William Sweet, CFP®, is an Investment Advisor at Ritholtz Wealth Management. Bill has spent much of his career minimizing the impact of income taxes on investment returns. He served on active duty in the US Army as an Armor Officer for six years and was awarded the Bronze Star for valorous action in combat in 2003 during Operation Iraqi Freedom. Bill holds a degree in Computer & Systems Engineering from Rensselaer Polytechnic Institute (RPI).

The most interesting thing about the Warren Buffett vs. Ted Seides million dollar bet on hedge funds vs. the S&P 500 index bet is not the philosophical debate between active vs. passive investing, or high-fee vs. low-fee investment vehicles. It’s not which hedge funds Mr. Seides chose, nor is it Mr. Buffett’s choice of the S&P 500 instead of a total US stock market index, an all-world index, or his own conglomerate Berkshire Hathaway.

It’s what they chose to do instead with the million dollars.

The world’s most famous value investor issued a challenge during Berkshire’s 2006 annual meeting. He would bet one million dollars against anyone who chose 10 hedge funds, vs. not Buffett himself, but rather the plain, vanilla, dumb S&P 500 index. Mr. Buffett’s point was that the onerous fees that hedge funds charge (typically 2% per year + 20% of the profits) were excessive and unreasonable, and that those fees would consume any excess value generated by hedge fund manager skill.

Ted Seides of Protégé Partners took him up on his offer. In a series of correspondence beginning in July of 2007, the two counterparties negotiated and haggled over conditions. They settled on Seides selecting five hedge fund managers in a fund-of-funds – not to be disclosed to the public, but who annual audits are available to Mr. Buffett – vs. the bellwether Standard and Poor’s 500 index. The winner gets to select the charity to receive the proceeds.

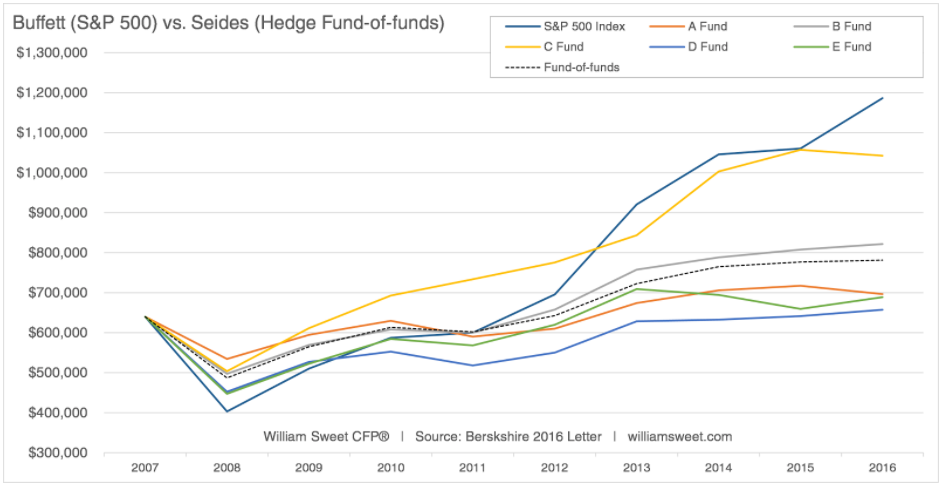

Mr. Buffett released the results of the contest in his 2016 letter to Berkshire investors. In spite of a massive -37% drawdown in 2008, choosing the S&P 500 seems to have been prophetic. At +7.1% per year annualized since the beginning of the bet on 01/01/2008, the S&P 500 index has far outpaced not only a blend of all five funds selected by Mr. Seides (2.1%), but even the best-performing individual C-fund at 5.6%.

With some time left in the home stretch, Mr. Seides appears to have lost the bet. The C- fund of the group would have to gain 17% on the S&P 500 index for 2017 in order to barely break even.

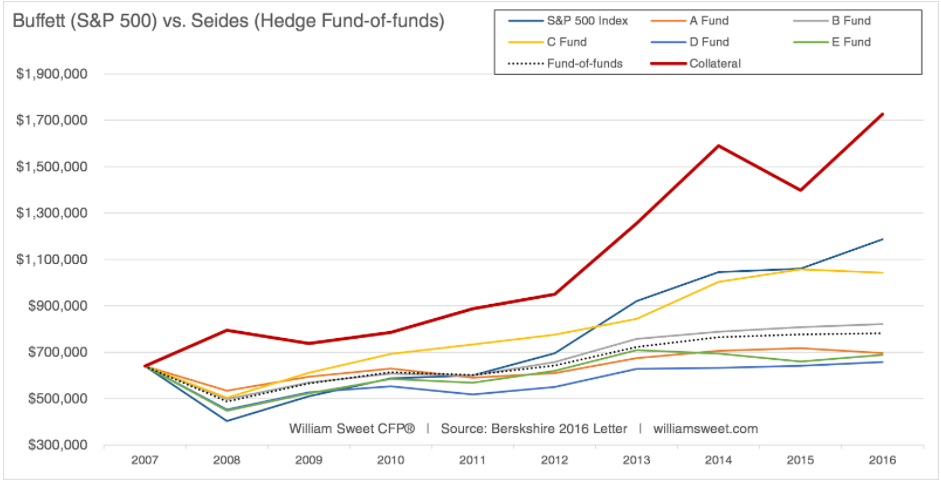

Now the more interesting part of the bet: the collateral.

In order to achieve the $1,000,000 pay-off to charity, Mr. Buffett and Mr. Seides agreed that they should both post 50% each to an investment guaranteed to mature at the one million necessary for charity. They chose a zero-coupon US Treasury bond purchased on or about January 1st, 2008, with a maturity date on January 1st, 2018 for the full $1 million. At the time of the purchase, effective 10-year interest rates at the time were higher than 4%.

Seides revealed the details on Patrick O’Shaugnessy’s excellent Invest Like the Best Podcast:

“What we actually did with the money – the collateral – beat the S&P 500 by a mile. We made one trade, and that trade was effectively to equities, we put it in Berkshire Hathaway, and now the collateral has made 300% during this time. The real winner was the charities and cash, not even the S&P 500.”

By the end of 2012, the $640,000 bond had matured in value to about $950,000. With the majority of the appreciation realized and faced with the potential for low returns (less than 1%) from 2013-2018, Seides and Buffett agreed to switch the collateral into shares of – what else – Berkshire Hathaway stock.

In summary, the “safe” collateral posted at the beginning of the bet returned 11.6% per year through 2016, outpacing both the S&P 500 index at 7.1% and the fund-of-funds at 2.1% and Berkshire Hathaway at 2.2%:

Two brilliant minds of investing, in public fashion, both underperformed not only a simple indexing strategy, but also a single trade they made with their own collateral of the bet.

Seides: “That was not a sophisticated investment decision for any type of investment reason, and yet, had by far the best outcome of anything we’ve been talking about.”

Investing is extremely difficult, even for the best and brightest. Randomness plays a far greater role in our success or failure than we’re comfortable with. And most of the time it’s better to be lucky than good.

William Sweet

Ritholtz Wealth Management

What's been said:

Discussions found on the web: