The McKinsey Global Institute has just released a new report with the following gloomy prognostication:

Our analysis suggests that over the next 20 years, total returns including dividends and capital appreciation could be considerably lower than they were in the past three decades. This would have important repercussions for investors and other stakeholders, many of whom have grown used to these high returns.

This report does one of the things I like least: It makes a forecast.

Longstanding readers probably will be familiar with my aversion to this type of marketing hype. What’s more, it’s for events so far in the future that not many people who are reading the report today will remember to hold McKinsey accountable 20 years from now (unless the forecast is right, in which case someone there will surely trumpet it).

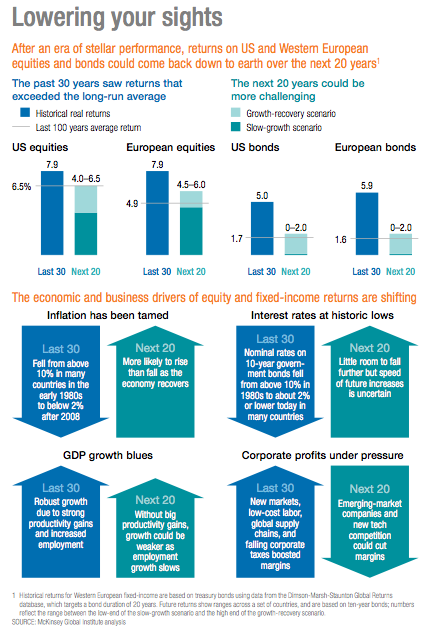

At least the report has a pretty colored graphic to go with it:

Source: McKinsey

There are a number of issues with this sort of report that deserve a more detailed critique.

First, it is filled with all manner of assumptions about growth in the U.S., Europe and Asia; some of them may be correct, but many of them are likely to be wrong. When fundamental assumptions of models are untrue, like a rocket pointed slightly in the wrong direction at launch, the trajectory of a projection is sure to be inaccurate.

Second, and perhaps an even more important assumption, is that the future will resemble the past. (Note I am not referring to mean reversion, where metrics such as valuation or growth eventually return to their long-term averages. Rather, I refer to the dynamic competition within the marketplace.) This kind of extrapolation is dangerous. Throughout the course of history, empires making this error have crumbled. So it’s a bit trite but true nonetheless: Past performance is no indicator of future results.

Third, McKinsey’s forecast meets all the conditions for a true financial-markets prediction:

— It’s about a specific asset class (stocks and bonds).

— It refers to a specific dollar or performance level.

— It sets a specific time frame.

Let’s look more closely at the assumptions. They are:

— The steep decline in inflation and interest rates has ended.

— Economic growth is likely to be sluggish amid labor-force expansion and limited productivity gains.

— Emerging-market companies expand and challenge those in developing markets.

— Technology giants disrupt established businesses.

— Smaller companies compete worldwide for customers via the Internet.

Perhaps some of these will turn out to be true, perhaps not. But all of these exist in a dynamic market place, and to assume that there will not be countervailing responses is hopelessly naive.

The interest-rate issue is emblematic of the problems in this kind of forecasting exercise. I have no idea if rates have bottomed, and neither do the authors of this report. The countryside is littered with the bodies of economists who built careers around forecasts that rates can’t possibly fall any further. We were told they were too low at 2 percent and had bottomed out. Then they hit 1 percent. Then zero. Now rates are negative. What are the odds that forecasts of where they will go during the next 20 years is wrong?

As to the rest of those assumptions, there is no reason to think that any of them are right: Productivity gains, for example, appear to be more of a measurement problem than anything else.

As to what tomorrow’s business landscape will look like, just consider the recent past. Ten years ago, who foresaw a social networking site started in a college dorm becoming one of the world’s 10 most valuable companies? And a decade ago who foresaw that what was once the world’s biggest automaker would need a federal bailout to avoid going bust? What we do know is that some of today’s leading companies will decline and even fail. Some will evolve, and maybe even prosper. Picking which is difficult, if not impossible.

Expand that question to the entire economy and financial markets. Will growth accelerate or fall? Will it be faster or slower than during the past 30 years? Will we enjoy a long bull market, or suffer the pain of a prolonged bear market? No one knows the answer; it’s arrogant for anyone to say with any certainty that they do.

As I said before, the future is different from the past, and that means new winners and new losers. But it’s important to keep in mind that long-term, economies tend to grow and markets tend to rise. That’s something positive to think about.

Originally: Forecasters Keep Trying to Predict the Future