Trump’s Bubble Predictions Are for Losers

The Donald’s economic forecasts are no better than guesswork.

Bloomberg December 21, 2015

“Remember the word bubble? You heard it here first.”

So said Donald Trump at a campaign event in Cedar Rapids, Iowa, on Saturday. As Bloombergreported, he was speaking to a group of about 1,200 people, discussing the economy in between taking potshots at former Florida Governor Jeb Bush.

Whether we are in a bubble has yet to be determined, although I have been rather skeptical. Whether Donald Trump is the first to declare so is not at issue; he most certainly is not.

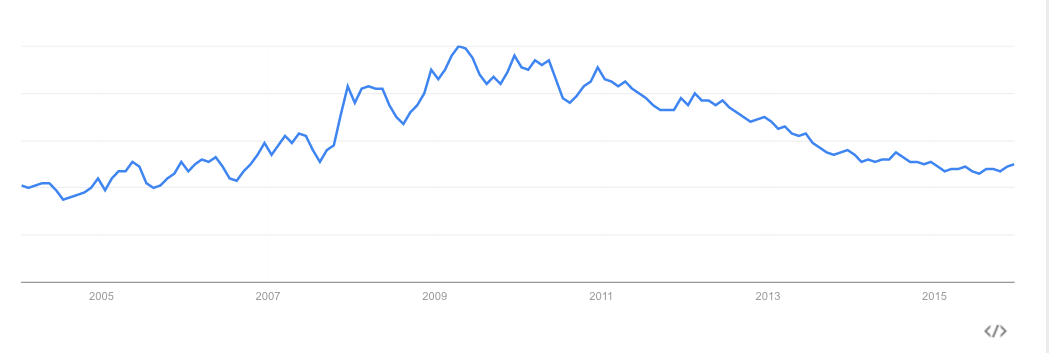

Have a look at the chart below of interest in the word “bubble” via Googletrends. It peaked in about March and April of 2009 — just as the market sell-off was hitting bottom. Those investors who were wary of U.S. equities because of their early 2009 bubble concerns missed a legendary rally, one in which indexes such as the Standard & Poor’s 500 Index recovered all of the losses from the financial crisis and then some, in a tripling from the lows to recent highs.

Source: Google

As you may recall, we have discussed this phenomenon many times during the past few years. Sometimes the bubble term is applied to the art market. Hedge-fund managers are sometimes guilty of carelessly using the term, as is the news media. Thing aren’t made any easier by definitional issues. (Also see this and this). It got so bad after the crisis that I declared we had a bubble in bubbles.

Regardless, you have been hearing bubble calls repeatedly, increasingly and incorrigibly. What’s so amusing is that they peaked after the last bubble popped, when all the warnings were too late. We now are at the end of the sixth year of incorrect bubble calls. Just as every general fights the last war, every disappointed investor, armchair strategist and fallen analyst who missed the most obvious bubble in history has now become an expert in spotting them.

Only they are not.

Last week, I chided Sam Zell, the brilliant real estate investor, for his performance as an economic forecaster, which radically underperforms his record as a commercial real estate investor.

Also chastised were those forecasters who have been incorrectly calling for the Trump bubble itself to pop. It seems almost from the very minute the Trump phenomena bloomed to life, the naysayers have been predicting its imminent demise. That may (or may not) come to pass one day, but so far the prediction that the Trump bubble is about to burst has been the most incorrect political assessment of 2015.

It seems the latest meme is a mashup of the two: Trump, the outsider finding political success by disproving the skeptics has become Trump, the billionaire, making an economic forecast. “We could be on a bubble and that bubble could crash and it’s not going to be a pretty picture,” said Trump. “The market has gone down big league the last couple of weeks. We could be in a big fat bubble and if that bubble crashes, it’s a problem.”

So how is Trump as a forecaster? Worse than Zell.

In 2013, he told Americans “to prepare for financial ruin.” “Right now, frankly, the country isn’t doing well,” Trump added, “Recession may be a nice word.” The S&P 500 rose 30 that year.

Also in 2013, Trump warned of the fall of the dollar. The U.S. currency has since risen to the highest in almost 13 years.

Earlier, in 2011, Trump predicted that unemployment, then at about 9 percent, would rise once Obamacare went into effect. It has since fallen to 5 percent.

In a sense, these aren’t really predictions; they’re the stump speeches of a political candidate who is giving the crowd what it wants.

Perhaps Trump will be proven right in saying “You heard it here first.” So many people have made so many bubble predictions that there is bound to be a chance that some of them will be correct. But here’s what’s more likely: When a bubble occurs and pops — and that will happen someday — the people listening to Trump will be among the most surprised that it didn’t happen the way he said it would.

~~~

Originally published here: Trump’s Bubble Predictions Are for Losers

This may have everything a BP post needs. So I’ll add only a brief comment:

The economy’s in a bubble? Not with Paul Ryan’s $700B in deficit exploding tax cuts it ain’t.

Speaking of Trump and predictions – don’t forget his predictions about Ebola, and his prediction that he had big news about President Obama’s nationality etc.

but it has to be. Obama is in charge.

its all his fault.

Someone is in a bubble – but is it Mr. Market or Mr Trumph?

Ryan’s budget easily approved by Obama, the biggest spending, largest deficit producing President ever. Where has all the money gone? To his healthcare friends?

Actually, Obama inherited a federal deficit of almost equal to 10% of GDP and has reduced it to 2.5% of GDP. On this basis Obama reduced the deficit more than any other president. The only one that came close was Clinton. The largest deficit presidents were Reagan and Bush II. But increasing the deficit is the aim of Republican economic policy. Haven’t you ever heard of “starve the beast”?

Do you have a source to show us how Obama was the largest producing president ever?

@rhkaplan @spencer Don’t forget that deficits lag policy decisions by 2-10 years. That means that if Obama does something today the effect will not be measurable for another 2-10 years.

rhkaplan:

percent increase in national debt listed by president:

Reagan 189%

GW Bush 86%

GHW Bush 55%

Clinton 37%

Obama 35%

Two things–Obama’s term is not over, but the trend seems clear; there is a difference between the national debt and the budget deficit.

A large part of Obama’s deficits is the economic collapse inherited as well as the GDP gap pushed by the disloyal opposition.

Then there is the trillion buck unfunded bombing of deserts.

Here is a graph of the debt to DGP ratio that is the number that really matters.

https://research.stlouisfed.org/fred2/series/GFDEGDQ188S

Regan was president from 1981-1989 he took the debt to GDP from around 30% to about 52%, For that debt we won the cold war, invented GPS, advanced the internet, and created modern telecommunications.

I am still trying to figure out what we have for Obama’s debt (from 62% to over 100%). Oh yeah “shovel ready projects” that must have been a big “B.S.” shovel and from your post it seems like you may have one. BTW I voted for Obama in his first term what a mistake!

And that’s the source of the Reagan Miracle.

Trump demands Clinton prove the extreme jihadists are using his face for promotion or apologize.

While no one demands to know how the GOP can say Obama and Clinton out performed 40 years of oil guzzling US meddling run mostly by GOPer in creating ISIS.

ISIS’ granddaddy was GHW Bush’s CIA, trying to dump Nasser, and keep the Shah in Iran.

I agree entirely with Donald Trump that the economy for the 0.1% is in a bubble.

Other times I can think of when that occurred were France c. 1770s-80s, Britain, France, Germany, and Austria-Hungary c. 1900, Russia c. 1910, US 1920s. If I recall, all of those periods of wealth and income inequality ended quite well for the 0.1% and everyone else.