Philippa Dunne is one of the editors of The Liscio Report, an independent research newsletter focusing on the U.S. labor market, debt issues, and international flows. Their work includes month-by-month tracking of tax revenues at the state level, and detailed analysis of federal data releases.

Yesterday, Rosie responded to my column (here and here); Today is Philippa’s turn. Enjoy.

~~~

Thanks for drawing my attention to this column. I do share the pain — amusement? — you feel watching the market react to monthly measures of the spray thrown off by a churning 144-million-job sea.

I am confident that most of the slowing in Treasury receipts early in the year was related to the timing and weakness of bonuses, not to slowing employment growth. And the current upswing, also reflected in our surveys, has more to do with moving through the bonus season, which can run through March, then with strengthening employment growth.

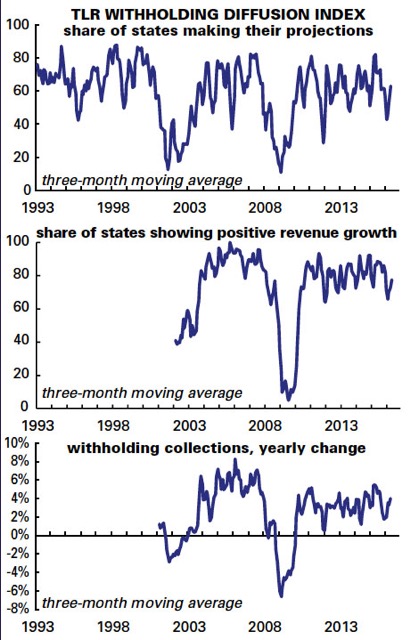

Here’s why. As you know, we do a similar exercise, which is tracking state-level withheld (and sales) tax receipts. In January, the percentage of states meeting their forecasted withholding collections plummeted 30 percentage points to 32%, where it remained in February before recovering to 71% in March.

The senior revenuers who take part in our surveys have their ears to the ground, and knew collections would crater in January and February because of information they had gleaned on bonuses from industry contacts. (They didn’t have that information when they made the forecasts, and they can’t change forecasts on a dime, so they bracket the results.) We were aware of all of this when we published our surveys, and forecast job numbers well above what the raw data suggested. Need I add this wasn’t the case when we saw similar, and astonishing, drops in March of 2001 and January of 2008, when no such explanations were trotted out?

You can see the weakening in all three of our surveys below. The first survey indicates how surprised tax officials are feeling as they watch the money roll into state coffers, or not. The second, the percentage reporting growth over the year, which is only of interest during recessions, and the third, the over-the-year percent change all weighted by state population.

Several times in the past the daily Treasury flows made it seem that change was afoot, and in each case our tax contacts had already identified a one-off reason for the move.