By many measures, the U.S. economy has spent most of the past six-plus years getting better: Unemployment has fallen by half to 5 percent, 12 million jobs have been created and household wealth is atrecord highs. Specific industries and regions seem to be doing well. But those averages belie exactly how uneven the gains have been spread.

No demographic group has suffered more from this disparate distribution of economic progress than the 25-34 age cohort (if we include college-age students, that increases the age range to 18-34). This group, despite all of the data showing improvements in the broader economy, continues to significantly endure economic hardship.

I was reminded of this recently when perusing some of the data on U.S. Census website. More millennials are living in poverty and fewer are employed or own homes, compared with baby boomers in 1980. The impact of graduating in a recession is more than a temporary setback; research has shown that it has lasting effects on a person’s career and their lifetime incomes.

While many pundits and politicians blame student debt, the most recent data suggest that borrowing to attend college isn’t the prime cause of young adults’ woes. Student debt is “generally not holding back those who earned degrees,” the Wall Street Journal reported. Most of those who have trouble with debt failed to earn the degree that leads to the higher income needed to repay loans.

When we do dive into the economic data, what we find is pretty basic: a lack of affordable housing.

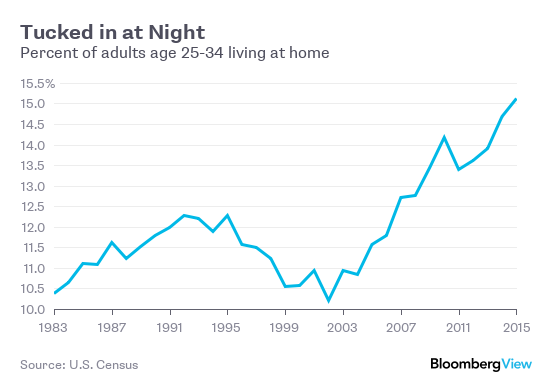

This manifests itself in in the number of 25- to 34-year-olds living at home. The rate began rising in 2003, fell briefly after the recession (perhaps because of first-time buyer-assistance programs), and then started rising again. As of last year, it was at a record high.

It isn’t merely living in their parents’ basements; more young adults are doubling up in apartments. Census data has identified this as a fast-growing living arrangement. The central theme is that expensive housing, along with a dearth of economic opportunities, forces young adults into less-than-desirable living arrangements.

To understand why so many young adults live with their parents look no further than soaring rents. Leverage and debt serve as the backdrop to this phenomenon.

After the housing boom and bust, an enormous swath of homeowners found themselves with little or no equity. These are folks who can’t easily sell in order to move up to bigger and more expensive houses. That means a lack of starter homes available for young adults. Jonathan Miller, head of real estate research firm of Miller Samuel Inc., has described this as the precovery. It’s not an actual recovery; it’s only the setup to a recovery — even though the recession ended almost seven years ago:

What’s missing from all the metrics being tracked and discussed is sharply falling inventory – that’s what is driving prices higher even though little else has changed. The reason for falling inventory? Sellers, when they sell, become buyers (or renters) and with >40% of mortgage holders having low or negative equity, they don’t qualify for the trade up. We have been so focused on negative equity that we’ve paid short shrift to the impact of low equity.

The impact of low equity and a low inventory of properties for sale is that many people who under normal circumstances would be first-time buyers are renters. Home ownership rates have been steadily falling on an annual basis since 2004. Those former owners are now tenants. Just as the huge influx of buyers drawn by low interest rates sent home prices soaring in the middle of the last decade, the reverse has happened since the end of the recession — demand for rental housing has outpaced supply.

The so-called affordability threshold has gotten especially steep in big cities. Five of the six counties in the U.S. with the highest share of the population under age 35 living with their parents are next to or near New York City (Nassau and Suffolk counties in New York; Passaic, Monmouth and Bergen counties in New Jersey).

The best hope for millennials is that 1) the economy continues to recover and that wages start rising consistently and 2) that home ownership rates, which finally started to rise in the second half of 2015, continue their climb. That will take some of the pressure off rents that crush so many millennial personal budgets (and those of lots of other people).

Youth may be wasted on the young, but it is beyond a doubt that this economy has been especially hard for those who came of age in the new century.

______

1. Some data series use the age cohort 18-34; others use 25-34. While they are similar, they are not precisely identical. I will note which series I am using to avoid conflating the two age groups or causing any confusion.

Originally: It’s Been Rough Coming of Age in the New Century