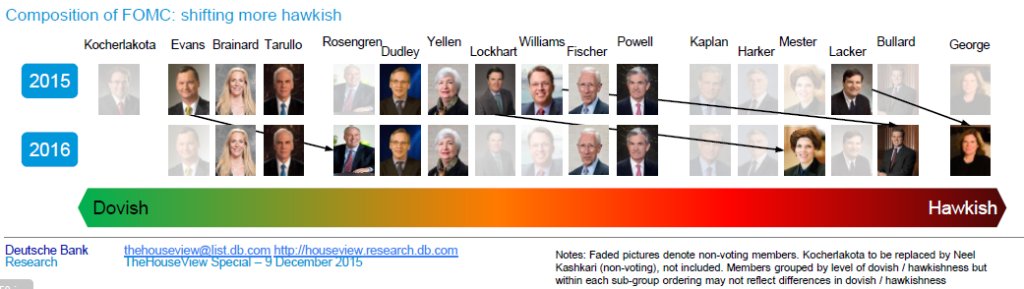

I really like this graphic and commentary from Deutsche Bank’s Torsten Sløk:

Torsten Sløk adds:

Markets entered the year with expectations for the Fed to raise rates. Several shocks that stayed the Fed’s hand in June and then September have now largely dissipated. There is now broad-based consensus that the Fed will take the plunge at its 16 December meeting and raise rates for the first time since 2006.

Despite this consensus, there are lingering concerns that this shift in policy is a mistake. We disagree: the economy is strong enough to withstand higher rates.

With the quasi-certainty of a hike this month, focus shifts to the Fed outlook beyond lift-off. How quickly will rates rise? How high will rates go?

We expect the Fed to raise rates gradually in 2016 as it assesses the economy’s reaction to this policy tightening, with the pace of hikes accelerating thereafter as the forces for going slow fade. The market is pricing a much more gradual ascent in rates; this disconnect should be resolved after a few hikes, with the market converging toward the Fed’s projections. Further out, rates should peak lower than in the past but very likely higher than current market expectations.

Within 2016 the Fed may hike more in the first half than the second half. From a macro point of view, inflation is likely to start slowing around mid-year. From a markets perspective, the repricing of the Fed’s rate path could lead to a tightening of financial conditions – this is especially true if the Fed decides to taper its reinvestment policy. These factors combined could lead the Fed to pause briefly in the second half of the year.

Given the widespread agreement that the Fed will hike, a strong initial market reaction is unlikely. Beyond the first hike, the outlook for risk assets will be determined by how the disagreement between the market and the Fed about the pace and extent of hikes gets resolved. Risk assets should be resilient in 2016 if this repricing is gradual and orderly.

Good stuff…

PDF

‘We expect the Fed to raise rates gradually in 2016 … with the pace of hikes accelerating thereafter.’

Yeah, right! Soon conservative savers will be able to earn 5 percent on T-bills again, as in the fondly-remembered 20th century.

If it sounds too good to be true, it probably is.

Gundlach disagrees with Sløk

Gundlach Says the Fed Might Regret Raising Rates

http://www.bloomberg.com/news/articles/2015-12-08/gundlach-says-coast-might-be-clear-for-fed-to-increase-rates

“…We disagree: the economy is strong enough to withstand higher rates…”

Certainly 0.25, or a range up to 0.5 won’t undercut anybody but short terms Treasury longs.

“…We expect the Fed to raise rates gradually in 2016…”

Maybe or maybe not. Since you have to prepare for either, what use is this?

“… Further out, rates should peak lower than in the past but very likely higher than current market expectations….”

Maybe or maybe not.

Fed will hike.

http://www.wsj.com/articles/fed-plans-to-signal-gradual-cautious-path-on-rate-hikes-1449682591

That’s funny Gundlach, Bianco and Santelli guaranteed rates wouldn’t go up on the floor of the CME live on CNBC.

Their story is about to get blasted.

Rate hikes don’t tighten anything. Matter of fact, it could cause a loosening of financial conditions. That is what happened in 99-00. Lets note, just the threat of a rate hike has caused loan standards to fall in recent weeks.

The Friedman/New Keynesian stuff must die.

“…the pace of hikes accelerating thereafter as the forces for going slow fade.”

What will the forces for going faster look like?

What (oh let’s face it, who) will propel credit expansion?