Invest and Profit With the POTUS Indexes

A light-hearted but not entirely silly way to think about stocks in the Trump era.

Bloomberg, January 10, 2017.

So the year begins and with it a new presidency. Everyone has ideas how best to invest your money. Simple indexing is the least expensive way to manage capital; no, smart beta is superior; this year we are told (once again) will be when active stock-picking makes its triumphant return.

Regardless of how you choose to allocate your assets, there is another way; a much better way; a method that cannot fail in its brilliance and simplicity. Go with the POTUS indexes.

Direct your attention to the relentless tweeting of the man who soon will be president. There is valuable information in those 140 characters that can move markets and alter perceptions of corporate fundamentals. This has real alpha-generating possibilities. Whoever is managing your favorite 401(k), hedge fund or trading account should take note.

To help you make sense of this, we have created two indexes based on Donald Trump’s tweet and other pre-presidential utterances.

Before we get to the specific stocks, I want to offer a bit more about the underlying concept. First it goes without saying that the U.S. president is the most powerful person on the planet. Although the U.S. Constitution places all sorts of constraints on his direct power, his every word is important, whether you agree with him or not.

Now consider the companies he has been tweeting or commenting about, both positively and negatively. You will recognize the two distinct groups that this creates, each with very different prospects.

In one group are companies that have drawn expressions of approval from Trump. An even greater endorsement is recruiting the senior executives of those companies to be cabinet members or advisers.

Let’s call this first group the Oligarch Index, or OLGY. (On your Bloomberg terminal, type .OLGY <Index> GP.) The Oligarch Index includes Colony Capital Inc., CoreCivic Inc., Exxon Mobil Corp., Facebook Inc., Ford Motor Co., Goldman Sachs Group Inc., JPMorgan Chase & Co., PayPal Holdings Inc., Sprint Corp., SoftBank Group Corp. and United Technologies Corp.

The other group is made up of those companies that Trump has trashed. We shall call this the Drain the Swamp Index, or SWMP. (On your Bloomberg terminal, type .SWMP <Index> GP.) This includes Amazon.Com Inc., Boeing Co., General Motors Co., Kellogg Co., Lockheed Martin Corp., Macy’s Inc., New York Times Co., PepsiCo Inc., Rexnord Corp., Tesla Motors Inc., Time Warner Inc., T-Mobile US Inc., Toyota Motor Corp. and Twitter Inc. and Constellation Brands Inc.

On the positive, oligarchic side, these are the companies that will help to make America great again:

• Colony Capital: Chairman Tom Barrack spoke at the Republican National Convention, and is chairman of Trump’s inauguration committee.

• Exxon Mobil: Chief Executive Officer Rex Tillerson, who has extensive global experience, is Trump’s nominee to be secretary of State.

• Goldman Sachs: Alum Steve Mnuchin is Trump’s pick for secretary of the Treasury and Gary Cohn, Goldman’s president, is his pick to head the National Economic Council. Besides, how could we have an oligarch portfolio without Goldman?

• PayPal: Co-founder Peter Thiel was one of the few techies who had the foresight to back Trump early; he is also a director of Facebook, a major venue for passing around fake news.

• JPMorgan: CEO Jamie Dimon was recruited to be Treasury secretary. He convinced Trump that he could do more to help make America great again by continuing to run the nation’s largest bank. A good guy and a great banker.

• United Technology: The company owns Carrier, which kept jobs in America. Thanks!

Now for some of the companies Trump disparaged, directly or otherwise:

• Amazon: Jeff Bezos, CEO, founder and largest shareholder of the online retailer, owns the Washington Post — Trump’s least favorite paper.

• Boeing: Costs for building the new Air Force One are out of control — cancel order!

• GM: It plans to make cars in Mexico? Make in U.S.A. or pay big border tax!

• Kellogg: It said that it would no longer advertise on conservative news website Breitbart. Boycott!

• Lockheed Martin: F-35s are a disaster — price out comparable F18!

• Macy’s: The retailer dropped Trump’s clothing lines, and it had a disappointing holiday-sales season and plans to cut 10,000 jobs. Disloyal!

• New York Times: It, of course, is failing!

• Tesla: Global warming is a Chinese hoax.

• Time Warner: It owns CNN, which was so embarrassed by its total support of Hillary Clinton, and yet she lost in a landslide, that they don’t know what to do.

• Twitter: It refused to create a “Lying Hillary” emoji; CEO Jack Dorsey was disinvited from Trump’s Tech Summit. Sad!

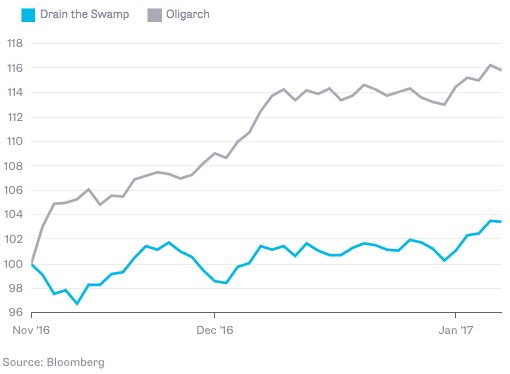

Rather than a stock-bond mix, think of this as a paired trade — long OLGY, short SWMP. Can you imagine how much more significant and market-moving those tweets will be once Trump is sworn into office? This is theme investing at its finest. And as you can see from the chart below, you would have done quite well by investing on this basis:

Some of you coastal liberal elites might not appreciate the wisdom of building specific portfolios from Trump’s tweets; that’s just because you don’t understand the new era of populism, viral social media and fact-free politics. You are stuck in the old way of thinking — growth, valuations, market cap and momentum. That’s old school. Catch up.

This is going to make index investing great again.

~~~

I originally published this at Bloomberg, January 10, 2017. All of my Bloomberg columns can be found here and here.