From Deutsche Bank:

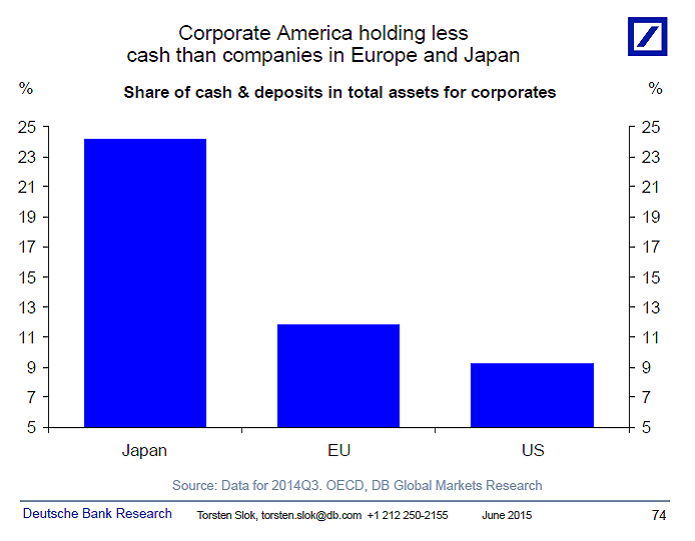

A striking feature of my ongoing discussions with clients is that many still believe that as a result of secular stagnation “long rates will never go up”. The problem is that holding onto that view has been expensive for the past seven weeks. Long rates in the US are driven by 1) US fundamentals, 2) Fed communication, and 3) demand for Treasuries from abroad, and it is the outlook for the rest of the world that has been a key driver of US rates recently (see also the chart in my Monthly chart book with Fed and ECB expectations). And investors are not only revising their view on the outlook for Europe at the moment. In Japan, up until H1 2014, the recovery was led by non-manufacturers and mid-sized and small companies but we are now beginning to see a broader recovery in 2015, including in capex, and the chart below shows that cash holdings in US companies are lower than cash holdings in European companies, which again are holding much less cash than Japanese companies. The bottom line is that developments over the past seven weeks show that US rates investors should be spending less time thinking about secular stagnation and instead spend more time thinking about the outlook for the rest of the world, because it is a revision of the outlook for the rest of the world that seems to be driving US rates at the moment. For more on the outlook for Japanese capex see our latest write-up here.

I need to demonstrate my ignorance. Does this article suggest that long bonds rates will go up because there will be many issuers – due to growth, and that one reason is that US companies have little cash, so will resort to bonds? Could they have said that? Does everybody already know what direction US rates have gone in the past seven weeks, so that also does not need to be mentioned?

If Japanese companies have lots of cash, are they less likely to issue bonds, so likely keeping bond rates low?