discount for emerging-market shares since November 2001, as seen in the chart’s bottom panel. A recent gap was 44 percent.

BMO Private Bank is considering an investment in the iShares MSCI Emerging Markets Asia exchange-traded fund, Ablin said. The ETF owns the shares of companies based in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, South Korea and Taiwan.

“Emerging economies that rely almost exclusively on natural resources” are to be avoided, said Ablin, based in Chicago. Shares of companies based in these countries will suffer, he said, as the price of oil and other commodities settle at lower levels.