From Torsten Sløk of Deutsche Bank:

click for full size image

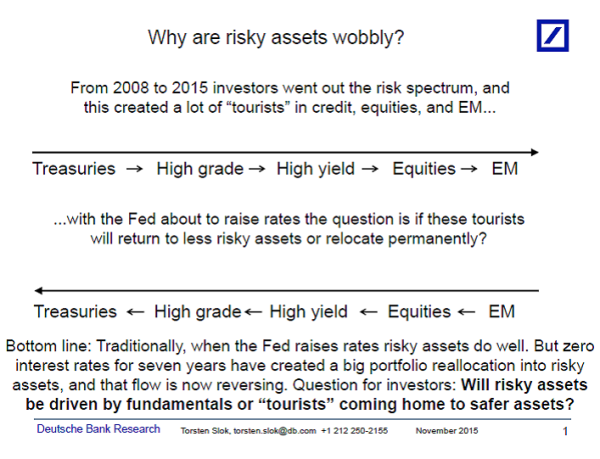

Source: Deutsche Bank Securities

When the Fed begins to raise rates, it is normally associated with higher equities and narrower spreads on high grade and high yield. But after seven years of zero interest rates, risky assets have not only been driven by improving fundamentals and expected future cash flows. A key reason why risky assets have done so well over the past seven years is because monetary policy and low interest rates encouraged investors to take more risk. Zero interest rates since 2008 has resulted in many “tourists” moving out the risk spectrum from Treasuries into high grade, MBS, loans, high yield, equities, and emerging market assets. On top of that, low interest rates resulted in high corporate issuance that was used for buy-backs, which also boosted equity prices. Now, with the Fed about to push up interest rates on risk-free assets, the question is the following: How many investors unwillingly bought high grade credit and loans and high yield and equities and EM assets over the past seven years, and will these “tourists” return to less risky assets when the Fed hikes, and hence trigger a significant tightening in financial conditions? This is the key question for investors, and hence also for the Fed, see chart below. With this backdrop, it is not a surprise that we continue to see turbulence across many asset classes as we get closer to Fed liftoff.

As a long time tourist in EM bonds there has been months of selling on the rumor of a fed hike. Druckenmiller and Icahn are predicting disaster in the high yield market. I’m not privy to their thinking. There is also the lack of liquidity meme going around. I’m not in a position to distinguish second level thinking from political posturing or talking their book on this topic. Buying on the news might be a play.

It will be interesting to see how the “great re-balancing” unfolds once the Fed starts to move on interest rates. My son is studying economic and this could be a good subject for a Master’s paper or PhD thesis in a couple of years….

Interest rates do not matter. Risky investments are made because that is where money is made.

I guess it’s an issue of what you mean by interest rates.An interest rate cycle might demonstrate the issue to you.