The Fed – Drunken Coxswain of the SS America

Paul L. Kasriel

The Econtrarian, March 17, 2015

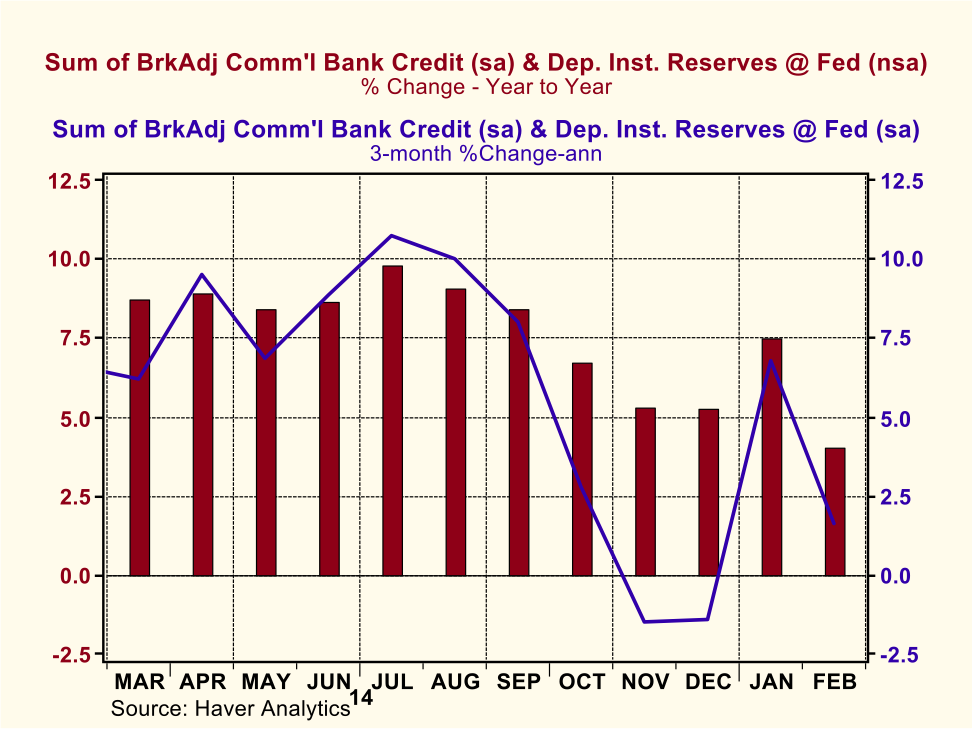

Back on January 25, I penned a piece entitled “The Fed – Lucky or Smart?”. In that commentary I argued that the Fed was managing the supply of total thin-air credit, i.e., the sum of commercial bank credit and depository institution reserves at the Fed, in a responsible manner such that growth in nominal economic activity would neither be too hot nor too cold. I noted that this Fed management of the supply of thin-air credit in mid January was more likely due to luck than to “smarts” on the part of our central bank. I also implicitly posed the question: What if the Fed’s luck should change for the worse without its “smarts” changing for better? Well, that question now is relevant. After rebounding to a rate approximately equal to its long-run median, growth in total thin-air credit sharply decelerated in February, both on a year-over-year basis as well as a three-month basis (see Chart 1).

Chart 1

In the first nine months of 2014, the year-over-year growth rate of total thin-air credit averaged 8.8% per month. In the final three months of 2014, the average monthly growth rate sank by 300 basis points to 5.8%. Then in January 2015, the year-over-year growth rate of total thin-air credit rebounded to 7.5% only to sink to 4.1% in February. The coxswain is the person in charge of steering a ship. It seems as though the Fed coxswain in charge of steering the U.S. economy should be tested for sobriety because she appears to be steering an erratic course.

One could challenge my allegation of a drunken Fed coxswain by questioning whether the sharp deceleration in the growth of thin-air credit, save for February’s rebound, has had any effect on economic activity. I submit it has.

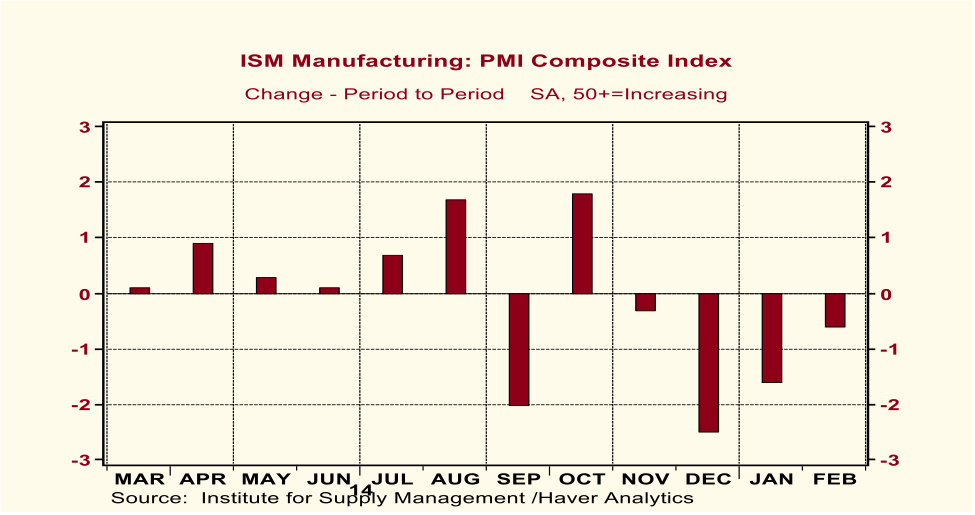

Firstly, I want to present exhibits of the recent behavior of the U.S. economy that will either not ever be revised or will be revised only minimally. First up is the ISM Manufacturing Purchasing Managers’ Composite Index (PMI). As shown in Chart 2, the PMI has declined in each of the past four months ended February 2015.

Chart 2

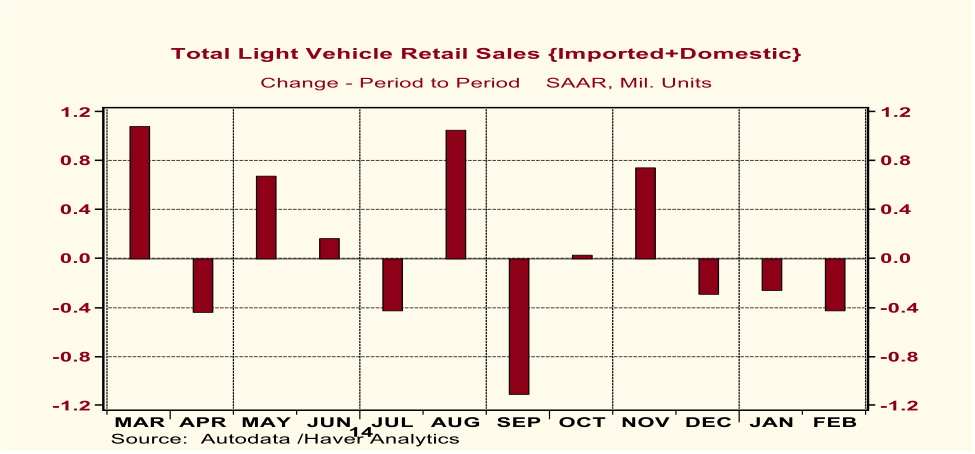

Unit sales of light motor vehicles have contracted in each of the past three months ended February 2015, as shown in Chart 3.

Chart 3

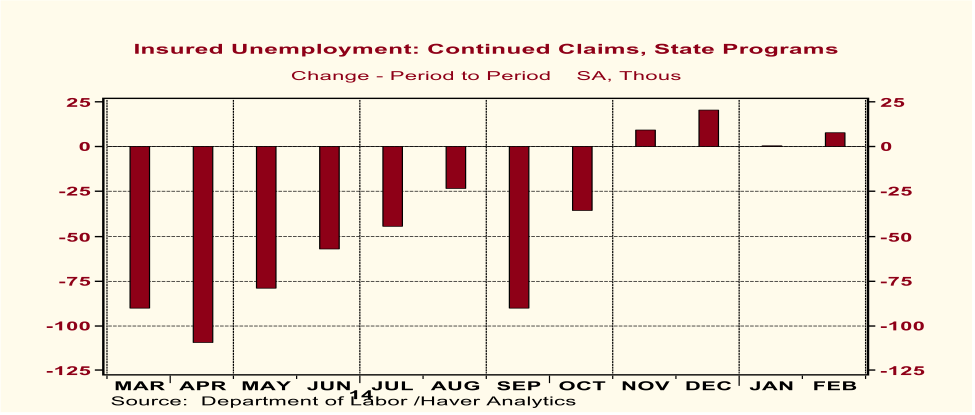

Continuing state unemployment insurance claims have increased in each of the past four months, as shown in Chart 4.

Chart 4

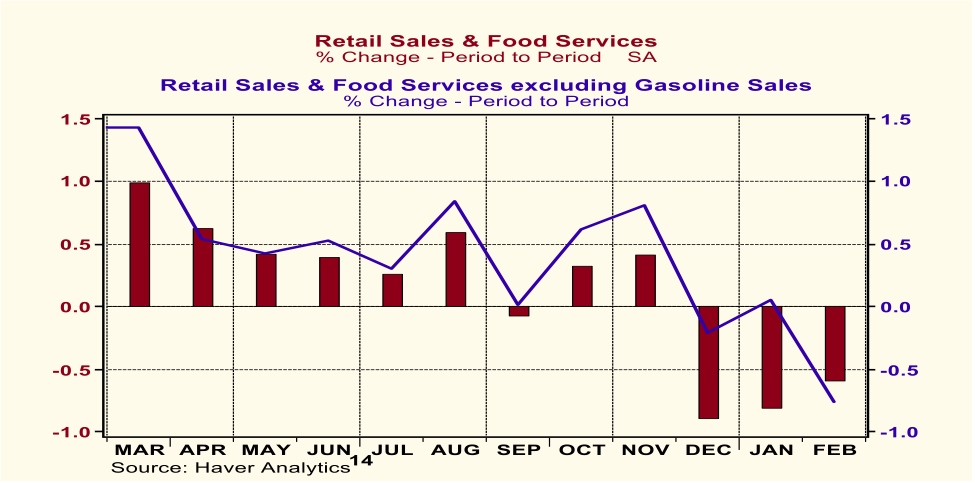

Because of its history of frequent and often significant revisions, I have less faith in the reliability of recent observations of nominal retail sales. But they paint the same general picture of the more reliable economic indicators cited above – that the economy has hit a “soft patch”. Total nominal retail sales have contracted in each of the past three months ended February 2015, as shown in Chart 5. Shown also in Chart 5 is that nominal retail sales excluding those of gasoline stations contracted in two of the past three months ended February 2015. It was against my better judgment that I excluded nominal gasoline sales from nominal retail sales. Yes, I know that when gasoline prices fall, nominal sales of gasoline also decline because households do not instantaneously drive more due to the lower gasoline prices. But with less of their nominal income being spent on gasoline, households might increase their nominal expenditures on other more discretionary goods and services by an amount equal to their nominal gasoline expenditure “savings”. This did not happen in each of three months ended February 2015.

Chart 5

One tangential thought regarding the February 2015 retail sales report. The consensus estimate of the change in total nominal February retail sales was an increase of 0.4%. The consensus did not even get the sign of the change correct. The Census Bureau reported that February total retail sales decreased by 0.6%. What was the common excuse for the big miss by the consensus? Blame it on the weather. But, wait a minute. The economicforecasters did not have to forecast the February weather. The actual February weather was a known fact when the forecast of February retail sales was made. Yes, the winter weather of this past February was unusually severe. But why wasn’t this fact incorporated into economists’ collective forecast of February retail sales?

I know that forecasting monthly economic data accurately is very difficult. I know that if a reporter calls you for a forecast and you tell him/her that you don’t have a clue, that reporter won’t call you again. And if reporters stop calling you, your job could be in jeopardy, because what, after all, is the principal function of a Street economist? Marketing the name of your employer. Why doesn’t some enterprising economics reporter do a study on the accuracy of consensus forecasts of economic data? Perhaps if the media could be weaned off this mugs game, then Street economists could do something more useful, such as conducting research as to what really drives the cyclical behavior of the economy.

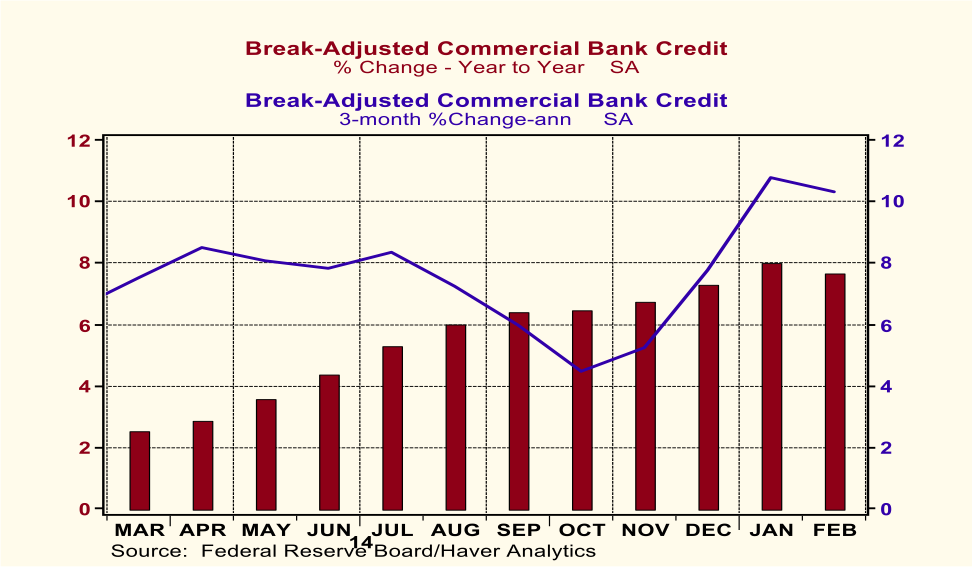

But I digress. Back to the drunken Fed coxswain. Why did growth in total thin-air credit take a dive in February 2015 and why was it relatively weak in November and December 2014? Was it because of weak growth in the commercial bank credit component? No. The data plotted in Chart 6 show that commercial bank credit growth, both on a year-over-year basis as well as a three-month annualized basis, has been quite strong.

Chart 6

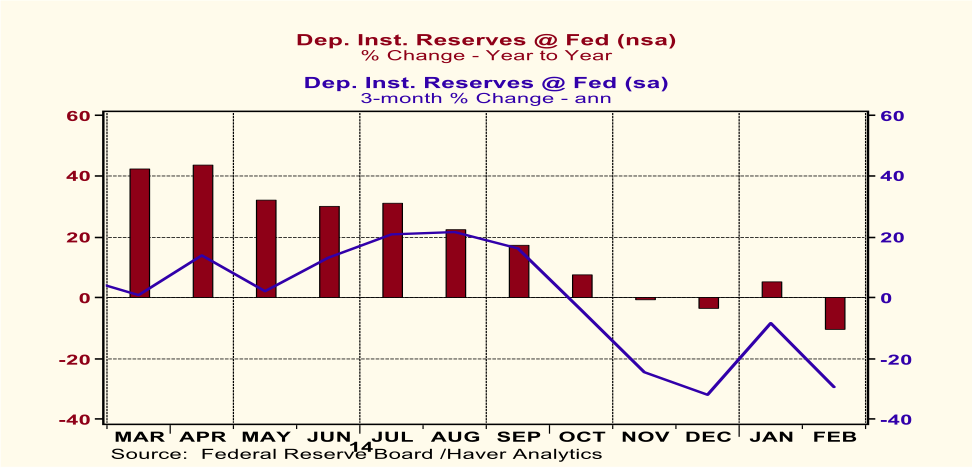

That leaves but one explanation for the recent weakness in total thin-air credit growth – weakness in the Fed component, i.e., depository institution reserves at the Fed. This is illustrated in Chart 7. Given the strong growth in commercial bank credit in recent months, it is entirely appropriate that Fed credit growth should have slowed from what it was when the QE III policy was being pursued. But the Fed has overdone it. In September 2014, the year-over-year change in Fed reserves was plus 17.3%. In February 2015, it was minus10.1%. In the three months ended 2014, the annualized change in Fed reserves was plus16.4%. In the three months ended February 2015, it was minus 29.5%.

Source:The Econtrarian

The Fed is steering its component of thin-air credit like a drunken coxswain. As a result,total thin-air credit is behaving in a similar fashion. And as a result of these frequent and, most likely, unintentional course changes in thin-air credit growth, my near-term forecasts of the pace of economic activity also have become erratic. The erratic behavior of my economic forecasts is inconsequential. But what is consequential is the effect on the economy and financial markets. If the Fed continues to “steer” growth in thin-air credit with these seemingly erratic and random course changes, then the economy will behave in a volatile fashion, which will impart volatility to the financial markets. Other than short-term financial-market traders, no one will benefit from this.

There is continued interest in Congress to impose some “rules” on the Fed as to how it should conduct monetary policy. I am sympathetic to the general notion of imposing rules on the Fed – but not Taylor’s [interest rate] Rule. We will have to leave a discussion of new rules on the Fed for another commentary.

Paul L. Kasriel

econtrarian@gmail.com

920-818-0236

http://www.the-econtrarian.blogspot.com/

Sr. Economic & Investment Advisor, Legacy Private Trust Co., Neenah, WI

Always enjoy Kasriel’s take. Thanks for posting it, Barry.

Chart 7 above is a dupe of Chart 6. The correct chart (key to Kasriel’s analysis) is posted at his blog, though.

~~~

ADMIN: Fixed. (You cant hire good help these days)

I think BR has been publishing Kasriel here since he left Northern Trust

Normally I can profit from reading and, occasionally disagreeing with, a Kasriel analysis but this one seems slippery, even incoherent; i.e., the causal distance or gap between (1) putative Fed inconsistency, (2) evidence supporting said inconsistency, (3) the effect of this inconsistency on the economy, and (4) the impact this effect will have on financial markets in turn appears too large to hold the piece together.

Maybe there was a length or style restriction on the column but there was a fair amount of hand-waving where I would normally expect to see reference to a model or mechanism.

Bottom line I got nothing from this.