From Wikipedia:

“ Behavior finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. Bubbles occur not only in real-world markets, with their inherent uncertainty and noise, but also in highly predictable experimental markets.”

“A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation”

Yesterday afternoon, Bill Gross was pressed about bubbles in an interview on CNBC. He spoke about the frothiness that he is seeing in today’s market and warned of the consequences when this thing pops. While we are all too familiar with the tech bubble in the 90’s, The real estate bubble in the 2000’s and the subsequent financial meltdown, we fail to recognize that in order to see where we are going, we have to recognize where we have been.

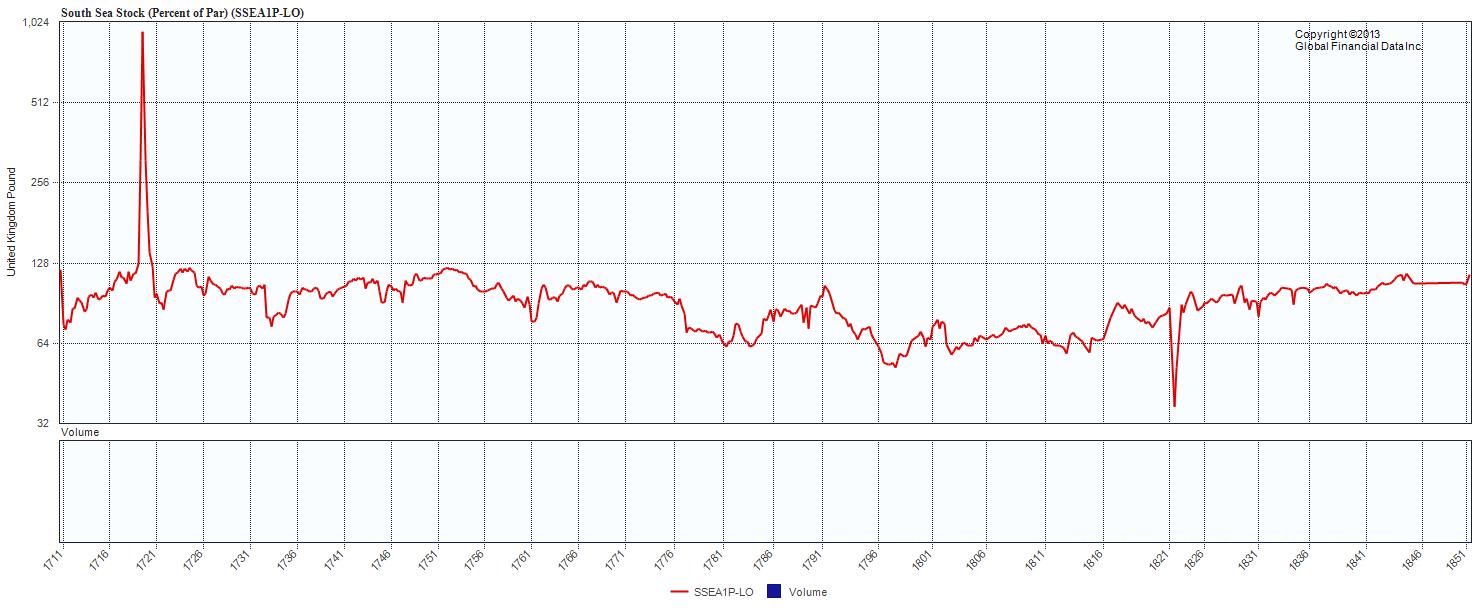

Bubbles seem to be commonplace in today’s marketplace. But, if you look back in history you will find that they have been much more common than you think. In fact, they have been around for more than 300 years. In the chart below, we take a look at one of the earliest, if not the first stock bubble. The South Sea Bubble.

The company, established in 1711 by the Lord Treasurer, Robert Harley, was granted exclusive trading rights in Spanish South America. At that time, when continental America was being explored and settled, Europeans applied the term “South Seas” only to South America and surrounding waters, not to any other ocean. The trading rights were presupposed on the successful conclusion of the War of the Spanish Succession, which did not end until 1713, and the actual treaty-granted rights were not as comprehensive as Harley had originally hoped. Harley needed to provide a mechanism for funding government debt incurred in the course of that war. However, he could not establish a bank, because the charter of the Bank of England made it the only joint stock bank. He therefore established what, on its face, was a trading company, though its main activity was in fact the funding of government debt.

In return for its exclusive trading rights the government saw an opportunity for a profitable trade-off. The government and the company convinced the holders of around £10 million of short-term government debt to exchange it with a new issue of stock in the company. In exchange, the government granted the company a perpetual annuity from the government paying £576,534 annually on the company’s books, or a perpetual loan of £10 million paying 6 percent. This guaranteed the new equity owners a steady stream of earnings to this new venture. The government thought it was in a win-win situation because it would fund the interest payment by placing a tariff on the goods brought from South America. The company did not undertake a trading voyage to South America until 1717 and made little actual profit. Furthermore, when ties between Spain and Britain deteriorated in 1718 the short-term prospects of the company were very poor. Nonetheless, the company continued to argue that its longer-term future would be extremely profitable.

Shares in the company were “sold” to politicians at the current market price; however, rather than paying for the shares, these lucky recipients simply held on to what shares they had been offered, “sold” them back to the company when and as they chose, and received as ‘profit’ the increase in market price. This method, while winning over the heads of government, the King’s mistress, etc., also had the advantage of binding their interests to the interests of the company. In order to secure their own profits, they had to help drive up the stock. In addition, by publicizing the names of their elite stockholders, the Company managed to clothe itself in an aura of legitimacy, which attracted and kept other buyers.

A number of other joint-stock companies then joined the market, making usually fraudulent claims about other foreign ventures or bizarre schemes, and were nicknamed “bubbles”.

The price of the stock went up over the course of a single year from about one hundred pounds a share to almost one thousand pounds per share. Its success caused a country-wide frenzy as all types of people—from peasants to lords—developed a feverish interest in investing; in South Seas primarily, but in stocks generally. Among the many companies to go public in 1720 is—famously—one that advertised itself as “a company for carrying out an undertaking of great advantage, but nobody to know what it is”. The price finally reached £1,000 in early August and the level of selling was such that the price started to fall, dropping back to one hundred pounds per share before the year was out, triggering bankruptcies amongst those who had bought on credit, and increasing selling, even short selling. Also, in August 1720, the first of the installment payments of the first and second money subscriptions on new issues of South Sea stock were due. Earlier in the year Blunt had come up with an idea to prop up the share price—the company would lend people money to buy its shares. As a result, a lot of shareholders could not pay for their shares other than by selling them. Furthermore, the scramble for liquidity appeared internationally as “bubbles” were also ending in Amsterdam and Paris. The collapse coincided with the fall of the Mississippi Scheme of John Law in France. As a result, the price of South Sea shares began to decline.

By the end of September the stock had fallen to £150. The company failures now extended to banks and goldsmiths as they could not collect loans made on the stock, and thousands of individuals were ruined (including many members of the aristocracy). One of the more famous investors to lose a massive amount of money was Sir Isaac Newton who lost the equivalent of $2.4 million in today’s money, a fortune at that time. With investors outraged, Parliament was recalled in December and an investigation began. Reporting in 1721, it revealed widespread fraud amongst the company directors and corruption in the Cabinet.

The newly appointed First Lord of the Treasury Robert Walpole was forced to introduce a series of measures to restore public confidence. Under the guidance of Walpole, Parliament attempted to deal with the financial crisis. The estates of the directors of the company were confiscated and used to relieve the suffering of the victims, and the stock of the South Sea Company was divided between the Bank of England and East India Company. A resolution was proposed in parliament that bankers be tied up in sacks filled with snakes and tipped into the murky Thames. The crisis had significantly damaged the credibility of King George I and of the Whig Party.

The company continued its trade (when not interrupted by war) until the end of the Seven Years’ War (1756–1763). However, its main function was always managing government debt, rather than trading with the Spanish colonies. The South Sea Company continued its management of the part of the National Debt until it was abolished in the 1850s.

Here we see a chart of the South Sea Stock to 1711:

Click to enlarge

Source:

Ralph M Dillon

Global Financial Data, March 23, 2013

rdillon@globalfinancialdata.com

What's been said:

Discussions found on the web: