Every single month, the Bureau of Labor Statistics releases their update on the Employment Situation. It is based on a model that, as we have painstakingly explained many, many times, is a near-real time, very noisy, error-laden, data series with a huge margin of error, that is subject to repeated revision and further benchmarking.

It is imperfect, but it is useful as it applies the same approach — warts and all — to the data, month after month. If you are not in the noise business, but instead run a business, or if you manage assets professionally, or if you are an investor, you either understand this or you suffer expensive consequences.

I should not be surprised by the reaction and overreaction to the monthly series, but it is astonishing. I have beaten this topic to death (see this, this and this).

* sigh * On to the data:

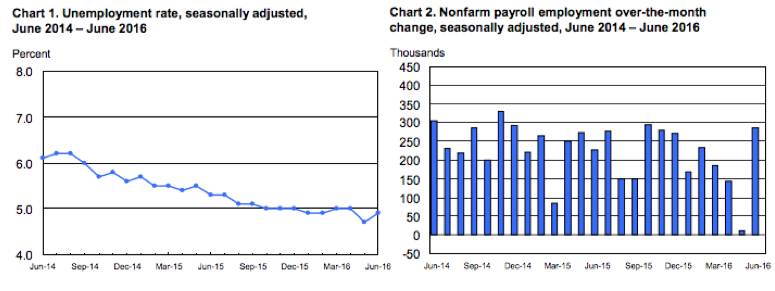

The month’s data for June 2016 was a very robust 287,000 following last month’s very punk 38,000 for May 2016. The unemployment rate ticked up 0.2 to 4.9 percent in June — offsetting the drop last month by the same amount. The phrase “Assume its noise” should be foremost in your thoughts as you read the BLS release.

Also, those 35,000 striking Verizon workers muddied the water both months, but if you have the a PhD. in applied mathematics, you might be able to perform the arithmetic functions of ADD 35,000 to MAY and SUBTRACT 35,000 to June — it should not throw you too much.

Let me remind readers (again) that the monthly employment situation report has a margin of error of 100,000 jobs. So last month could very likely have been as high as 173k (38 + 35 + 100) and this months could very likely be as low as 152k (287 – 35 – 100). If you understand this simple math, you should be able to understand why I insist on noting the actual BLS official monthly number ain’t all that.

I am told by some folks that we obsess over the monthly payroll data as an early warning on any upcoming recession. This belief is, in my opinion, incorrect. We are more likely to see a recession coming in other data before NFP. The yield curve and earnings and therefor stock prices will give you the heads up before payrolls do.

Hence, some obsess because they are mostly innumerate, or are newbies or are in the business of generating clicks. I am sure there are other reasons equally as silly to obsess over these numbers, feel free to tweet them to me.

Once you understand the data series, how it is put together, what its inherent limitations are (as well as its strengths), you can stop obsessing over this each month, and instead focus on things that really matter. Like Zika, Brexit, and the U.S. Presidential elections.*

__________

* Just kidding . . .

What's been said:

Discussions found on the web: