Markets and Politics in 2016

David R Kotok

Cumberland Advisors, July 7, 2016

As the second half of 2016 unfolds, politics seem to be the single dominant global force. Markets either ignore politics or panic in the face of them. Let’s take an inventory.

Brexit

Certainly all eyes will watch continually as the evolution of Brexit changes the government of the UK — and maybe ultimately of Scotland and Northern Ireland. Both of these are component parts of the UK. Both have active majorities that voted Remain.

Many ask what will happen to London as a financial center. There are already indications that certain financial institutions are rethinking their London activities. Those from elsewhere in the world are altering the amount of credit exposure they will have in the United Kingdom. The surprising Brexit outcome has changed the risk profile permanently.

Meanwhile, competitors line up for their pieces of the London pie. Among the elements involved in that competitive financial global arena is relative regulation. The United States may have a competitive disadvantage against other centers worldwide.

Will newcomers attempt to obtain market share from London? The answer is yes. Will London be able to negotiate a role with the EU so as to preserve its existing status? That outcome doesn’t seem to be in the cards, but uncertainty is high. What will happen with Frankfurt or Paris? We have more questions than answers about Brexit’s ramifications. What we do know is that 2016 will be a year in which history is made as disunion commences in Europe.

Financial markets absorbed the Brexit shock as central banks immediately responded with liquidity beyond any observable requirements. Interest rates fell, and negative interest rates expanded globally. It seems as if the only responses that can come from crisis are additional quantitative easing (QE) and monetary stimulus. Governments seem stymied in the fiscal realm; therefore, monetary policy reduces the cost of the indebtedness by lowering the interest rate to near zero.

More NIRP will evolve over the course of the second half of the year. Globally, we have about 12 trillion USD equivalent in negative-rate debt. The number is growing by several hundred billion USD equivalent a month. An inventory of global central banks reveals that all advanced economies except the US are easing. Those are Japan, the UK, New Zealand, Australia, and the eurozone ECB. Among emerging economies, China, India, Indonesia, Korea, Hungary, Poland, Russia, and Turkey are easing. Only South Africa, Brazil, and Mexico have some tightening bias, and they have now delayed any further activity because of Brexit.

The Fed

The Fed has provided some confusing messages this year. In January 2016, Vice Chairman Stanley Fischer suggested to CNBC that there could be as many as four rate hikes this year. (Click here to watch the interview: https://www.youtube.com/watch?v=P6sBpjeN6lc.) So far we have not seen a single one, and the likelihood of any rate hike in 2016 has diminished enormously. When the messages from the Fed are profoundly lacking in clarity, confusion inevitably results. St. Louis Federal Reserve President Bullard just released a paper that discusses the difficulties of policy making and the fact that the appropriate direction of policy seems to be difficult, if not impossible, to determine, given the moving forces that are at work in the world. See https://www.stlouisfed.org/~/media/Files/PDFs/Bullard/remarks/Bullard-SBE-London-30-June-2016.pdf. Bullard’s paper has caused some consternation within the Fed. Readers may want to review it and especially the mention of risks to forecasts.

Bullard notes that market-based estimates of inflation expectations are not working. Contrast that with his April paper which discusses them: https://www.stlouisfed.org/publications/regional-economist/april-2016/inflation-expectations-are-important-to-central-bankers-too. He doesn’t say why the estimates are failing. He doesn’t mention the scope of NIRP’s influence. Nor does he refer to the flattening of yield curves globally, even as spreads between the Treasury curve and NIRP curves widen while all flatten. Perhaps a lot more explanation will be forthcoming from St. Louis.

The phrase “data dependency” is now a cliché. It is invoked often and means different things to different folks. We could say that central-bank policies are always data-dependent. How do you make policy without data? And how do you have data today that can tell you what the data will be tomorrow? Trying to make forward-looking policy based on historical data is like driving using only the rear-view mirror. No wonder market agents are confused.

Today we have forces at work that are rendering forecast models ineffective. Lacking clarity in message and policy puts the Fed in a position of being a political target in a political year. And the two presumptive presidential candidates are not Fed-friendly.

Neither is the Congress. Remember, the Fed is already saddled with certain payments that Congress has positioned to bypass the appropriations process. What will happen to our central banks as their independence erodes and their political vulnerability increases? That is a subject of debate. The Fed will reveal more in the second half of 2016. The only thing we can depend on is that interest rates will be very low for longer than Stanley Fisher led us to anticipate when he made his comment about the four hikes in early 2016.

Puerto Rico

Puerto Rico will come under federal oversight; seven members will be appointed to the PROMESA-authorized board. That legislation will take from Puerto Rico political powers it enjoyed and impose on Puerto Rico a governing system it resists. Why? Because the Commonwealth has failed on its own. Twenty years of neglect and fiscal irresponsibility will come to an end. The final version of PROMESA allows this board to attempt a settlement first with claimants and with the government of Puerto Rico negotiating. If that settlement cannot be reached voluntarily by all parties, then the board will take power away from the government of Puerto Rico and can impose solutions or seek court access for certain decisions.

Puerto Rico’s $70 billion of indebtedness will be restructured. Only two states, California and New York, have greater liabilities than Puerto Rico does. In addition, Puerto Rico’s unfunded pension and other promised benefit liabilities exceed $40 billion. These, too, will be restructured. Thus, the Commonwealth, with its population of approximately three million, has an impossible task ahead. That means haircuts are in order.

Munis

Notwithstanding the recent evolution of the Puerto Rico situation, the entire municipal bond market has seen a huge rally as interest rates have fallen to levels without modern precedents. A second derivative of NIRP and monetary easing is these remarkable lower muni yields. The trend has little to do with improved state and local governments. Witness New Jersey or Illinois or Kentucky or Connecticut. All four are now poster children for irresponsible fiscal management.

Municipal investors now face some very difficult decisions. They can place their money in a high-grade, floating-interest-rate credit and earn one half of 1% or slightly less. Or they can place their money in a 30-year maturity and earn 2%. Thus, the difference between a cash equivalent, or a one-week floater, and a 30-year-duration risk is an added compensation of one and a half points. What does the tax-free investor do when faced with those choices? Interim and shorter-maturity possibilities yield 1% or so, perhaps a little more. These are the options that municipal investors face in the second half of 2016.

At the same time, credit quality is more important than ever under circumstances where very low interest rates are masking credit troubles and investors are chasing yield anywhere they can find it. Investors are bidding up prices and lowering interest rates on weaker credits. More evolution and challenges to bond management lie in store as the proliferation of very low interest rates influences investor decisions.

Marijuana

The marijuana initiatives in progress in nine states are an added political force in 2016. With some excellent data, ConvergEx has followed the growth of the marijuana industry – and it is really growing. Here is the link to their latest report: http://www.cumber.com/pdf/Convergex_Morning_Briefing_2016_6_28.pdf. We thank ConvergEx for allowing us to share their work with readers. Now think about the Electoral College and how turnout will be affected this year in those nine states. I wonder if the Donald or Hillary has a “toke” policy position paper.

Asia

Politics in Asia are huge now. We think that developments around Japan’s policies will be critically important to global financial and market conditions. There are expectations that the Bank of Japan (BoJ) will expand its monetary stimulus program in a variety of ways at its July 28–29 meeting. Japan has disappointed market participants for a number of months. While statements suggest that a more negative interest rate base and wider purchases of assets by the central bank will occur, the Bank of Japan has not yet acted in that way.

In addition, Japan faces political changes, including the proposal to amend its 1946 constitution. This amendment would allow Japan to expand its military activity from solely defensive to more global or offensive efforts as well. It is logical for the Japanese to expand high-tech capability in the military arena, especially with the threatening activity occurring around them.

Look at the South China Sea and at North Korea’s behavior to see why Japan feels threatened. We in the United States would feel threatened, too, if an ancient enemy fired a rocket over our heads. Japan holds an important key to financial markets since it is the world’s third largest economy, its second largest mature economy, and its third largest reserve currency economy. Japanese activity becomes more critical given the activities in the UK as well as expanded risk concerning the pound and the Bank of England.

We expect the BoJ to take its negative interest rate policy threshold to somewhere between -0.3% and -0.5%. We also expect the BoJ to widen the tiers such that the lowest level would be -0.5, but there would be a tier at zero. Essentially, the BoJ would construct their version of a program similar to Mario Draghi’s at the European Central Bank.

The Japanese stock market, by all valuation measures, seems extremely cheap. One can project that the interest rate in Japan will be zero for many years. If the interest rate is zero, then asset prices and their valuation will be determined relative to the sovereign debt risk at a zero interest rate.

That has been the case in Japan for some time. However, the evolution of that policy has been gradual, and Japan has struggled with the debate over deflation versus inflation. Japanese policy makers have not been able to achieve their inflation targets, even after years of trying. Thus, Japan views itself in one context while it administers a monetary policy in which it purchases baskets of stocks and Japanese market REITs in addition to fixed-income assets. We would expect the BoJ policy to be more expansive in that area.

The Japanese stock market as a whole shows that the equity risk premium in Japan is over 7%. At the same time, the earnings yield is over 7%. It is an extraordinary situation where the equity risk premium calculation based against the earnings yield results in a higher number than the earnings yield itself. That can only happen in a climate where the projection of negative interest rates extends for years into the future. Such is the case for Japan.

The US Election

By the end of July, both political parties will have completed their conventions; and the presumptive nominees, Clinton and Trump, will have running mates and platforms. We know that platforms are documents mostly ignored in the electoral process. We also know that the outcome of this unpredictable political year is open to debate and discussion. Long-shot possibilities include an indictment of Hillary Clinton and an independent or other challenge to Donald Trump. The most likely outcome is the presumptive nominees’ battle in the battleground states through to November.

Those who follow electoral politics closely know it is the Electoral College that really counts. The important economic outcomes are seen in states that alter the balance between Clinton and Trump. Donald Trump seems to gain from weakening economies and falling employment, while Hillary Clinton seems to benefit from states that have a flourishing economy. Bill Clinton’s adviser James Carville once offered the infamous quote, “It’s the economy, stupid.” It seems to apply.

A second aspect is what will happen in the Senate and maybe in the House. Certainly a Trump debacle (a la Barry Goldwater) could put the House in jeopardy as well.

What will happen with serious policy discussions? In our view, very little. The appeals to voters’ emotions will determine outcomes. We have candidates with record-high negative voter ratings. Most voters will not dig deep into the analysis of taxes, budget deficits, or the types of policy questions that some of us wish were the center point of debate. For discussion in depth, please see Maya MacGuineas’ article on taxes and budget, “Appropriations Watch” <http://crfb.org/blogs/appropriations-watch-fy-2017> on July 1, 2016. In addition, we published a commentary on MacGuineas’ work at http://www.cumber.com/federal-budget-clinton-vs-trump-lets-ask-maya-macguineas/.

Investment Implications

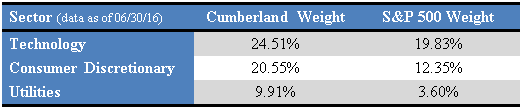

Cumberland Advisors’ view of the world and the economic recovery in the United States is reflected by our US sector weights. As shown in Table 1, we are overweight the technology, consumer discretionary, and utility sectors as compared to the S&P 500 weights.

Table 1

Within the consumer discretionary sector, Cumberland Advisors continues to be overweight housing. We expect the housing recovery to accelerate and become more robust for the rest of this decade. Several million more housing units need to be built before some new equilibrium level is reached. Remarkably low housing finance interest rates are in effect. We are bullish on the housing sector and all the things that come to pass because of it.

Utilities have been continuously and progressively stellar performers. This sector’s outperformance is attributable to several characteristics including its yield relative to riskless US Treasury yields, its predictable single-digit compounding growth rate – predominantly in the electric power – and the fact that nearly the entire business of the sector is conducted within the US in US dollars. There is every reason for utilities to have continuous stellar performance. The cause for concern is that on valuation metrics utilities are exceeding historical levels by a large margin. Price/sales ratios, for example, are at extremes not seen for many decades. What does one do with a winning position embedded in portfolios that are performing well? Remain nervous, watch closely, and on any given day perhaps decide to put the profits in the bank and move on.

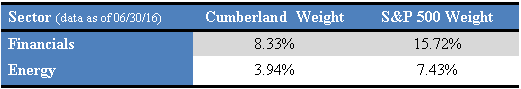

Underweight sectors are a different matter. Table 2 shows that Cumberland Advisors is underweight the financial and energy sectors compared to the S&P 500.

Table 2

The energy patch continues to struggle. Natural gas is doing better, but oil is not. World forces continue to suppress price pressure and thus moderate the rise in oil prices. There is no way to know what oil prices will be. There can be an argument for a $30 low or an $80 high. Geopolitical risks are enormous, whether in Venezuela, Nigeria, or the Middle East. Meanwhile, new technologies have made major changes in the ability of the energy sector, particularly oil, to rebound quickly if prices rise. The old days of long waiting periods have become mere stories in the history books. We remain underweight the energy sector. We think it is too soon to go to market weight let alone overweight in the energy sector.

The second half of 2016 has many moving parts. Politics seem to be driving most of them. When politicians prowl, market agents have good reason to worry. We are fully invested thanks to a Brexit entry opportunity. That could change at any time.

~~~

David R Kotok, Chairman and Chief Investment Officer