Oil’s Rebound and Other Wrong-Way Forecasts

People keep making predictions, though they’re almost always incorrect.

Bloomberg, February 11, 2016

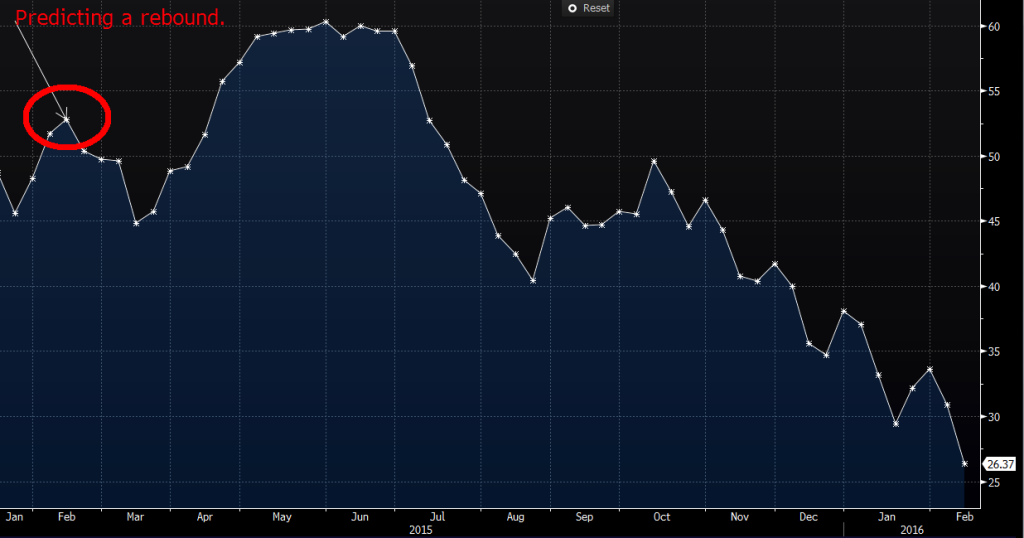

This year’s stock-market correction reminds us once again that forecasting is folly. We have discussed this many times before (see this, this and this) so suffice it to say that the evidence is in: humans have no ability to say what will occur in the future. I was reminded of this courtesy of an article published one year ago today on the imminent recovery in oil prices.

The article in question, headlined “Why Oil Prices Will Rebound Before We Know It,” appeared when oil prices were about $50 a barrel. Crude briefly bounced to $60, before dropping more than 50 percent to about $26, where it trades today.

It’s not just energy forecasters who make mistakes — all of Wall Street has an unfortunate tendency to try to divine the future by looking at chicken entrails. Consider two recent Bloomberg stories: The first reported that Goldman Sachs had abandoned five of its six top trade recommendations for 2016 just six weeks into the new year. In the same vein Wall Street analysts are reducing their estimates for the Standard & Poor’s 500 Index, again just a few weeks into the new year. My colleague Josh Brown calls this phenomenon “Nobody Knows Nothing, Episode 653.”

Consider this definition: a prediction contains these key elements — it is a forecast of a future event that is specific in time and numerical value. For investors’ purposes, this means an asset class, a price target and a date.

Let’s distinguish a true forecast from the everyday probabilistic assumptions we make. That you can cross Fifth Avenue without that bus hitting you isn’t so much a forecast as a reasonable statement of probable outcomes.

Also, let’s remove such general statements as “stocks tend to rise over time.” It is possible to counter this claim — at least for now — by pointing out that Japanese equities haven’t risen since 1989. However, it will take some time (perhaps a very long time) before we can prove or disprove that statement. In other words, a forecast must be specific, and it must be disprovable within some reasonable time frame.

So let’s consider the Employment Situation report from the Bureau of Labor Statistics, which each month is accompanied by hundreds of forecasts from Wall Street economists and thousands more via Twitter. Almost all those predictions are wrong.

What other forecasts have been bandied about lately? The perennial favorite since the last recession ended is that a double dip is imminent. (Claiming the 2007-09 recession never ended isn’t a forecast but rather a misstatement of fact.) Forecasts of a tech bubble inflating and bursting was another favorite, though this one now looks like it’s just happens to be accurate. The collapse of the so-called unicorns, closely held tech startups valued at more than $1 billion, was supposed to have happened long ago. Gold’s surge to a one-year high finally gives some comfort to the bugs who for more than four years have predicted a rise, even as the precious metal fell from a high of almost $1,900 an ounce to less than $1,100 at the end of 2015. The collapse in high-yield debt wasn’t foreseen by many, at least if we go by money flows.

The trouble with all this is that the accurate calls are indistinguishable from random chance.

That’s before we get to the broken clocks and the “permas,” both bulls and bears alike. The folks who have been forecasting a market crash for five years deserve no credit for repeating the same prognostication year after year. If you predicted a decline of 30 percent, but indexes are still 50 percent higher than when you first issued your bearish warnings, you deserve no credit at all.

The battle against foolish predictions, or paying them much mind, requires continuous diligence. I plan on reminding you of that until the foolish forecasting stops. I predict that won’t be for a long, long time.

Originally: Oil’s Rebound and Other Wrong-Way Forecasts

What's been said:

Discussions found on the web: