I just spent almost a year with a Fitbit Flex on my wrist. My wife bought us a matching pair for my birthday last October, and we were excited about tracking our fitness. The good news is I am 10 pounds lighter than I was a year ago. How much of that is attributable to the Flex is up for debate.

Perhaps the more interesting question for an indexer like me is whether this is a stock worth buying.

Stock pickers could do worse than following the model developed by investing legend Peter Lynch. He didn’t merely excel at “Beating the Street” — he trounced it. At Fidelity Magellan, the fund he ran, his returns averaged 29.2 percent annually during a 13-year span. Had you been lucky enough to put $10,000 into Magellan when Lynch took over the fund in 1977, it would have grown to $247,000 by the time he stepped down in 1990; an initial investment of $37,000 would have made you a millionaire.

Lynch’s advice for investors was straight-forward: Invest in what you know and understand; expect to hold stocks for the long run; research investments thoroughly, focusing on company fundamentals; most important of all, look for companies with modest price-earnings ratios relative to growth (PEG ratio). A lower PEG ratio can indicate that a stock is inexpensive in light of its potential earnings growth.

Let’s use Lynch’s technique to look at the product (Flex) and the company (Fitbit). The idea of fitness trackers in general is great: You can’t manage what you can’t measure. Having metrics that let you track your activities is both helpful and motivational.

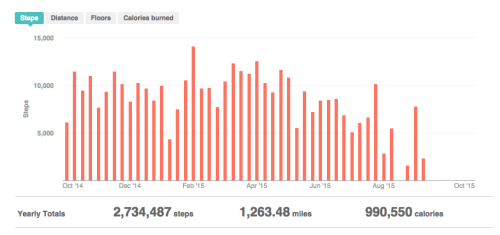

The best aspect of my Fitbit Flex was the software: It is intuitive, letting you set a variety of goals (calories, miles, nutrition, steps, etc.). Mine was to walk 10,000 steps a day. I tried to consistently meet it. See the chart above to see how I did.

The weakest feature, at least in my experience, was the hardware, just about every aspect of which disappointed. Plus, the resin wrist bracelet needed to be replaced in less than a year, which shouldn’t have happened.

There were other issues. The Fitbit syncs with your phone and updates in real time. At least, it’s supposed to. Sometimes it did and sometimes it didn’t. I learned from other Fitbit users that this wasn’t all that uncommon. It was very frustrating. Fitbit will replace a defective or damaged unit, but the process is time-consuming and way too annoying. I understand this is a $99 product, and I shouldn’t expect Lexus-like service, but it seemed the intent was to discourage users from making repairs or replacement requests. I gave up after a while. But by this time my wife had become bored and gave me her Flex, which for some reason worked much better than mine. Sync problem solved.

I also had issues with the battery life. It lasts three to four days, which is a very unintuitive time span. A week would have been better. Making the device a few centimeters longer or thicker would allow for a larger battery.

Finally, the charger didn’t always work. The contacts had to be just so, and occasionally failed to connect. Sometimes wedging in a paperclip would make the contact better and allow a charge. Eventually the plastic holder for the Flex stopped charging altogether.

That was pretty much the end of my Flex usage, a little shy of a year.

My takeaway is it’s a great concept, good software, poor customer service, terrible hardware. Perhaps I have been spoiled by Apple, but the Flex feels like a product that’s not quite ready yet.

The company itself is expensive, with a P/E ratio of 72, although Lynch’s favorite metric, the PEG ratio, is 1.78. That’s lower than other major companies in the fitness business, such as Under Armour or Nike. NPD Data noted that Fitbit’s market share in 2014 was a dominant 67 percent, which suggests it’s likely to attract more competition. It’s also a newly public company, having sold shares in June at $20 each. It now trades for about $38.

Because I didn’t love the Fitbit, not to mention some indications that the shares are expensive, I suspect this isn’t a company that Peter Lynch would have embraced.

I haven’t turned against the concept of a fitness tracker. And maybe the mistake was buying Fitbit’s 1.0 version. You probably should never buy the first iteration of any tech product. That’s why I skipped the Apple Watch. When the 2.0 version comes out, it will likely be on my wish list.

I’d have to think hard about giving Fitbit another shot.

Originally published here: Would Peter Lynch Love Fitbit?

One of Peter Lynch’s fundamental precepts was looking for companies with a moat to protect their assets and earnings for an extended period of time. An example he gave as local quarry companies, since heavy rock and earthen materials are expensive to truck and competition is limited to just a few miles away – similarly, their land was also only subject to competition within a few miles.

I don’t see any moat at all for Fitbit. It is small tech sitting on a wrist with dozens of small potential competitors, as well as huge ones (Apple & Samsung come to mind). The fitness basis for their algorithms is common knowledge. I don’t see any trade secrets or proprietary closed systems, like Blackberry’s communication network, that could provide a moat for a few years before better designed competitors can take over.

One really good competitor and Fitbit is toast overnight, like many companies in the tech world. The best tech companies have fundamental embedded systems (Microsoft OS on billions of machines), high quality operational systems (Amazon), laser-like focus on design (Apple) etc. I only see Fitbit being a major company if they can become the Apple of fitness.

I agree completely, and one of the things they would need to do to get to that point is establish a health database that one could share with doctors, hospitals, etc — the key principle here being that the user “owns” the data, they merely provide the repository to house it, and make it available to all others.

Fitbit, despite its users clamoring for an interface between the data Fitbit collects and Apple’s Health database — I am told this is the #1 requested feature by Fitbit users — refuses to do so. I am not clear on who “owns” the data Fitbit collects, but they are acting as if they do, not the user. To me, that sounds like an anti-moat, the sort of thing that competitors could use to drive a wedge between Fitbit and potential customers.

But that is probably just the way I see it, as Jawbone has a product that is nearly identical to Fitbit, except that the Jawbone product can interface with the Apple Health database, and so far as I can see, that does not appear to be drawing many customers to it. If Fitbit were actively looking to prevent competitors from entering their market, about the only tactic at their disposal is for them to leverage their large customer base by bringing out an ever-decreasing-in-price line of products, using cost as their moat. That does not seem to be the case, as each new product is a bit more expensive as its predecessor — a natural thing, for most companies, is to make their products increasingly profitable over time.

Fitbit may be a “flash product”, that explodes in popularity, and then fades away just as quickly, or it may endure for a long time, but there is nothing I can see in what it offers that will compete with a device that does all the same measurements and also is programmable. In a few years, the Apple watch (and probably others as well) will be ginormously more powerful, run for a week on a charge, and may even recharge itself from ambient RF noise (cell towers, TV stations, wifi), offering a platform that provides a hundred times the functionality of a Fitbit wrist band for less than double the price. If Apple (or Alphabet, or Microsoft, or any other large tech company) wants to take Fitbit’s customers, there is nothing to stop them from doing so.

I used to work for Fidelity before I struck out on my own.IMHO, the Best Financial company on the planet. My simple answer is NO.

I have a fitbit and am a long distance runner. I keep track of my runs, and have all the times, places, and (approximate) distances recorded back into the 90’s, when I picked up the sport. I used to race and did scientific preparation for the races. In many ways, I should have been pretty eager fitbit customer, but was not (it was a gift) and am not. First off, there are a lot of competitors out there, led by the Apple watch and filled out by traditional watch companies like Timex and Casio, fitness competitors like Polar and Soleus, GPS competitors like Garmin and Tom-Tom, and an assortment of others – Bushnell, for example. Fitbit may emerge as the dominant player, but that is far from clear right now – for one, their sophisticated pedometer technology seems inferior to GPS – I know mine always understates my runs and overstates my hikes, while it gets my walking around town just about right. Having their technology obsoleted so quickly really makes you wonder about their moat.

On the subject of your information, no fitness geek worth his or her salt is going to buy anything that doesn’t allow you to download pretty much everything inot a spreadsheet, which means the companies will only be able to sell some low margin cloud services, if anything.

I see fitness monitors as something a little like digital cameras. A lot of them will be sold, and someone will make money on them, but even if you see the trend coming, it’s going to be hard to see just how to ride it.